Here is what you need to know on Tuesday, January 17:

Traders return today after a long weekend in the US, and initial signs are for a muted start to the week. Data overnight from China was positive, but we failed to see a positive push forward from commodities. Europe then added to the bullish sentiment with a strong ZEW from Germany, but again the market shrugged its shoulders and went all "meh". With a big earnings season upon us perhaps that should come as no surprise. This week we get the end of the investment banks today with Morgan Stanley (MS) and Goldman (GS). Then it is onto the regional and commercial banks. Netflix (NFLX) opens the tech season on Thursday.

The US Dollar is a touch weaker in thin trading at 102.16 for the Dollar Index as we await the Bank of Japan. Gold is also lower at $1,912, and Oil has now spiked above $80 to $80.47, as perhaps a late reaction to the strong ZEW and Chinese data.

European markets: mixed, FTSE, CAC, DAX, and Eurostoxx all trading just around flat.

US futures: all lower by -0.2%.

Wall Street top news

German ZEW is much better than expected.

China's GDP, retail sales and unemployment are all better than expected.

Morgan Stanley (MS): in line EPS, beats on revenue.

Goldman Sachs (GS) big miss on EPS and revenue.

Reuters headlines

Activision Blizzard Inc (ATVI) & Microsoft Corp (MSFT): Microsoft is likely to receive an EU antitrust warning about its $69 billion bid for "Call of Duty" maker Activision Blizzard, people familiar with the matter said, that could pose another challenge to completing the deal.

AbbVie Inc & Eli Lilly and Co (ABBV): The pharmaceutical companies have withdrawn from Britain's voluntary medicines pricing agreement, an industry body said on Monday.

Alibaba Group Holding Ltd (BABA): Billionaire investor Ryan Cohen has built a stake in China's Alibaba Group worth hundreds of millions of dollars and is pushing the e-commerce giant to increase and speed up share buybacks, people familiar with the matter said on Monday.

Credit Suisse Group AG (CS) & UBS Group AG: UBS has no interest in buying fellow Swiss lender Credit Suisse, the bank's Chairman Colm Kelleher said in a interview published on Saturday.

Manchester United PLC (MANU): The company set out a dazzling Davos shop front this week, but insisted its lounge was to entertain clients and partners rather than to attract buyers for the English soccer club.

Pfizer Inc (PFE): Chinese authorities have acknowledged that supplies of Paxlovid are still insufficient to meet demand, even as Pfizer CEO Albert Bourla said last week that thousands of courses of the treatment were shipped to the country last year and in the past couple of weeks millions more were shipped.

Rio Tinto PLC (RIO): The miner said that China's reopening from COVID-19 restrictions is set to raise near-term risks of labour and supply-chain shortages, while it also flagged a strong start to iron ore shipments for 2023.

Upgrades and downgrades

Upgrades

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

AvalonBay |

AVB |

Truist |

Hold>>Buy |

$186>>$190 |

|

Cadence Design |

CDNS |

Atlantic Equities |

Neutral>>Overweight |

$200 |

|

Church & Dwight |

CHD |

Morgan Stanley |

Equal-Weight>>Overweight |

$82>>$91 |

|

Church & Dwight |

CHD |

Credit Suisse |

Neutral>>Outperform |

$85>>$95 |

|

Dun & Bradstreet |

DNB |

BofA Securities |

Neutral>>Buy |

$15.5 |

|

Equity Residential |

EQR |

Truist |

Hold>>Buy |

$68 |

|

World Wrestling |

WWE |

Wells Fargo |

Underweight>>Equal Weight |

$52>>$100 |

|

Valero Energy |

VLO |

BMO Capital Markets |

Market Perform>>Outperform |

$135>>$160 |

Downgrades

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

A.O. Smith |

AOS |

Loop Capital |

Buy>>Hold |

$67>>$65 |

|

Americold Realty Trust |

COLD |

Truist |

Buy>>Hold |

$34 |

|

Extra Space Storage |

EXR |

Truist |

Buy>>Hold |

$175>>$160 |

|

Lions Gate Entertainment |

LGF.A |

Truist |

Buy>>Hold |

$11>>$8 |

|

Kimco Realty |

KIM |

Truist |

Buy>>Hold |

$25>>$24 |

|

Mid-America Aptmt |

MAA |

Truist |

Buy>>Hold |

$176>>$167 |

|

First Advantage Corp. |

FA |

BofA Securities |

Buy>>Neutral |

$14.5 |

|

Pfizer |

PFE |

Wells Fargo |

Overweight>>Equal Weight |

$54>>$50 |

Source: WSJ.com

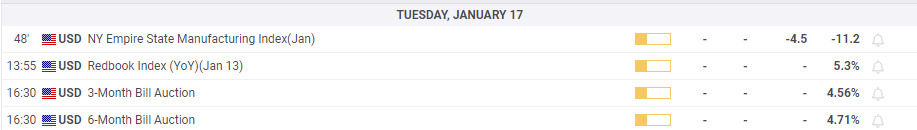

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD drops below 1.1400 after Germany and EU PMI data

EUR/USD struggles to hold its ground and trades below 1.1400 in the European session on Wednesday. PMI data from Germany and the Eurozone showed that the business activity in the service sector contracted in April. Markets await comments from central bankers and US PMI data.

GBP/USD stays weak near 1.3300, UK PMI eyed

GBP/USD is off the lows but remains under pressure near 1.3300 in early Europe on Wednesday. The pair stays weak as investor appetite shifts back toward US assets, including the US Dollar, buoyed by a more optimistic tone from US President Donald Trump. UK/US PMIs are next in focus.

Gold price touches fresh weekly low, below $3,300 amid easing US-China trade tensions

Gold price extends its steady intraday descent through the first half of the European session and momentarily slips below the $3,300 mark in the last hour as the upbeat market mood conditions undermine demand for safe-haven assets.

Dogecoin lead double-digit gains across meme coins, with Shiba Inu, PEPE and BONK skyrocketing to new monthly highs

Top meme coins Dogecoin, Shiba Inu, PEPE and BONK lead the meme coin sector with double-digit gains on Wednesday following the crypto market recovery.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.