Here is what you need to know on Monday, January 9:

Markets got another boost for risk assets as China reponed its borders. This saw Asian stocks move higher and the Aussie and Kiwi Dollars gained notably in the currency sphere. JPMorgan was out with a note saying this could add 1% to Australian GDP over the next two years. So far the moves in Europe are more constrained with mixed performance, while the Nikkei and Hang Seng performed positively. Tesla (TSLA) looks for a stronger open on waiting time reports, but Bank of America (BAC) has slashed its price target for Tesla, so it remains to be seen if the gains can hold.

The US Dollar is lower at 103.63 for the Dollar Index. Oil boosted by the China news is up to $76.10, while Gold is stuck at $1,875.

European markets are mixed, FTSE is lower by 0.2%, while Dax is +0.8% and Eurostoxx is +0.3%.

US futures are all green: Nasdaq +0.6%, S&P +0.5% and Dow +0.3%.

Wall Street top news

Moderna (MRNA) sees $5 billion in covid vaccine sales in 2023 compared to $18 billion in 2022.

Tilray (TLRY) misses on earnings.

Lululemon (LULU) lowers margin guidance.

Bed Bath & Beyond (BBBY) jumps 17% despite bankruptcy worries.

Ferrari (RACE) is named top pick by Bank of America. It's always a top pick for me!

Reuters headlines

Goldman Sachs (GS) to start cutting thousands of jobs midweek -sources

Tesla (TSLA) delivery time is longer on some China models after discounts.

AstraZeneca Plc (AZN) & CinCor Pharma Inc: The company said it has struck a deal to buy CinCor for up to $1.8 billion to bolster its arsenal of heart and kidney drugs.

Alcoa Corp (AA): The Aluminium producer said it expects production at its partially owned Kwinana alumina refinery in Western Australia to be cut by about 30% due to a shortage of gas supply.

Alibaba Group Holding Ltd (BABA): The Chinese e-commerce giant is planning a logistics hub at Istanbul Airport and a data centre near the Turkish capital Ankara with an investment of more than $1 billion, its president, Michael Evans, was cited as saying.

American Airlines group Inc (AAL): The union representing 15,000 American Airlines pilots has voiced concerns regarding the new cockpit protocols enforced by the airline, without adequate training.

General Motors Co (GM): The company said Friday it wants the U.S. Treasury to reconsider classification of GM's electric Cadillac Lyriq to allow it to qualify for federal tax credits.

Macy's Inc (M): The company said on Friday it expects fourth-quarter sales to come in at the lower end of its forecast.

Salesforce Inc (CRM): The Cloud-based software firm is looking to cut costs by $3 billion to $5 billion, Chief Executive Marc Benioff told company insiders this week after announcing layoffs, Fortune reported, citing an audio recording of a meeting.

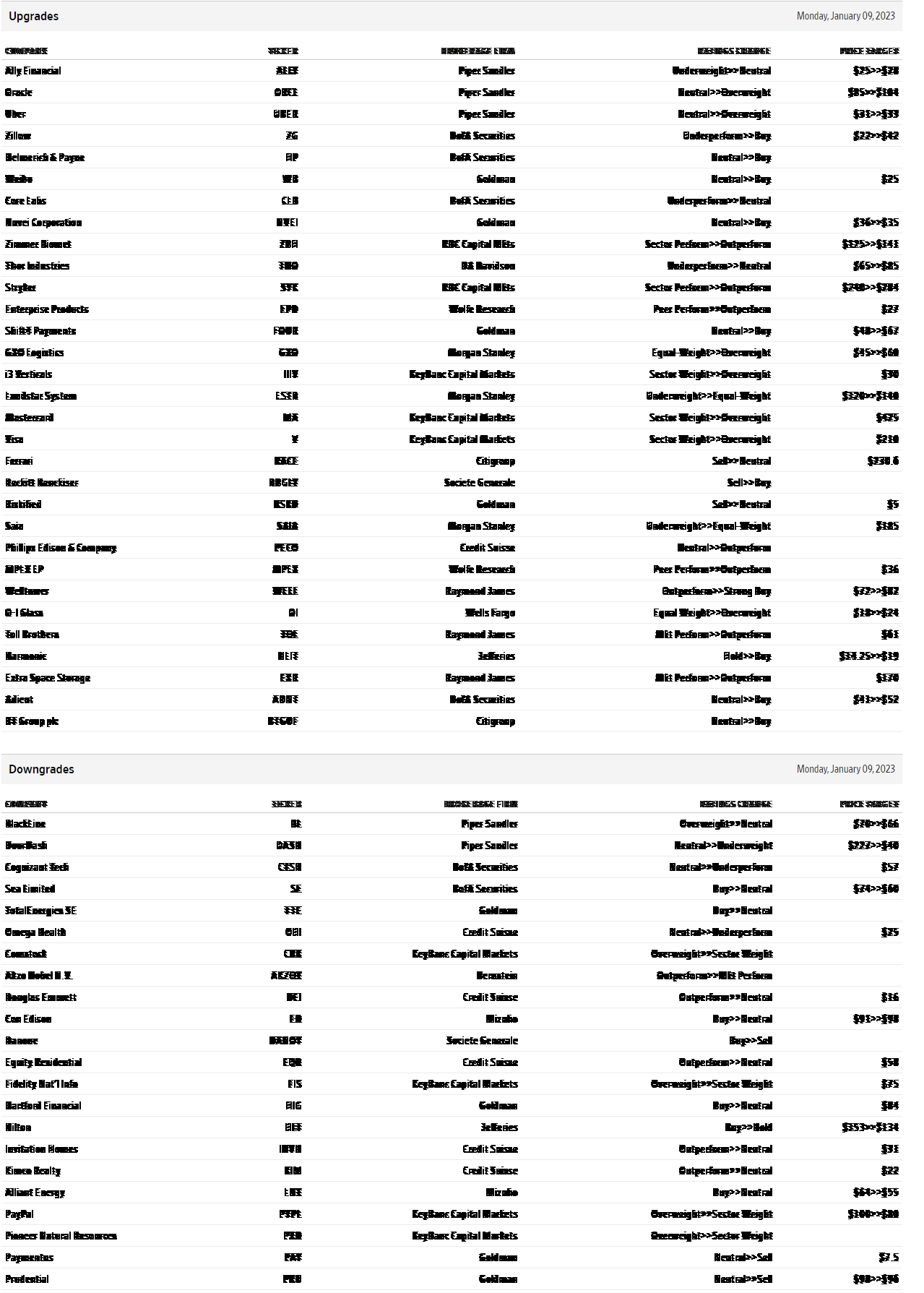

Upgrades and downgrades

source: WSJ.com

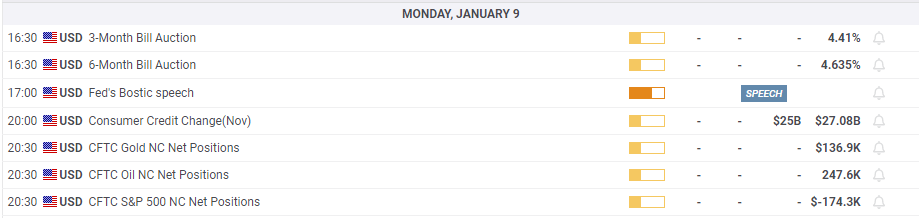

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds lower ground near 0.6350 after weak Aussie jobs data

AUD/USD is holding lower ground near 0.6350 in Asian trading on Thursday. The downbeat Australian jobs data fans RBA rate cut bets, maintaining the downward pressure on the pair. US-China trade tensions and US Dollar recovery act as a headwind for the pair.

USD/JPY stages a solid recovery toward 143.00 on US-Japan trade optimism

USD/JPY holds the impressive rebound from seven-month lows of 141.61, directed toward 143.00 in the Asian session on Thursday. The pair tracks the US Dollar rebound, fuelled by contrstructive trade talks between the US and Japan. A tepid risk recovery also aids the pair's upswing.

Gold price extends the record run amid US tariffs-inspired rush to safety

Gold price builds on the previous day's breakout momentum above the $3,300 mark and touches a fresh all-time peak during the Asian session on Thursday. Tariff uncertainty, the escalating US-China trade war, global recession fears, and expectations of more aggressive Fed easing continue to support XAU/USD.

Ethereum face value-accrual risks due to data availability roadmap

Ethereum declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.