Wake Up Wall Street (SPY) (QQQ) (SPX): Is it 'no time to die' for the equity market?

Here is what you need to know on Monday, October 4:

No Time to Die is kicking up a storm in the UK and is due to do the same for the US when it is out on Thursday, so AMC apes get ready for some strong audience numbers if the UK experience is anything to go by. The equity market does feel like it is time to die though, despite a modest dead cat bounce on Friday. Things again look bleak on Monday (they always do!) if European markets are anything to go by. President Biden's much touted infrastructure deal is struggling for support just when many of the beneficiary stocks could do with a boost. Lawmakers also have to avoid the US failing to meet its debt burden, which kind of overshadows Evergrande's worries. But then the US is unlikely to default, whereas Evergrande might have some sort of controlled restructuring.

The dollar meanwhile continues to take a breather following last week's yield-induced run. It is currently trading at 1.1640 now versus the euro. Gold is at $1,754 and Oil at $76. Bitcoin is lower at $47,700, while the US 10-Year yield is also down at 1.48%. VIX is up 6% to 22.58.

See forex today

European markets are lower: FTSE -0.4%, Dax -0.1% and Eurostoxx -0.7%.

US futures are lower: S&P -0.3%, Dow -0.3% and Nasdaq -0.4%.

Wall Street (SPY) top news

The US to resume tariff exclusion procedure for Chinese imports.

UK wants to renegotiate the exit agreement with the EU, specifically over Northern Ireland.

UK admits a UK-US trade agreement could be 10 years away.

German electricity wholesale price reaches a record high.

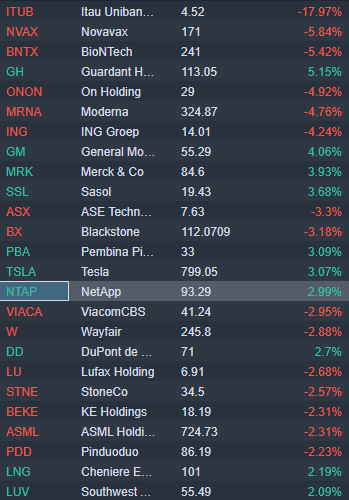

Tesla (TSLA) up in premarket by 2% on strong delivery numbers, see here.

Evergrande raising up to $5 billion cash from asset sales.

Facebook (FB) whistleblower gives negative interview to CBS 60 minutes.

BioNTech (BNTX), Pfizer (PFE), Moderna (MRNA), Novavax (NVAX) are still down after Merck's (MRK) covid pill results on Friday.

Merck (MRK) up 4% in premarket on SVB price target rise and continued follow through from Friday.

Guardent Health (GH): Bloomberg reports company not buying NeoGenomics.

General Motors (GM) up 3% premarket. Company announces strategic supplier agreement with Wolfspeed for silicon carbide.

NetApp (NTAP) to acquire Cloudchecker.

Delta (DAL) reinstates Q3 revenue forecasts.

Southwest (LUV): Barclays upgraded it.

Proctor and Gamble (PG): Deutsche Bank ups price target.

Hasbro (HAS): Stifel lowers price target.

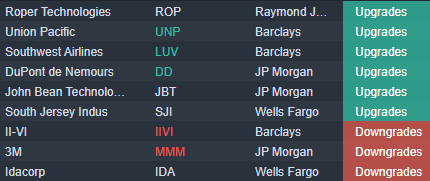

Upgrades, downgrades and premarket movers

Source: Benzinga Pro

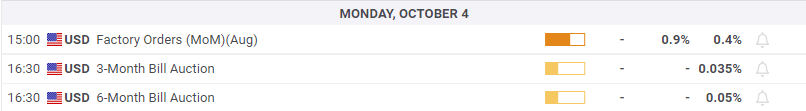

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.