Here is what you need to know on Wednesday, January 12:

Equity markets got the usual Powell push on Tuesday as the Fed Chair's testimony kept the straight and narrow and delivered nothing too surprising. The Fed has become adept at signaling its intentions well in advance to the market. A few months ago the thought of a March rate hike would likely have sent markets into panic mode, but now the probability is running at nearly 90% and equity markets appear calm. The Nasdaq has returned to the green and is making up for lost time. The just out CPI is high, very high, but markets expect this, and so we should see more gains on Wednesday.

The dollar has weakened after the CPI as perhaps more was expected. It is trading at 1.1393 now versus the euro. Gold is at $1,818, and Oil has moved higher at $82.04. Bitcoin is recovering ground and is back to $43,000.

European markets are higher: Eurostoxx +0.4%, FTSE +0.5% and Dax +0.35.

US futures are higher: S&P +0.4%, Dow +0.35 and Nasdaq +0.5%

Wall Street (SPY) (QQQ) stock news

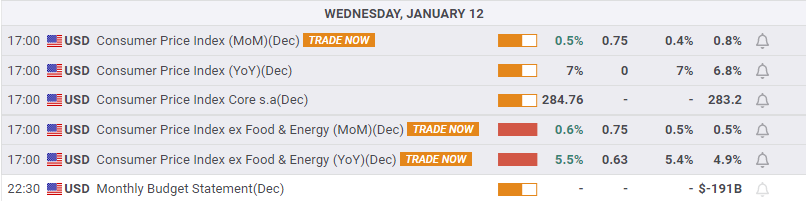

US CPI 7% for Dec. inline. Core CPI 5.5% yearly, 0.6% monthly.

Tesla (TSLA): Chinese deliveries hit a record.

Biogen (BIIB) falls 9% premarket on the decision of Medicare/Medicaid to only grant coverage for new Alzheimers drug if the patient is in a clinical trial.

Moderna (MRNA) fell 5% on Tuesday despite a market rally.

Ocugen (OCGN) up 5% premarket on covaxin data showing positive results versus Omicron and Delta.

DoorDash (DASH) upgraded by Evercore.

Meta Platforms (FB) names Door Dash CEO to its board.

DIDI up 5% on talk of Hong Kong listing in Q2.

Crocs (CROX): Piper Sandler names it a top pick.

DISH and DirecTV are in merger talks, according to New York Post.

Paypal (PYPL) downgraded at Jefferies.

Just Eat (GRUB): Did somebody say...up 4% on maintaining 2022 forecasts.

Ally Financial (ALLY) raises dividend by 20%, $2 billion share buyback.

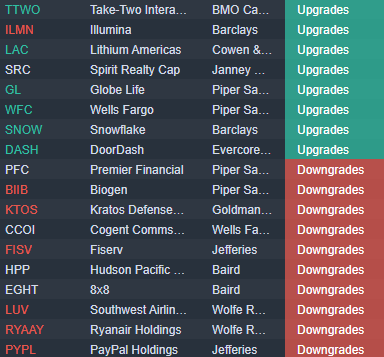

Upgrades and downgrades

Source: Benzinga Pro

Economic releases

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD struggles around 1.2600 after BoE rate decision

GBP/USD retreated from its daily peak and battles around 1.2600 following the Bank of England monetary policy decision. The BoE kept the benchmark interest rate unchanged at 4.75% as expected, but the accompanying statement leaned to dovish. Three out of nine MPC members opted for a cut.

EUR/USD retakes 1.0400 amid the post-Fed recovery

EUR/USD is recovering ground to near 1.0400 in the European session on Thursday. The pair corrects higher, reversing the hawkish Fed rate cut-led losses. Meanwhile, the US Dollar takes a breather ahead of US data releases.

Gold price recovers from one-month low, retains modest gains above $2,600

Gold price attracts some haven flows in the wake of the post-FOMC sell-off in the equity markets. The Fed’s hawkish outlook lifts US bond yields and provides near-term support to XAU/USD. Market players await US GDP and employment-related data.

Aave Price Forecast: Poised for double-digit correction as holders book profit

Aave (AAVE) price hovers around $343 on Thursday after correcting more than 6% this week. The recent downturn has led to $5.13 million in total liquidations, 84% of which were from long positions.

Fed-ECB: 2025, the great decoupling?

The year 2024 was marked by further progress in disinflation in both the United States and the Eurozone, sufficient to pave the way for rate cuts. The Fed and the ECB did not quite follow the same timetable and tempo, but by the end of the year, the cumulative size of their rate cuts is the same: 100 basis points.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.