Here is what you need to know on Monday, March 27:

Equity markets are set for more gains on Monday as the recent rally and short squeeze look set to continue. This is a slap in the face for bears but not as bad as that dished out at the Oscars last night. Ouch! We have the usual news flow on Monday of hopes for peace in Ukraine, but so far this looks a bit off. Bond markets continue to surge, well rather yields do, as participants look to test the Fed's mettle this year. The US 10-year is heading toward a move above 2.5% this week, but so far equity markets remain more focused on the US economy.

We will get some data this week to confirm or deny if indeed the Goldilocks scenario of a soft landing is possible. Nonfarm payrolls on Friday, April 1, will be no joke and will be key for the future direction of the markets. A strong number is required. The stronger the better. There is not much downside to an inflationary, better-than-expected number as equity markets are banking on the Fed reigning in inflation while keeping employment and the economy afloat. No downside from an upside surprise, therefore, but all the risk is to the downside in our view.

The currencies are mixed this morning, but the dollar index remains strong at 99.5. Euro/dollar is at 1.0960 now, and the closer to the party we get, the stronger the magnetism of the number becomes. Bitcoin is stronger at $47,100, and Gold is lower at $1,941. Oil is $5 lower on more Chinese lockdowns at $108.

European markets are higher: Dax +25, FTSE +0.3% and Eurostoxx +1%.

US futures are also higher: Nasdaq +0.2% and Dow and S&P both +0.1%.

Wall Street Top News

Bank of England Governor says the impact of inflation is the greatest since the 1970s.

Kremlin says no progress on Putin-Zelensky meeting.

Germany says G7 will not pay in Roubles for Russian energy.

Shanghai enters lockdown.

Tesla (TSLA) surges on asking shareholders to vote on the stock split.

Apple (AAPL): Nikkei reports Apple will cut production by 20% next quarter.

Barclays (BCS) loses $592 in bond trades.

AMC CEO heads to the Oscars, bulled up for more deals after HYMC.

UBER wins a new 30-month license to operate in London.

Mullen Automotive (MULN) says it will have $65 million in cash.

Tilray (TLRY), Canopy Growth (CGC) are both down 7% premarket.

RIOT and MARA are up 7% premarket.

Sonos (SONO) to be added to S&P SmallCap 600.

Upgrades and Downgrades

Source: Benzinga Pro

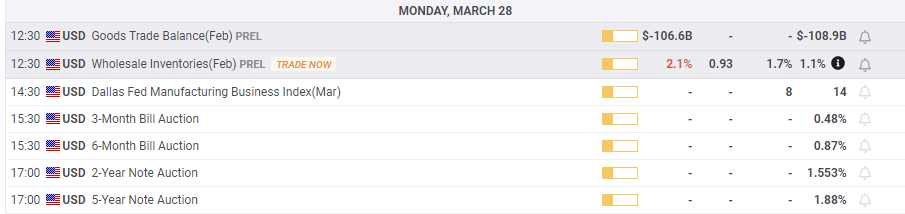

Economic Releases

The author is long puts on HYMC, MULN and AMC.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays below 1.0500 as markets assess German election outcome

EUR/USD struggles to build on earlier gains and stays below 1.0500 on Monday as markets assess German Conservatives Party's win in the federal election, which revived hopes for better economic outlook. The upside remains elusive due to a cautious mood and mixed German IFO data.

GBP/USD retreats below 1.2650 as markets await comments from BoE officials

GBP/USD retreats from the multi-month high it touched earlier and trades below 1.2650 on Monday. The pair eases as the US Dollar pauses its decline but the downside appears limited ahead of speeches from several BoE policymakers.

Gold climbs to an all-time high near $2,960

Prices of Gold glimmered higher on Monday, hitting an all-time high around $2,955 per ounce troy on the back of the US Dollar's inconclusive price action as investors are warming up for a key inflation report due toward the end of the week.

Bitcoin Price Forecast: BTC standoff continues

Bitcoin has been consolidating between $94,000 and $100,000 since early February. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $540 million net outflow last week, signaling institutional demand weakness.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.