Here is what you need to know on Monday, October 18:

Monday is not a great day for stocks. Historically, it is one of the worst-performing days. Thursday is the best, and this Monday is proving that theory with more losses likely. The reasons are pretty obvious and will not take a lot of searching through macro research papers. Oil is nearing $84 this morning, yields are back above 1.6% for the US 10-year, and the dollar is higher again. This is not exactly a bullish cocktail for stocks then. Added to this is the likely default of Chinese developer Sinic, and you have a hangover before the week has even begun. Maybe earnings season can change. This week sees another big slate with Tesla (TSLA) and Netflix (NFLX) probably the highlights.

The dollar is higher at 1.1590 versus the euro. Oil is surging to nearly $84, Bitcoin is lower at $60,900, Gold is at $1,766, and the 10-year yield is 1.6%.

European markets are lower: Eurostoxx -1%, FTSE -0.5% and Dax -0.6%.

US futures are lower: S&P -0.3%, Dow -0.4% and Nasdaq -0.3%.

Wall Street (SPY) (QQQ) news

Chinese industrial output and GDP miss economist estimates.

Zillow (Z) down 5% premarket on a Bloomberg report that it has stopped home-buying services.-CNBC

Apple (AAPL) is set to unveil new Mac laptops today.

Walt Disney (DIS) down nearly 2% premarket as Barclays downgrades it.

Amazon (AMZN): "Five members of the U.S. House Judiciary committee wrote to Amazon.com’s chief executive on Sunday and accused the company's top executives, including founder Jeff Bezos, of either misleading Congress or possibly lying to it about Amazon's business practices."-Reuters

Netflix (NFLX) puts the value of Squid Game at $900 million, according to a Bloomberg report.

Facebook (FB) to add up to 10,000 jobs in the EU over the next five years as it builds out a metaverse.

NetApp (NTAP) is downgraded by Goldman Sachs.

Square (SQ) Chief Executive Officer Jack Dorsey said on Friday that the fintech company will build a Bitcoin mining system.-Reuters

Corsair (CRSR): Cowen&Co cuts price target.

Baidu (BIDU) up 4% premarket on a report that China is considering rules making some content accessible in Baidu's search engine.

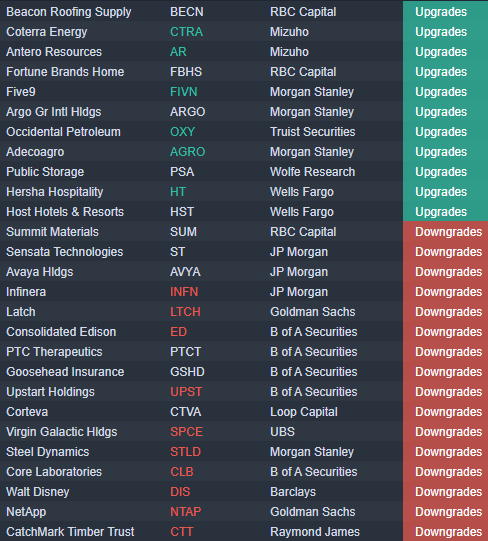

Upgrades, downgrades and premarket

Source: Benzinga Pro

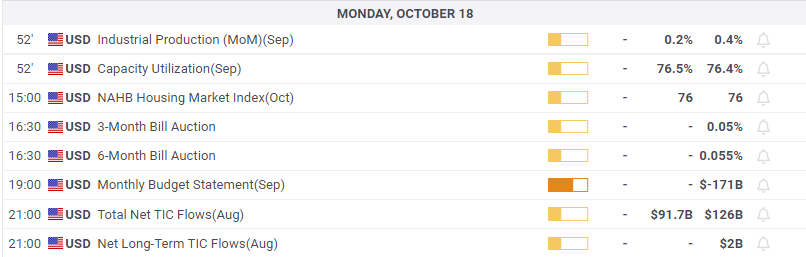

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: A challenge of the 2025 peaks looms closer

AUD/USD rose further, coming closer to the key resistance zone around 0.6400 despite the strong rebound in the Greenback and the mixed performance in the risk-associated universe. The pair’s solid price action was also propped up by a firm jobs report in Oz.

EUR/USD: Extra gains likely above 1.1400

EUR/USD came under renewed downside pressure following another bull run to the 1.1400 region on Thursday. The knee-jerk in spot came in response to the decent bounce in the US Dollar, while the dovish tone from the ECB’s Lagarde seems to have also contributed to the bearish developments in the pair.

Gold bounces off daily lows, back near $3,320

The prevailing risk-on mood among traders challenges the metal’s recent gains and prompts a modest knee-jerk in its prices on Thursday. After bottoming out near the $3,280 zone per troy ounce, Gold prices are now reclaiming the $3,320 area in spite of the stronger Greenback.

Canada launches world's first Solana ETF as $270M in staking deposits propel SOL price above BTC and ETH

Solana price jumps on Thursday as Canadian firm launches the world’s first SOL ETF, fueling bullish sentiment alongside $270 million in new staking deposits this week.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.