Here is what you need to know on Wednesday, November 23:

Equity markets continued the upbeat mood on Tuesday with more gains for the main indices. The drop in bond yields helped as did some recent retail earnings which continued to show resilience from the US consumer. The volume though was light in this shortened week, and that will remain the theme today. We are likely to see some profit-taking ahead of the long weekend and some headwinds could add to this. News from China is not positive with more covid lockdowns putting the reopening trade under pressure.

Oil has spiked as The Wall Street Journal's report was denied by the Saudi government. This is inflationary although it has since fallen as the EU looks to put a low cap on Russian oil. The EU gas cap is put at a very high level. Apple (APPL) looks to be in trouble with reports of major disruptions and protests at its Foxconn-owned supplier factory. Finally, we will get FOMC minutes later. Given how hawkish Powell was in the press conference, there is no reason to expect the minutes to be much different.

This morning sees oil continue its rocky ride back below $78 now. The Dollar Index is just a touch lower to 106.96. Gold is trading at $1,735, and Bitcoin has risen to $16,500.

European markets are quiet, the Eurostoxx is -0.3%, while all others are flat.

US futures are all trading flat.

Wall Street top news

EU rumoured to put a cap of $65 to $70 on Russian oil.

Apple (AAPL): Reuters reports protests at Foxconn factory.

Deere (DE) posts strong earnings.

HP (HPQ) announces large job cuts.

Manchester United (MANU) up on talk of selling the club.

Guess (GES) down on weak outlook.

Credit Suisse (CS) down on capital raise plans.

Reuters headlines

Nordstrom (JWN): The company said on Tuesday net sales at its eponymous retail stores fell 3.4% in its third quarter

ConocoPhillips (COP) & Sempra Energy (SRE): Sempra Energy said on Tuesday that ConocoPhillips will buy five million tonnes per annum of liquefied natural gas (LNG)

Alibaba Group (BABA): Debt-laden Chinese conglomerate Fosun International is seeking to offload a minority stake in Alibaba Group's logistics arm Cainiao.

Berkshire Hathaway (BRKB): The investment company owned by Warren Buffett has sold 3.23 million Hong Kong-listed shares of electric vehicle maker BYD for HK$630.33 million, a stock exchange filing showed.

Tesla (TSLA) Chief Executive Elon Musk said that South Korea was among its top candidate locations for a factory it plans to build in Asia for making electric vehicles (EVs), according to South Korea's presidential office.

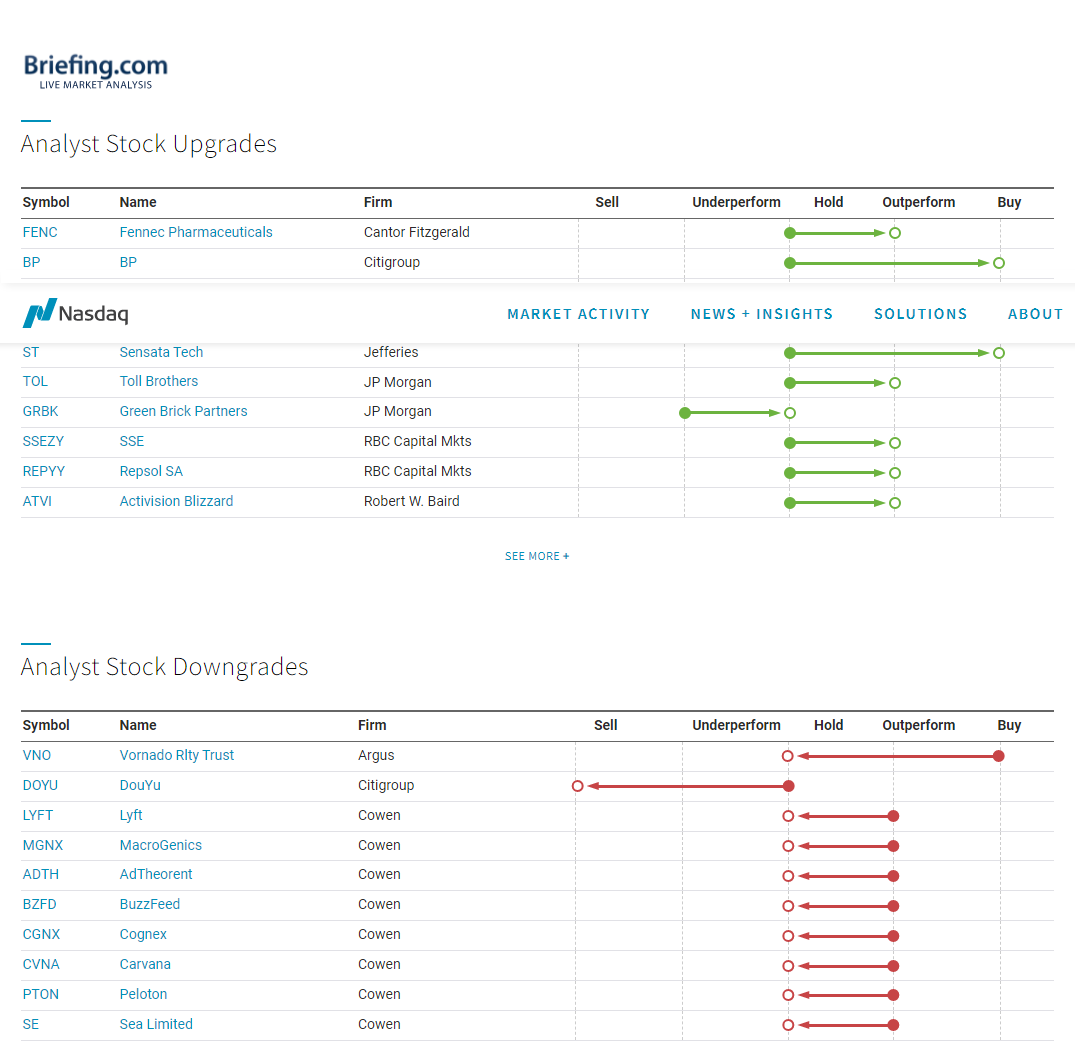

Upgrades and downgrades

Source: Nasdaq.com

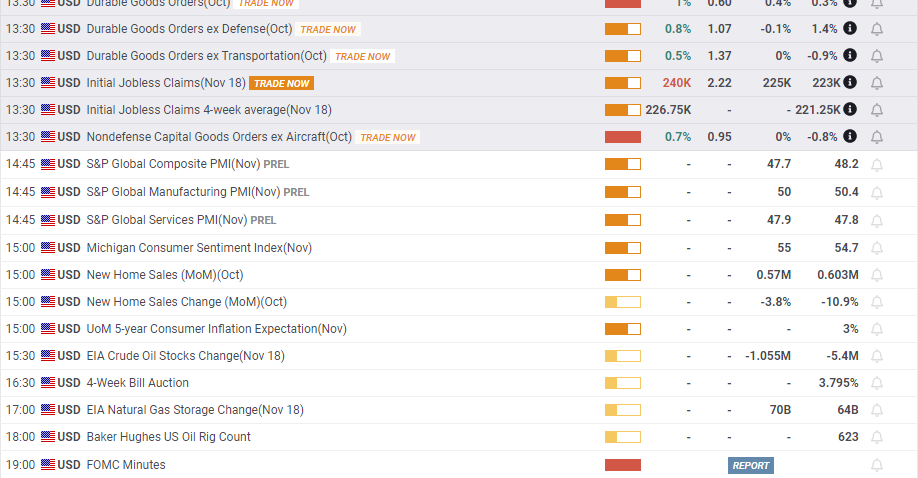

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD consolidates gains near 0.6400; remains close to YTD top

AUD/USD holds gains near the 0.6400 mark early Friday and remains well within striking distance of the YTD peak touched earlier this week. A positive risk tone and a potential for a de-escalation in the US-China trade war act as a tailwind for the Aussie but fresh US Dollar byuing could check the pair's upside.

USD/JPY rises above 143.00 amid hot Tokyo CPI print

USD/JPY attracts some dip-buyers adn retakes 143.00 following Thursday's pullback from a two-week high as hopes for an eventual US-China trade deal tempers demand for the JPY. Data released this Friday showed that core inflation in Tokyo accelerated sharply in April, bolstering bets for more rate hikes by the BoJ.

Gold eyes US-China trade talks and third straight weekly gain

Gold price holds Thursday’s rebound, defending weekly gains near $3,350 early Friday. Gold buyers catch a breather, taking stock of the trade developments globally after US President Donald Trump’s tariffs whiplash.

TON Foundation appoints new CEO after $400M investment: Will Toncoin price reach $5 in 2025?

TON Foundation has appointed Maximilian Crown, co-founder of MoonPay, as its new CEO. Toncoin price remained muted, consolidating with a tight 2% range between $3.08 and $3.21 on Thursday.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.