Here is what you need to know on Monday, December 14:

Equity markets are in a holding pattern as Monday brings little in the way of fresh data, while the remainder of the week is a blockbuster. Tuesday sees US CPI followed by the Fed on Wednesday and then the ECB and BOE on Thursday. So far this morning, oil and yields are lower, helping to engineer a largely flat session in Europe despite Asia closing lower.

The US Dollar is slightly lower with the Dollar Index moving to 104.72, while oil continues to slide as it hits $70.69 now. Gold is more or less flat at $1,793, and Bitcoin is trading at $16,900.

European markets are flat: Eurosotxx +0.15%, FTSE +0.1% and Dax -0.8%. Well flat ish!

US futures are higher: Nasdaq +0.3%, S&P +0.25% and Dow +0.2%.

Wall Street top news

UK Chancellor Hunt says UK economy is likely to get worse and does not know if inflation has peaked.

Microsoft (MSFT) to buy a stake in London Stock Exchange.

Amgen (AMGN) to buy Horizon Therapuetiucs (HZNP).

Coupa Software (COUP) jumps as Thoma Bravo rumored to offer $81 a share.

Reuters headlines

Clovis Oncology (CLVS): The US drugmaker on Sunday filed for bankruptcy protection in Delaware.

Coinbase Global (COIN): The US Supreme Court on Friday agreed to hear cryptocurrency exchange Coinbase's bid to halt lawsuits the company contends belong in private arbitration, including one by a user suing after a scammer stole from his account.

General Motors (GM): The US Energy Department said it had finalized a $2.5 billion low-cost loan to a joint venture of General Motors and LG Energy Solution to help pay for three new lithium-ion battery cell manufacturing facilities.

Rivian Automotive (RIVN): The company said it is pausing its joint venture with Mercedes-Benz Vans, just three months after the companies entered a partnership to make electric vans in Europe.

Spirit Airlines (SAVE): The company has offered as much as a 43% cumulative weighted-average pay raise to its pilots over two years, according to a union memo seen by Reuters.

Upgrades and downgrades

Upgrades $BBY $BDX $COUP $GPS $MNDY $UAAhttps://t.co/eAzzXmW2uv pic.twitter.com/K0ojaJrFsL

— *Walter Bloomberg (@DeItaone) December 12, 2022

Downgrades $BYD $ILMN $LEVI $MU $NRVO $QCOM $ULTAhttps://t.co/h7EhokdnFw pic.twitter.com/GUfD65h9Wm

— *Walter Bloomberg (@DeItaone) December 12, 2022

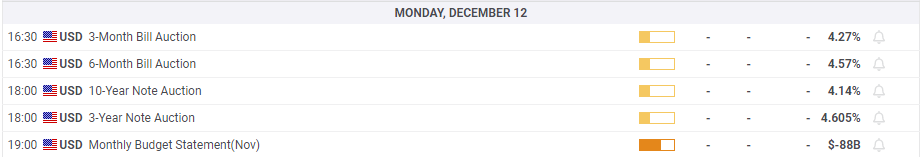

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.