Here is what you need to know on Wednesday, February 1:

All you need to know is the Federal Reserve. Nothing else matters really. Yes, we have ADP numbers shortly, but those will be totally overshadowed by the Fed decision. Not so much the decision, but the statement and presser. 25 basis points seems nailed on, but Powell has been hawkish all the time and the risk markets may not like that. It is a busy week though with NFP on Friday, so that may see the big money wait and look for confirmation. A hawkish Fed needs a strong NFP, and a dovish Fed needs a weak NFP. Anything else and we are set for more confusion and range trading.

Ahead of the Fed the US Dollar Index is lower at 101.86, oil is up to $79.57 but still much lower for the week. Gold trades at $1,928 for no change.

European markets are mixed: Eurostoxx and FTSE completely flat, CAC -0.37%. DAX +0.3%.

US futures lower: NASDAQ flat, S&P 500 -0.2% and Dow -0.3%.

Wall Street top news

Eurozone CPI lower than expected, but German data delayed.

Meta Platforms (META) provides earnings after the close.

Advanced Micro Devices (AMD): revenue ahead of forecasts.

Amgen (AMGN): EPS in line, revenue ahead.

Electronic Arts (EA): down 9% on lowered forecasts.

GSK: beats on top and bottom lines.

Match Group (MTCH): Stock drops 8% on low forecasts as earnings miss estimates.

Mondelez International (MDLZ): beats on top and bottom lines.

Snap (SNAP): beats on EPS, but revenue misses. Stock down sharply on weak outlook.

Intel (NTC): cuts wages.

Upgrades and downgrades

Upgrades

Wednesday, February 01, 2023

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

Primis Financial |

FRST |

Piper Sandler |

Neutral>>Overweight |

$13>>$14 |

|

NeoGenomics |

NEO |

Needham |

Hold>>Buy |

$15 |

|

Magna |

MGA |

BMO Capital Markets |

Market Perform>>Outperform |

$65>>$74 |

|

Hubbell |

HUBB |

JP Morgan |

Underweight>>Neutral |

$200>>$205 |

|

First Interstate Bancsystem |

FIBK |

Stephens |

Equal-Weight>>Overweight |

$44>>$43 |

Downgrades

Wednesday, February 01, 2023

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

American Electric |

AEP |

Wells Fargo |

Overweight>>Equal Weight |

$108>>$99 |

|

Edison |

EIX |

Wells Fargo |

Overweight>>Equal Weight |

$76>>$73 |

|

Equitrans Midstream |

ETRN |

Goldman |

Buy>>Sell |

$9.5>>$6 |

|

Funko |

FNKO |

Goldman |

Neutral>>Sell |

$22>>$8.5 |

|

Hasbro |

HAS |

Goldman |

Buy>>Neutral |

$64 |

|

Veradigm |

MDRX |

Piper Sandler |

Overweight>>Neutral |

$17>>$18.5 |

|

Taysha Gene Therapies |

TSHA |

Jefferies |

Buy>>Hold |

$14>>$1.5 |

|

WSFS Financial |

WSFS |

Piper Sandler |

Overweight>>Neutral |

$53>>$52 |

Source: WSJ.com

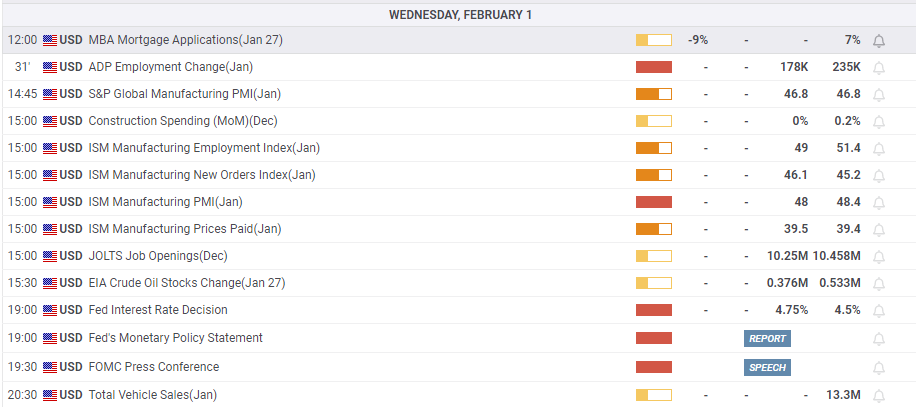

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold refreshes all-time highs above $3,000 on escalating geopolitical tensions

Gold price regains the $3,000 mark early Tuesday, refreshing record highs on intensifying geopolitical Middle East tensions. Israel resumes military operations against Hamas in Gaza after the group rejected US proposals for extending ceasefire. Further US-Iran tensions also add to the latest leg up in the safe-haven Gold.

AUD/USD trades with caution below 0.6400 amid MiIddle East tensions

AUD/USD has paused its upsurge, trading with caution in Tuesday's Asian trading. Traders prefer to stay on the sidelines amid intensifying geopolitical risks in the Middle East, reducing the appeal of the higher-yielding Aussie. Meanwhile, the US Dollar finds its feet due to risk aversion.

USD/JPY sits at two-week high near 149.50 as US Dollar finds demand

USD/JPY sits at two-week high near 149.50 in the Asian session on Tuesday as renewed Middle East geopolitical jitters revive the safe-haven demand for the US Dollar. However, further upside appears elusive amid divergent BoJ-Fed expectations and rising trade tensions.

Solana price faces 50-day resistance as SOL futures debut on CME Group with $5M volume on fifth anniversary

Solana stagnated around the $128 mark on Monday despite multiple bullish catalysts. The recent SOL unlocks by Alameda Research, ahead of FTX creditor repayments, have created a persistent bearish overhang since early March.

Five Fundamentals for the week: Fed leads central bank parade as uncertainty remains extreme Premium

Central bank bonanza – perhaps its is not as exciting as comments from the White House, but central banks still have sway. They have a chance to share insights about the impact of tariffs, especially when they come from the world's most powerful central bank, the Fed.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.