Here is what you need to know on Friday, October 1:

Equity markets remain cautious despite another slew of losses for the main indices on Thursday to close out September and the quarter. Normally a dead cat bounce would be in evidence at this stage, but even that seems a tough act now as European markets remain shaky. Just with perfect timing, it seems everyone is now long the equity market, with the latest Bank of America survey showing household holding of equities has reached a 70-year high. Have we all become stock market gurus or lemmings heading for the cliff?

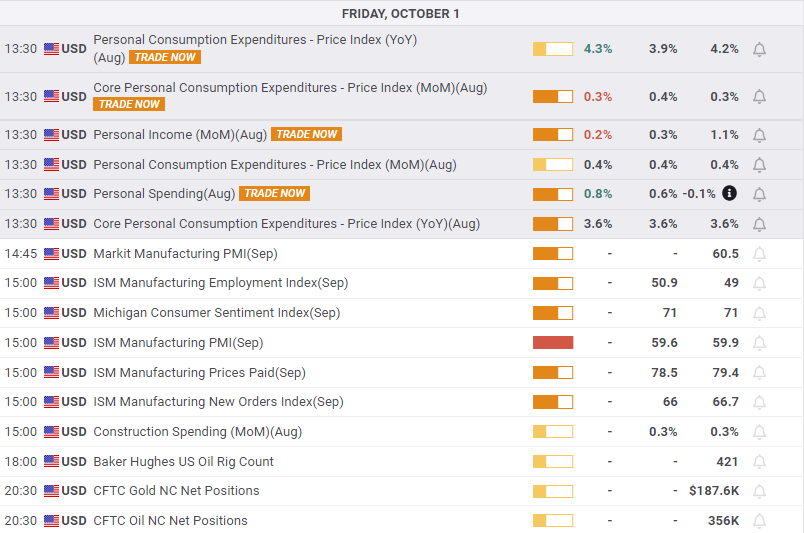

Inflation remains the watchword as yields head higher again after the latest PCE data shows it running above the norm. The US 10-year has just popped back above 1.5% and futures have fallen after the release.

The dollar is seeing some profit-taking at 1.1602 now versus the euro, Oil is at $74.41, and Bitcoin is surging to $47,400 after Fed chair Powell says there are no plans to ban it.

See forex today

European markets are mixed: FTSE -0.3%, Eurostoxx +0.1% and Dax -0.1%.

US futures are higher: S&P +0.2%, Dow +0.2% and Nasdaq flat.

Wall Street (SPY) top news

US PCE +0.4% versus +0.3% expected.

President Biden signs a funding bill, so the government shutdown avoided, but debt ceiling still beckons.

President Biden's infrastructure bill is still deadlocked.

Merck (MRK) announces oral covid drug cuts risk of hospitalization and death by up to 50% and will seek emergency FDA approval.

Lordstown Motors (RIDE) to sell its Ohio plant to Foxconn for $230 million.

Novavax (NVAX), Moderna (MRNA), BioNTech (BNTX), and Pfizer (PFE) are all down premarket, likely on Merck oral drug news above.

XPeng (XPEV): record September deliveries, shares up 4% premarket.

NIO shares up 3% premarket on strong delivery numbers.

Li Auto (LI) delivery data is also strong, stock up 2% premarket.

Zoom Video (ZM) and Five9 (FIVN) deal is cancelled by mutual consent.

Five9 (FIVN) upgraded by Barclays and Wells Fargo, up 1.5% premarket.

Exxon (XOM) says higher oil and gas prices could increase Q3 earnings by $1.5 billion.

Jefferies (JEF) results well ahead with a strong performance in investment banking.

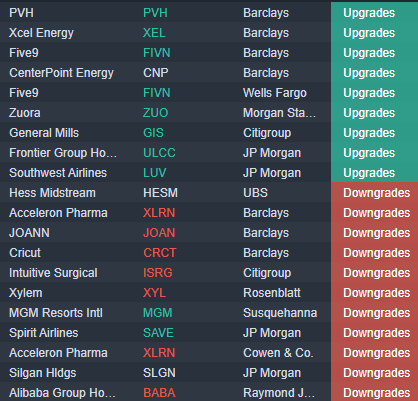

Upgrades, downgrades and premarket movers

Source: Benzinga Pro

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady above 1.0550 on modest USD weakness

EUR/USD struggles to gather recovery momentum but clings to modest daily gains above 1.0550 in the second half of the day on Monday. Although the US Dollar corrects lower following the previous week's rally, the cautious market mood makes it hard for the pair to push higher.

GBP/USD stabilizes above 1.2600 following previous week's drop

GBP/USD defends minor bids above 1.2600 in the American session on Monday, while the negative shift seen in risk sentiment caps the pair's upside. The Bank of England Monetary Policy Hearings and UK inflation data this week could influence Pound Sterling's valuation.

Gold gives signs of life and reclaims $2,600/oz

After suffering large losses in the previous week, Gold gathers recovery momentum and trades in positive territory above $2,600 on Monday. In the absence of high-tier data releases, escalating geopolitical tensions help XAU/USD hold its ground.

Bonk holds near record-high as traders cheer hefty token burn

Bonk (BONK) price extends its gains on Monday after surging more than 100% last week and reaching a new all-time high on Sunday. This rally was fueled by the announcement on Friday that BONK would burn 1 trillion tokens by Christmas.

The week ahead: Powell stumps the US stock rally as Bitcoin surges, as we wait Nvidia earnings, UK CPI

The mood music is shifting for the Trump trade. Stocks fell sharply at the end of last week, led by big tech. The S&P 500 was down by more than 2% last week, its weakest performance in 2 months, while the Nasdaq was lower by 3%. The market has now given back half of the post-Trump election win gains.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.