Here is what you need to know on Thursday, July 28:

The Fed did as expected but unexpectedly went all dovish, saying it will adopt a wait-and-see approach going forward. Risk assets liked what they heard and rallied hard, but US GDP just out confirms a recession as the economy shrank 0.9% when growth of 0.5% was the consensus. The GDP Price Index was also high. Futures ticked lower but recovered.

Equities

The Fed decision gave us about two solid hours of bullishness, and in that time the Nasdaq added 4% and the S&P 500 closed up just under 3%. The sentiment was strong across the board with 86% of all stocks closing higher. After the close Facebook parent Meta Platforms put a dampener on things when it announced its first revenue decline as a public company and saw advertising spending dropping. The Zuck was pretty bearish on the economy during the call. A hiring freeze is on to cut costs.

This has calmed things overnight, and Qualcomm too managed to put bearish thoughts back on high alert. Retailers continue to show that this economy looks like it is in recession as Best Buy cut forecasts. Data just out as I type confirms this recession with US GDP falling for the second quarter in a row. Equities fell on the release but have already moved back to where they were before the GDP release. This will likely add to the recent choppy trading, but overall equities are underweight, meaning funds have to buy buy Apple and Amazon after the close.

Fixed Income

Bond yields all moved lower after the Fed pivoted to a wait-and-see approach. This has continued again with the GDP number. The 2-year is now yielding 2.9%, and the 10-year is at 2.74%. The probability of a rate hike in September had already lessened and now this GDP number increases the likelihood of 50bps or lower in September. Remember that there is no August meeting. December Eurodollar futures have now taken out 50 bps of hikes since the middle of June.

Oil and gas

Oil is underpinned by the US continuing to drain its inventories, and Wednesday saw a higher than expected number here. Oil is just under $100 as the market digests a dovish Fed versus GDP recession. Gas is higher again in Europe on continued fears over the Norstream pipeline. This story will drag on.

FX

The dollar is weaker across the board with US GDP and a doveish Fed a double whammy to dollar bulls. Positioning was also skewed long dollars, and this will unwind now, so the move could continue. However, the caveat is Europe remains a basket case, which may cap dollar gains in the pair. The yen gained on some hawkish comments from the favorite next-in-line BOJ governor Amamiya saying wages would exceed inflation.

Bitcoin continues to benefit from the risk-on sentiment and has moved up above $23,000, while Gold is up to $1,748.

European markets are lower: Eurostoxx and Dax are flat, and the FTSE is -0.5%

US futures are lower: S&P and Dow are -0.2%, while the Nasdaq is -0.5%.

Wall Street news (QQQ) (SPY)

US GDP -0.9% versus +0.5% expected, RECESSION!

President Biden is to speak to Chinese President Xi today.

US House Democrats propose a stock trading ban on lawmakers.

German inflation is higher than forecast.

Senator Manchin agrees to Inflation Act, which boosts green energy stocks PLUG, JNKO, RUN, SEDG, etc.

Facebook (META) missed on earnings, guidance cut. Shares fell.

Qualcomm (QCOM) beats but cuts outlook.

Ford (F) beats on EPS and revenue and affirms 2022 guidance.

JetBlue (JBLU) finally gets Spirit (SAVE) as the merger is confirmed.

Southwest (LUV) beats on EPS and revenue and says it will be profitable for the rest of the year, but cost concerns send stock lower.

Mastercard (MA) beats EPS and revenue estimates as consumer spending is strong.

Stanley Black and Decker (SWK) falls sharply on earnings miss.

Comcast (CMCSA) falls as broadband growth is flat.

Harley Davidson (HOG) is up on strong earnings and guidance.

Best Buy (BBY) down 3% on cut to forecasts.

Teladoc (TDOC) falls sharply on earnings.

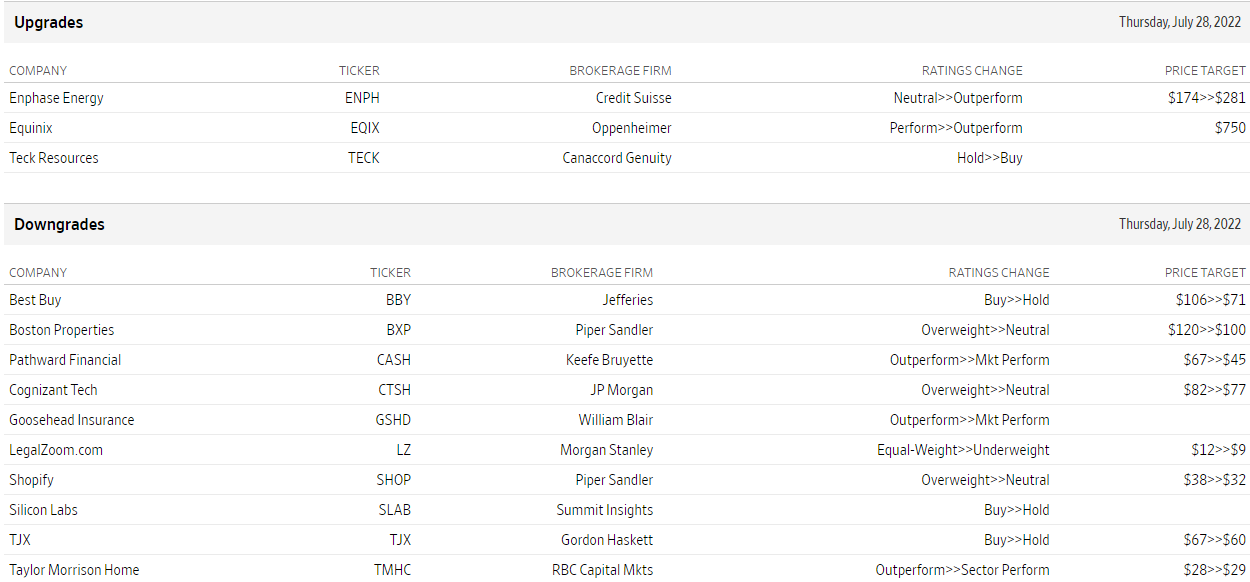

Upgrades and downgrades

Source: WSJ.com

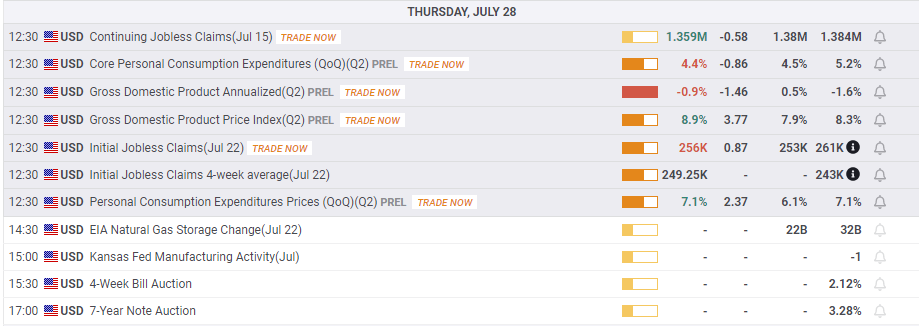

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637946098222775980.png)