Here is what you need to know on Monday, November 29:

Delta may be finally on the way out but it might be replaced by another variant as Omicron, first identified in South Africa, is now being picked up globally. Whether this is a good or bad thing is as yet unknown. Will omicron be more transmissible but milder? That would be blue-sky thinking and more study is needed. What is known is that this creates some uncertainty and as we bang on here repeatedly, markets hate uncertainty. Markets are forward-looking and can plan with known good or bad news but not with uncertainty. So we will likely see some volatility for the next few weeks until more information on omicron becomes available. Friday was an aberration with reduced holiday volumes exaggerating the fall. Already Monday is seeing a strong rally. But Merck's (MRK) anti-viral pill may not be a silver bullet so covid fears remain elevated. Friday's big winners were all the vaccine makers, with Moderna (MRNA) the standout at +20%. For now, its all hands to the holiday season as demand for the new Spiderman movie sees ticket sites crash but AMC fails to pop. Black Friday retail sales were also slightly on the low side so retail stocks could struggle. Earnings from Big Lots (BIG), Kroger (KR) and Dollar General (DG) are up this week.

The dollar meanwhile eases back from its run, to 1.1276 now against the euro, Gold is back down to $1792, bitcoin at $57,300 and Oil is back up to $71.55.

See forex today

European markets are higher: Eurostoxx +2%, FTSE +1.6% and Dax +0.7%.

US futures are higher: S&P +0.7%, Dow +0.6% and Nasdaq +0.9%.

S&P 500 (SPY) Nasdaq (QQQ) top news

AMC, Spider-Man set for big opening with ticket sites crashing, see more.

Tesla (TSLA) after last quarter's "super hardcore" Elon Musk urges focus on costs for next quarter, see more.

Moderna (MRNA) says it could have a vaccine ready for omicron variant by early 2022, see more.

Merck (MRK) data for its antiviral pill for covid not as positive as first thought. Citi downgrades.

Reuters sees online sales of $11.3 billion on cyber Monday, a drop from last year.

Phoenix Motors Co (PEV) to IPO under ticker PEV. electric vehicle company, yes another one! Rivian (RIVN) is slowing as deliveries are delayed, see more.

Pfizer (PFE) JPMorgan raises the price target.

Adagio Therapeutics (ADGI) up 30% as the company says its covid vaccine candidate is likely to be effective against omicron variant.

Hertz (HTZ) up 8% on share buyback program of $2 billion.

Li auto (LI) up 8% on earnings beat on top and bottom lines.

Upgrades and downgrades

Source: Benzinga Pro

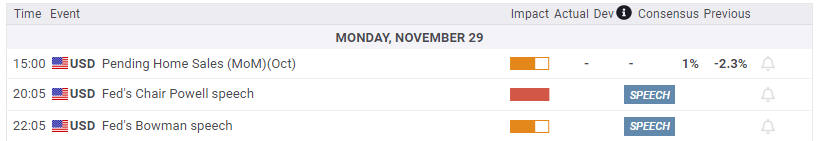

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD remains offered in the low-1.0900s

The generalised selling pressure continues to weigh on the risk complex, pushing EUR/USD back toward the 1.0900 support level amid a growing risk-off mood, as traders assess President Trump’s reciprocal tariffs and their impact on economic activity.

GBP/USD retreats further and breaks below 1.2800

The US Dollar is picking up extra pace and flirting with daily highs, sending GBP/USD to multi-week lows near 1.2770 in a context where safe-haven demand continues to dictate sentiment amid the chaos of US tariffs.

Gold recedes to four-week lows near $2,950

The persistent selling pressure is now dragging Gold prices to the area of fresh multi-week troughs near the $2,950 mark per troy ounce, always amid the continuation of the recovery in the US Dollar, highr US yields across the curve and unabated tariff tensions.

US stock market suddenly reverses higher after rumor of 90-day tariff pause before sinking again Premium

NASDAQ sinks 4% before shooting higher on tariff pause rumor. CNBC says White House unaware of tariff pause rumor. S&P 500 sinks to January 2024 level. Bank of America cuts its year-end target for S&P 500 by 16%.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.