Here is what you need to know on Monday, May 23:

Consumer stocks will once again take the focus this week. Costco (COST), Dollar General (DG) and Dollar Tree (DLTR) are the highlights later in the week. After the horror show of Walmart (WMT) and Target (TGT) last week, investors will be wondering just how much worse it can get. Wait and see, but the risk/reward is not favoring outerperformance in our view. A fairly light slate on the data front this morning sees the German IFO suprise to the upside, which has helped European equities build on Friday's late US rally.

Investor sentiment is terrible. The latest from AAII, Investors Intelligence and the Bank of America Monthly Fund Manager survey all demonstrates that investors are strongly bearish and reducing equity exposure. This could and should set up the potential for a month-end rally.

The dollar too showed some overweight positions from the lastest CME commitment of traders report, and it has already been on the back foot this morning. The Dollar Index is back to 102.35. Oil trades at $111.30, and Bitcoin is still clinging to $30,000. Gold is steady at $1,855.

European markets are higher: Eurostoxx +0.2%, FTSE +1% and Dax +0.8%.

US futures are also higher: S&P +0.8%, Nasdaq +0.5% and Dow +0.9%.

Wall Street Top News (SPY) (QQQ)

President Biden says US is willing to defend Taiwan.

German IFO better than expected.

Electronic Arts (EA) rumoured to be up for sale, according to Puck News.

GameStop (GME) launches digital wallet for NFTs.

Pfizer (PFE) says three doses offer strong protection to kids under five.

Emergent Bio (EBS) and SIGA up strongly on monkeypox concerns.

Boeing (BA) airliner docks with space station successfully.

VMWare (VMW) spiking on reports that it is to be bought by Broadcom (AVGO).

AMD debuts new Ryzen chips.

Upgrades and downgrades

Source: Benzinga

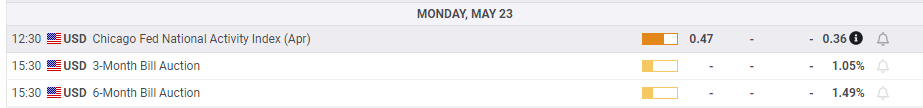

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady above 1.0550 on modest USD weakness

EUR/USD struggles to gather recovery momentum but clings to modest daily gains above 1.0550 in the second half of the day on Monday. Although the US Dollar corrects lower following the previous week's rally, the cautious market mood makes it hard for the pair to push higher.

GBP/USD stabilizes above 1.2600 following previous week's drop

GBP/USD defends minor bids above 1.2600 in the American session on Monday, while the negative shift seen in risk sentiment caps the pair's upside. The Bank of England Monetary Policy Hearings and UK inflation data this week could influence Pound Sterling's valuation.

Gold benefits from escalating geopolitical tensions, rises above $2,600

After suffering large losses in the previous week, Gold gathers recovery momentum and trades in positive territory above $2,600 on Monday. In the absence of high-tier data releases, escalating geopolitical tensions help XAU/USD hold its ground.

Bonk holds near record-high as traders cheer hefty token burn

Bonk (BONK) price extends its gains on Monday after surging more than 100% last week and reaching a new all-time high on Sunday. This rally was fueled by the announcement on Friday that BONK would burn 1 trillion tokens by Christmas.

The week ahead: Powell stumps the US stock rally as Bitcoin surges, as we wait Nvidia earnings, UK CPI

The mood music is shifting for the Trump trade. Stocks fell sharply at the end of last week, led by big tech. The S&P 500 was down by more than 2% last week, its weakest performance in 2 months, while the Nasdaq was lower by 3%. The market has now given back half of the post-Trump election win gains.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.