Wake Up Wall Street (SPY) (QQQ): Bitcoin bumbles, Peloton stumbles, Walmart, Home Depot rumble

Here is what you need to know on Tuesday, November 16:

Tesla (TSLA) loses its membership in the $1 trillion club as the stock slides again after more insider sales. JPMorgan also adds to the stock woes as its sues Tesla.

The US consumer may be more durable than previously thought or they just may have wanted to stop online shopping. Either way, it benefitted both Home Depot and Walmart, who posted strong earnings. Peloton was not so lucky in its recent earnings, and now the fitness company launches a $1 billion stock offering.

The dollar remains strong at $1.1365 now as it goes through another handle versus the euro. Bitcoin is suffering at $60,300, up from $59,000, after a tough Monday. Oil is back above $81, and Gold trades at $1,873.

European markets are higher: Eurostoxx +0.5%, FTSE flat and Dax +0.4%.

US futures are mixed: S&P flat, Dow +0.1% and Nasdaq -0.1%.

Wall Street (SPY) QQQ) stock news

Home Depot (HD) beats on earnings, see more.

Walmart (WMT) also beats on earnings, see here.

AMC to accept Shiba Inu, see here.

Advance Auto Parts (AAP) beats on revenue and EPS.

Marathon Digital (MARA) collapses 27% on Monday and is down in premarket, see more.

Diageo (DEO) up 2% on strong guidance.

Tesla (TSLA): JPM Morgan to sue over breaching a contract in relation to stock warrants. see here.

Lucid Motors (LCID) up 5% premarket on strong results and sales, see more.

Peloton (PTON) launches a $1 billion stock offering.

Rivian (RIVN) up again on Monday and in Tuesday's premarket, see more.

Pfizer (PFE) says it will allow generic drug makers to supply its experimental antiviral treatment for covid to low and middle-income countries through a licensing agreement.-Reuters.

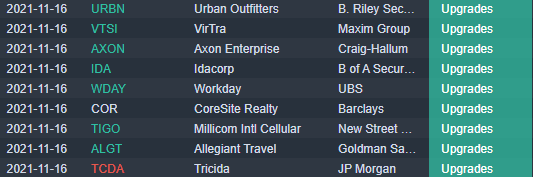

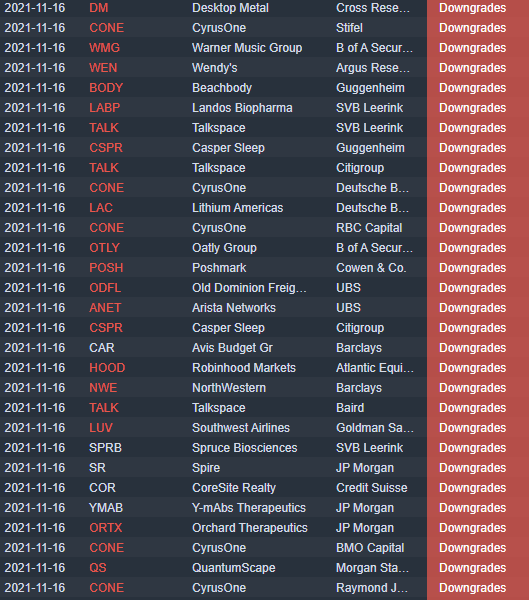

Upgrades and downgrades

Source: Benzinga Pro

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.