Here is what you need to know on Friday, August 19:

Bed Bath & Beyond (BBBY) caused a commotion on Thursday as news emerged of retail favorite Ryan Cohen's RC Ventures selling its stake in BBBY. Ryan Cohen chairs GameStop (GME), the original of the species when it comes to meme stocks. BBBY cratered afterhours and is down 40% (the author is short and long puts). Outside of the meme space, momentum is beginning to wane as this rally gets longer in the tooth. Futures are lower on Friday with some decent sell option flows expected on the expiration day. Risk aversion is growing with some profit taking and the high-risk side hitting the Nasdaq index. Bitcoin falling 7% is also hitting risk appetites, and we note the recent pretty high correlation between Bitcoin and the Nasdaq. Bitcoin is currently down 7% to $21,400.

Oil is at $89, a slight fall from Thursday as yields rose overnight. Gold is also lower at $1,751, and the dollar index is higher at 108 on yields rising and some risk aversion flows.

European markets are mixed: Eurostoxx -0.5%, FTSE flat, and Dax -0.5%

US futures are also lower: S&P -0.9%, Nasdaq -1% and Dow -0.7%.

Wall Street top news (QQQ)(SPY)

Yields rise globally, Germany up 13bps, US up nearly 10bps on ten-year yields

Bed Bath and Beyond (BBBY): Ryan Cohen investment firm sells its stake, and shares collapse.

Deere (DE) cuts guidance, falls 5%.

Foot Locker (FL) gains on earnings beat and new CEO.

Weber (WEBR) up on retail meme interest.

Applied Materials (AMAT) beats on earnings.

Home Depot (HD) outlines a share repurchase plan.

Bill.com (BILL) is up on strong earnings.

General Motors (GM) reinstates dividends.

Meta Platforms (META) forecasts were lowered by Morgan Stanley.

Wayfair (W) announced cuts to the workforce.

GameStop (GME) down 10%.

Madison Square Garden (MSGE) up on revenue beat.

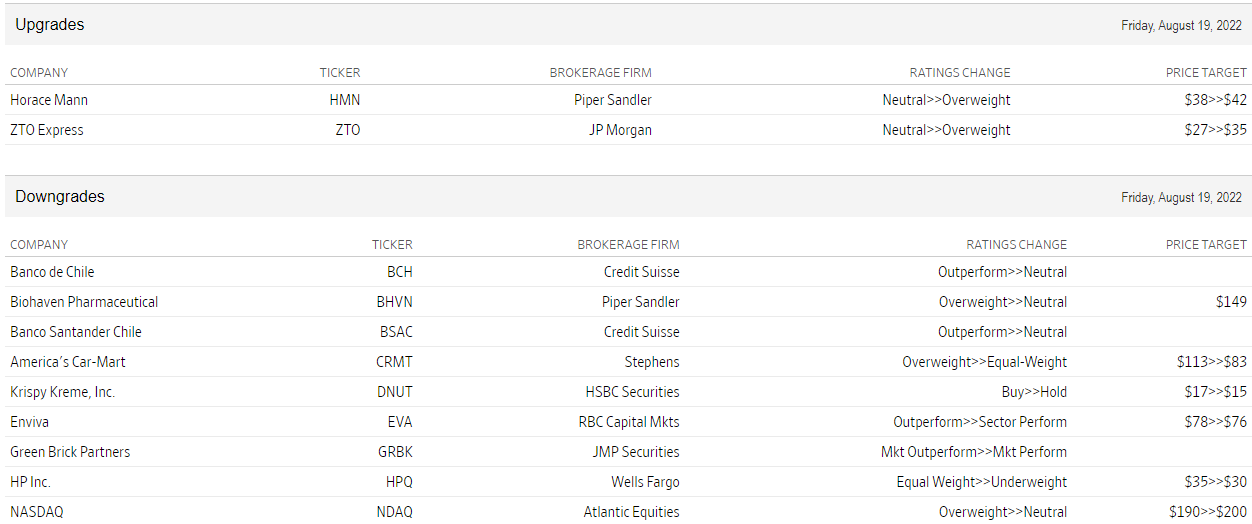

Upgrades and downgrades

Source: WSJ.com

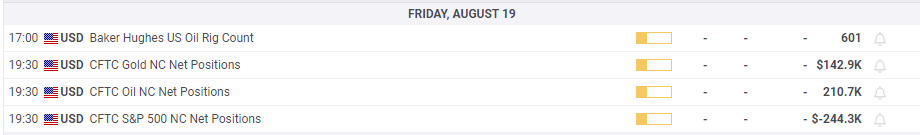

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD consolidates around 0.6400; remains close to YTD top

AUD/USD holds steady around the 0.6400 mark on Friday and remains well within striking distance of the YTD peak touched earlier this week. A positive risk tone, along with the potential for a de-escalation in the US-China trade war, act as a tailwind for the Aussie amid a bank holiday in Australia and the lack of any meaningful USD buying.

USD/JPY edges higher to 143.00 mark despite strong Tokyo CPI print

USD/JPY attracts some dip-buyers following Thursday's pullback from a two-week high as hopes for an eventual US-China trade deal tempers demand for the JPY. Data released this Friday showed that core inflation in Tokyo accelerated sharply in April, bolstering bets for more rate hikes by the BoJ.

Gold price bulls seem reluctant amid the upbeat market mood

Gold price trades with positive bias for the second straight day, though it lacks bullish conviction. Hopes for a faster resolution to the US-China standoff remain supportive of a positive risk tone. Adding to this modest USD uptick caps the upside for the commodity.

TON Foundation appoints new CEO after $400M investment: Will Toncoin price reach $5 in 2025?

TON Foundation has appointed Maximilian Crown, co-founder of MoonPay, as its new CEO. Toncoin price remained muted, consolidating with a tight 2% range between $3.08 and $3.21 on Thursday.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.