Here is what you need to know on Monday, August 8:

Equity markets are on hold really until Wednesday's Consumer Price Index (CPI). Given that macro narratives are what has been driving the market of late, expect that number to either give the rally the kiss of death or breathe new life into the dovish Fed argument. Earnings season is more or less complete and was not as bad as feared. Reactions to earnings disappointments were also slightly more positive than usual, meaning we all perhaps got a tad too negative into the season. Certainly, sentiment readings backed this up and helped fuel the turnaround rally.

Former retail favorite Palantir has disappointed again with the security company once again lowering forward guidance. PLTR stock is down 10% in the premakret. Green energy and health stocks could catch a boost from the finally passed climate and healthcare package, which Democrats finally got over the line. The package is much less than originally hoped for however.

The dollar has lost some ground this morning and is down to 106.40 for the dollar index. Gold trades at $1,785, and Bitcoin is at $24,100. Oil is trading at $88.07.

European markets are higher: Eurostoxx +0.8%, FTSE +0.4% and Dax +0.9%.

US futures are also higher: S&P +0.5%, Dow +0.4% and Nasdaq +0.7%.

Wall Street top news (QQQ) (SPY)

China military drills continue near Taiwan.

Palantir (PLTR) earnings mixed, but lower guidance hits the stock.

CVS Health (CVS) planning to bid for Signify Health (SGFY), according to WSJ.

Tyson foods (TSN) earnings mixed, and shares fall 2%.

First Solar (FSLR) catches multiple broker upgrades as the climate act finally gets through.

Barrick Gold (GOLD) is up on solid earnings.

BioNTech (BNTX) down on earnings.

Crisper Therapeutics (CRSP) misses on earnings.

LYFT creates a new advertising unit.

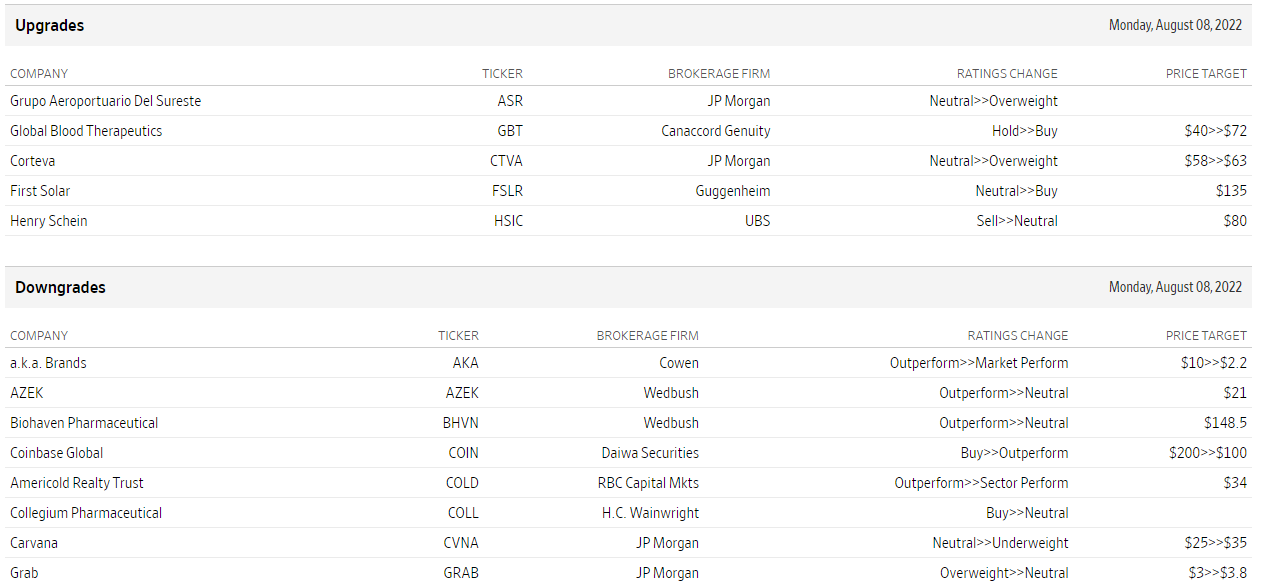

Upgrades and downgrades

Source: WSJ.com

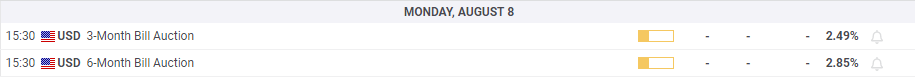

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD eases to daily lows near 1.0260

Better-than-expected results from the US docket on Friday lend wings to the US Dollar and spark a corrective decline in EUR/USD to the area of daily lows near 1.0260.

GBP/USD remains under pressure on strong Dollar, data

GBP/USD remains on track to close another week of losses on Friday, hovering around the 1.2190 zone against the backdrop of the bullish bias in the Greenback and poor results from the UK calendar.

Gold recedes from tops, retests $2,700

The daily improvement in the Greenback motivates Gold prices to give away part of the weekly strong advance and slip back to the vicinity of the $2,700 region per troy ounce at the end of the week.

Five keys to trading Trump 2.0 with Gold, Stocks and the US Dollar Premium

Donald Trump returns to the White House, which impacts the trading environment. An immediate impact on market reaction functions, tariff talk and regulation will be seen. Tax cuts and the fate of the Federal Reserve will be in the background.

Hedara bulls aim for all-time highs

Hedara’s price extends its gains, trading at $0.384 on Friday after rallying more than 38% this week. Hedara announces partnership with Vaultik and World Gemological Institute to tokenize $3 billion in diamonds and gemstones

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.