Here is what you need to know on Friday, July 15:

Thursday was another one to keep investors on their toes as the delayed reaction to Wednesday's shock inflation seemed more in keeping with what should have happened, i.e. more selling. Things were going swimmingly for bears until Fed man Waller stepped up to the plate and swatted away talk of a 100-basis-point hike in July. Fed funds futures markets totally repriced, and the probability for a 100 bps hike moved from near 90% certainty back to 50/50 now versus 75 bps. James Bullard then told the Nikkei later that he was going for 75 bps in July. Both Waller and Bullard would be noted hawks (higher rates), so the market took this accordingly. The S&P and Nasdaq recovered about 2% from intraday lows to close almost unchanged.

Earnings season has commenced, and Jamie Dimon remained in hurricane crisis mode as the bank missed on both EPS and revenue estimates, stopped its buybacks, and generally spoke gloomily about prospects for the economy. Citibank (C) though this morning is making a mockery of those commenters as it smashes earnings forecasts, beating EPS expecations by a wide margin, $2.19 versus $1.69, and revenue as well. Citigroup shares are up 5% in the premarket.

The commodity sphere remains focused on an impending recession as prices remain bearish. Oil is still below $100 at $98 now, which is a tad higher than Thursday. Copper remains under pressure, and we will delve a bit more deeply into this space in our Week Ahead on Wall Street article posted in a few hours. Gold is also lackluster at $1,710, while Bitcoin is managing to gain 2% up to $21,000 now. The dollar remains near multi-decade highs at $108.20 for the dollar index. Europe remains in basket case mode as the Italians rumble over whether to have a leader or not, taking the lead from the UK, while Germany prepares for a pretty cold winter irrespective of what happens to the actual weather. Sovereign spreads continue to blow out, helping the euro to continue its path below parity versus the dollar. Yields too have begun to move lower as bond markets increasingly price in a global recession.

European markets are higher: Eurostoxx +0.6%, FTSE +0.7% and Dax +1.6%.

US futures are also higher: S&P +0.5%, Dow +0.6% and Nasdaq +0.3%.

Wall Street top news (SPX) (QQQ)

ECB Rehn says likely to hike 25 bps in July.

China announces more covid lockdowns.

China economic growth slows sharply, GDP worse than expected.

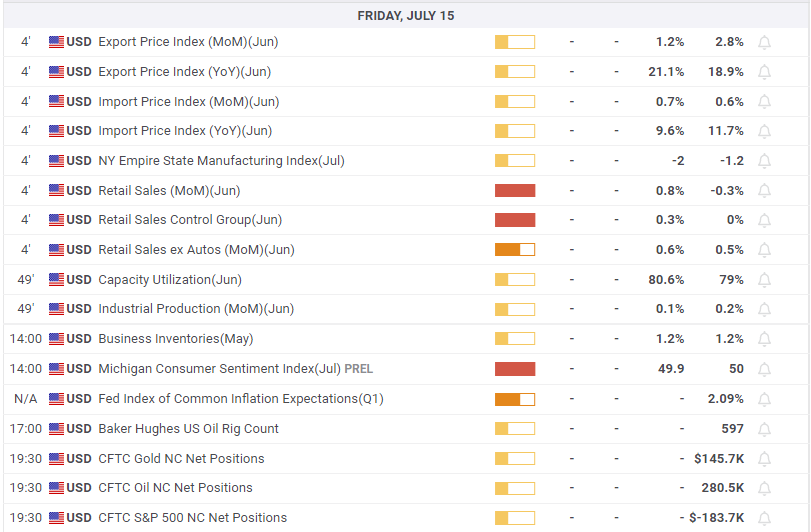

US retail sales remain strong though: 1% versus 0.9% expected and core 1% versus 0.7% expected.

Fed's Bostic says moving too dramatically could undermine the economy and add to uncertainty. 75 bps it is then!

Citibank (C) beats on top and bottom lines.

Pinterest (PINS) spikes higher on Elliot Investment Management stake.

Wells Fargo (WFC) follows Citigroup in missing due to bad debt provision increases.

Rio Tinto (RIO) warns of labor shortages.

BlackRock (BLK) missed on top and bottom lines.

United Health (UNH) beats on EPS and revenue.

Canoo (GOEV) gets an Army contract.

Solar Edge (SEDG) is down on Senator Manchin blocking the climate bill.

Novavax (NVAX) is down as EMA side effects news.

State Street (STT) beats on EPS but misses revenue.

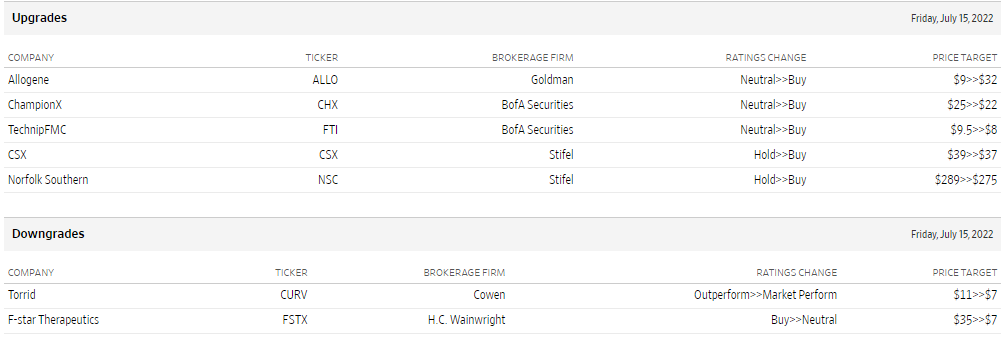

Upgrades and downgrades

Source: WSJ.com

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds lower ground near 0.6350 after downbeat Aussie jobs data

AUD/USD is holding lower ground near 0.6350 in Asian trading on Thursday. The downbeat Australian jobs data fans RBA rate cut bets, maintaining the downward pressure on the pair. US-China trade tensions and US Dollar recovery act as a headwind for the pair.

USD/JPY fades the rebound to 142.85 amid US-Japan trade optimism

USD/JPY fades the impressive rebound from seven-month lows of 141.61, falling back toward 142.00 in the Asian session on Thursday. The pair tracks the US Dollar price action, fuelled by contrstructive trade talks between the US and Japan. A tepid risk recovery supports the pair.

Gold price corrects from record highs of $3,358

Gold price retreats from a fresh all-time peak of $3,358 reached earlier in the Asian session on Thursday. Despite the pullback, tariff uncertainty, the escalating US-China trade war, global recession fears, and expectations of more aggressive Fed easing will likely cishion the Gold price downside.

Ethereum face value-accrual risks due to data availability roadmap

Ethereum declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.