Here is what you need to know on Thursday, July 29:

China stocks went green for the day on Wednesday, and no it was not St. Patrick's Day but perhaps a dead cat bounce. The Fed certainly helped the green shoots as it continued its doveish stance, saying there was no sign yet of dialing back ultra-loose policy. Facebook (FB) did put a dampener on things after the close as it reported earnings well ahead of estimates. The dampener was it guiding advertising revenue lower and daily and monthly active users just matching estimates, see more. The stock dropped 3% aftermarket and is down a similar amount in Thursday's premarket.

Robinhood (HOOD) makes its debut on the stock market today and will be closely watched by all, including retail investors who are largely responsible for its transformation. The IPO price is set at $38, the low end of the range, so it will be interesting to see how this one goes. Goldman and JPMorgan are the leads, and they usually know what they are pricing, see more here.

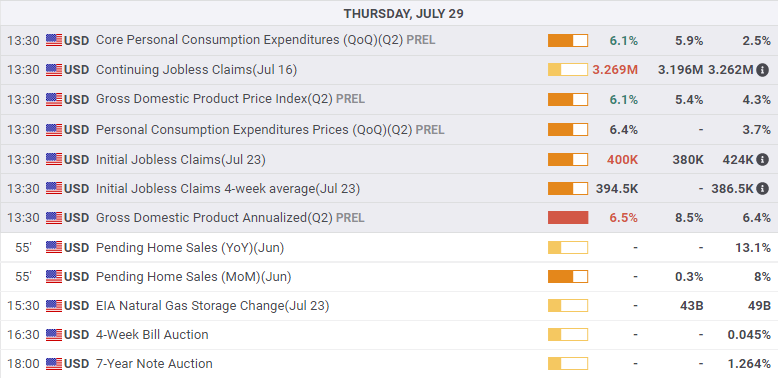

US GDP has just hit the tape at a somewhat disappointing 6.5% as the estimate was 8.4%. This will test the resolve of equity investors. Are they determined to carry on for more records.

The dollar has weakened after that GDP number and is now at 1.1880 versus the euro, while Gold is also higher at $1,825. Oil is flat at $72.60. Bitcoin continues to trade just under $40,000.

See more on US GDP here.

SPY stock news and forecast

European markets are higher: FTSE +1%, Dax +0.5% and Eurostoxx +0.8%.

US futures are still positive but lower after the GDP number. S&P +0.1%, Dow +0.3% and Nasdaq is flat.

US GDP +6.5% estimate 8.4%.

US jobless claims 400k estimate 385k.

Japan extends the virus state of emergency until the end of August.

China to hike export tariffs on steel at the end of August.

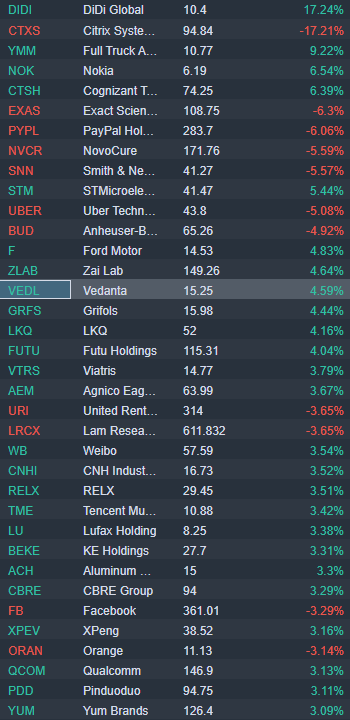

Facebook (FB) reported after the close on Wednesday. EPS and revenue beat, but the company warned of slowing revenue, shares dropped 3% see more.

DIDI denies reports that it will go private, shares surge 17% in the premarket.

Citrix (CTXS) sales miss estimates. EPS beats, guidance disappoints, stock down 17%.

Novocure (NVCR) down 6% premarket after EPS and sales miss estimates.

Cognizant Tech (CTSH) earnings released after the close on Wednesday. EPS beats, revenue beats and increases guidance. Up 6%.

Paypal (PYPL) released earnings after the close, down 6% as sales miss and FY EPS also lower than estimated.

Smith and Nephew (SNN) down 5% on earnings.

UBER: Financial Times reports Softbank is selling a block of shares.

Budweiser, ok Anheuser-Bush InBev (BUD): Q2 results beat on EPS and revenue, down 4%. Citi said core profit missed estimates.

Ford (F) up 5% after earnings beat and raises guidance.

Comcast (CMCSA) EPS beats, up 2%.

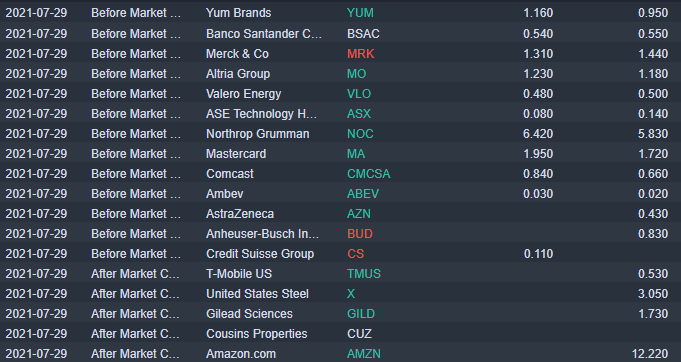

YUM Brands beats EPS estimates, and revenue is also ahead. Up 2% premarket.

Molson Coors (TAP) up 2% as EPS and revenue beat estimates.

AMZN reports after the clsoe today.

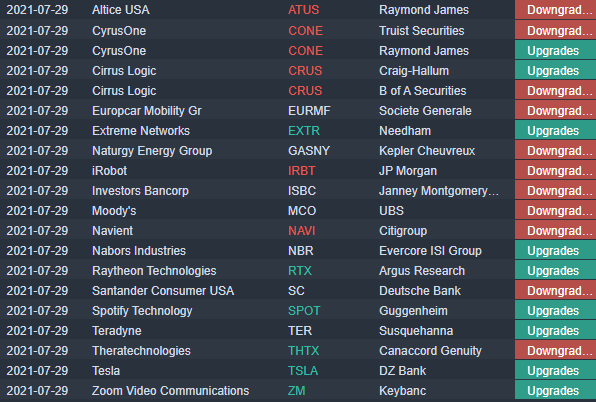

Tesla (TSLA) upgraded by DZ Bank.

Zoom Video (ZM) upgraded by Keybanc.

Spotify (SPOT) upgraded by Guggenheim.

Upgrades, downgrades, premarket and earnings

Source: Benzinga Pro

Economic releases

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0500 ahead of Fed rate call

EUR/USD fluctuates in a narrow range at around 1.0500 in on Wednesday. The pair's further upside remains capped as traders stay cautious and refrain from placing fresh bets ahead of the Federal Reserve's highly-anticipated policy announcements.

GBP/USD holds above 1.2700 after UK inflation data

GBP/USD enters a consolidation phase above 1.2700 following the earlier decline. The data from the UK showed that the annual CPI inflation rose to 2.6% in November from 2.3%, as expected. Investors gear up for the Fed's monetary policy decisions.

Gold stays at around $2,650, upside remains limited with all eyes on Fed

Gold is practically flat near $2,650 on Wednesday after bouncing up from a one-week low it set on Tuesday. The precious metal remains on the defensive as the market braces for the outcome of the last Federal Reserve’s (Fed) meeting of the year.

Federal Reserve set for hawkish interest-rate cut as traders dial back chances of additional easing in 2025

The Federal Reserve is widely expected to lower the policy rate by 25 bps at the last meeting of 2024. Fed Chairman Powell’s remarks and the revised dot plot could provide important clues about the interest-rate outlook.

Sticky UK services inflation to come lower in 2025

Services inflation is stuck at 5% and will stay around there for the next few months. But further progress, helped by more benign annual rises in index-linked prices in April, should see ‘core services’ inflation fall materially in the spring.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.