Here is what you need to know on Friday, May 21:

Equity markets look to end a frenetic week on a positive note as the Fed is wrestled into thinking about thinking about tapering, leading to a big tech rally. Bitcoin is steady. Yes, you read that correctly. The crypto king (or is that Elon) holds the $40,000 level despite Deutsche saying it is gone from trendy to tacky.

Speaking of crypto, Tesla notches a nice bounce from near a strong support level on Thursday, racking up a 4% jump and sitting near key resistance at $591. Other big tech names also rally, helping to propel the major indices.

The dollar is calm just below 1.22 against the euro, while Gold at $1,886 is up slightly. Oil is also moderately higher at $62.83.

European markets are green with the FTSE flat, Dax +0.4%, and EuroStoxx +0.6%.

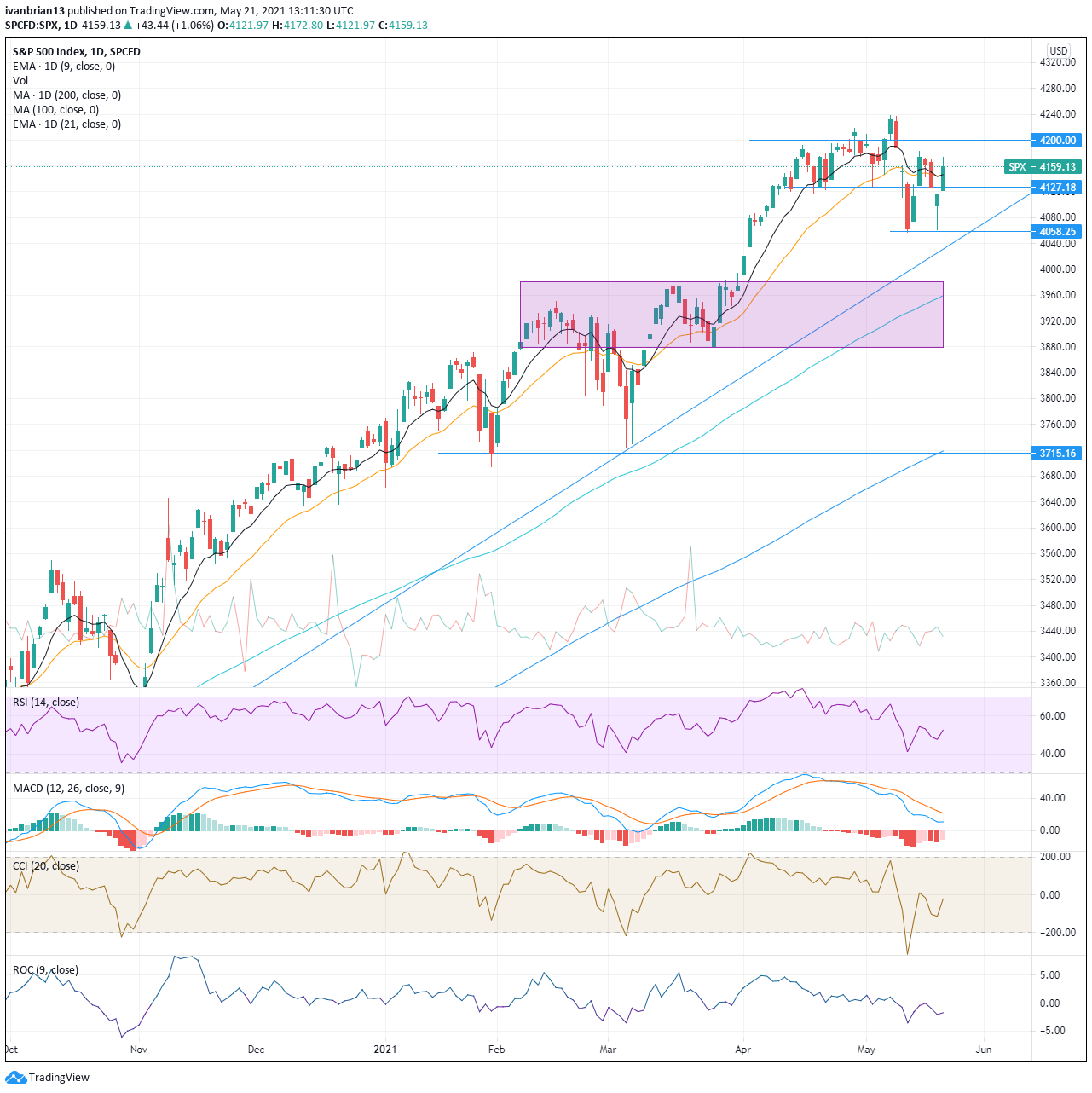

US futures are all higher with the three main indices Dow, S&P 500 and Nasdaq all up 0.4%.

Stay up to speed with hot stocks' news!

Wall Street top news

Israel and Hamas ceasefire in effect.

Germany says current vaccines are significantly less successful against the Indian version. The UK had earlier said they were reasonably effective.

UK Manufacturing PMI 66.1 versus forecast 60.8.

TSLA raises prices of Model 3 and Model Y, according to Electrek. Tesla cars are also banned from some Chinese government compounds-Reuters.

AAPL CEO Tim Cook to testify on Friday in an antitrust case by Epic Games, maker of Fortnite.

The US-proposed global corporate tax rate of 15% is a floor and the actual rate could be higher.

BA Boeing discussing plans to increase 737 Max jet output in 2022 -Reuters.

Fisker (FSR) to deliver new Pope mobile in 2022.

VF Corp (VFC): maker of North Face, Timberland and Vans posts lower than expected EPS but revenue beats. Shares down sharply premarket.

Deere (DE) results are strong, beating estimates on EPS and revenue. Shares up in premarket by about 1%.

Palo Alto Networks (PANW) up in premarket after strong EPS and revenue.

Foot Locker (FL) strong beat on EPS, revenue also ahead.

Deckers (DECK) also strongly ahead on EPS.

JNJ: GAVI vaccine alliance group says it has agreed to buy 200 million doses of JNJ's covid vaccine.

Uber and Lyft: California clean air regulator says 90% of journeys must be in electric vehicles by 2030.

Applied Materials (AMAT) EPS beats estimates as does revenue for the semiconductor maker.

Carnival (CCL) to resume Alaska cruises in July.

Oatly (OTLY) IPO'd at $17, now trading $21.66 in Fridays premarket.

Ups and Downs

Source: Benzinga

Premarket movers

Source: Benzinga

Economic releases due

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds below 0.6400 amid signs of easing US-China tensions

The AUD/USD pair trades in negative territory near 0.6390 during the early Asian session on Monday. The US Dollar edges higher against the Aussie amid signs of easing US-China tensions. China will hold a press conference about policies and measures on stabilizing employment and ensuring stable growth on Monday, which will be closely watched by traders.

USD/JPY holds steady above mid-143.00s amid Trump's uncertainty

USD/JPY kicks off the week on a subdued note and consolidates above mid-143.00s amid mixed cues. Investors push back expectations for an immediate BoJ rate hike amid rising economic risks from US tariffs, which acts as a headwind for the JPY and lends support to the pair amid a modest USD uptick.

Gold edges lower to near $3,300 as US-China trade tensions ease

Gold price loses ground to near $3,310 in Monday’s early Asian session, down 0.30% on the day. De-escalating trade tensions between the US and China underpins the Gold price. The fears of the US recession might help limit the Gold’s losses.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637571988350345188.png)

-637571992649608771.png)

-637571989110895294.png)