Here is what you need to know on Friday, December 9:

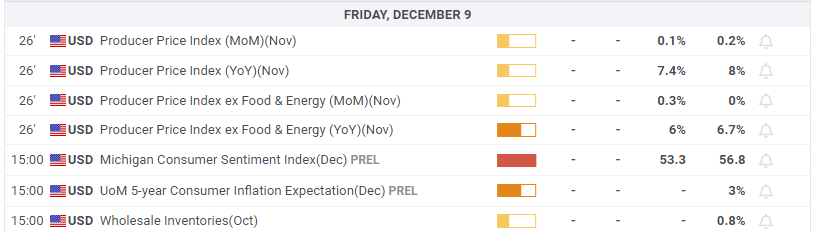

Equity markets recovered ground on Thursday on the back of no news. That may be a bit disingenuous to say, but really this week has been one of waiting before next week's volcano. Markets were due a bounce on Thursday after five straight days of losses and some position closing ahead of the weekend and today's PPI. At least the PPI will provide some form of catalyst, but it is likely to be shortlived. Next week is just too big a week to go into with large open positions. We have the ECB, Fed and CPI as well as a massive options expiry on Friday.

The US Dollar has also given up some gains and is largely flat this morning, down to 104.65 for Dollar Index. Oil is still under pressure at $72.05, and Gold at least looks a little brighter (excuse the pun!) at $1,801. Bitcoin is looking lively at $17,200.

European markets higher: Eurostoxx +0.3%, FTSE +0.1% and Dax +0.4%.

US futures are higher: Nasdaq +1.7%, Dow +1% and S&P +1.3%.

Wall Street top news

Russian and US reps to meet in Turkey - TASS citing sources.

Reuters headlines

Tesla Inc (TSLA): Tesla will suspend Model Y assembly at its Shanghai plant between Dec. 25 and Jan. 1, according to an internal memo detailing the automaker's latest production plan, reviewed by Reuters, and two people with knowledge of the matter.

Broadcom Inc (AVGO): The company forecast current-quarter revenue above Wall Street estimates on Thursday, signaling strong demand for chips used in data centers and networking equipment.

Costco Wholesale Corp (COST): The company reported first-quarter results on Thursday that missed analysts' estimates.

Alphabet Inc (GOOGL): Australia's competition regulator said its lawsuit against Alphabet's Google that alleged consumers were misled about expanded use of personal data for targeted advertising had been dismissed by a court.

Apple Inc (AAPL): Hundreds of Apple workers in Australia are preparing to go on a strike ahead of Christmas to demand better working conditions and wages, union leaders and staff said.

Bath & Body Works Inc (BBWI): Hedge fund Third Point has built a stake of just over 6% in Bath & Body Works and is pushing for new board members at the retailer, the fund said in a regulatory filing on Thursday.

Boeing Co (BA) & United Airlines Holdings Inc (UAL): Chicago-based United Airlines plans to announce a major Boeing 787 Dreamliner order next week, two sources briefed on the matter told Reuters.

Meta Platforms Inc (META): The Biden administration on Thursday accused Meta of trying to buy its way to dominance in the metaverse, kicking off a high-profile trial to try to prevent the Facebook parent from buying virtual reality app developer Within Inc.

Other news

FTC sues to block Microsoft's (MSFT) deal for Activision (ATVI).

Pfizer (PFE) BioNTech (BNTX) single shot covid/flue vaccine gets FDA fast track status.

Li Auto (LI) misses earnings.

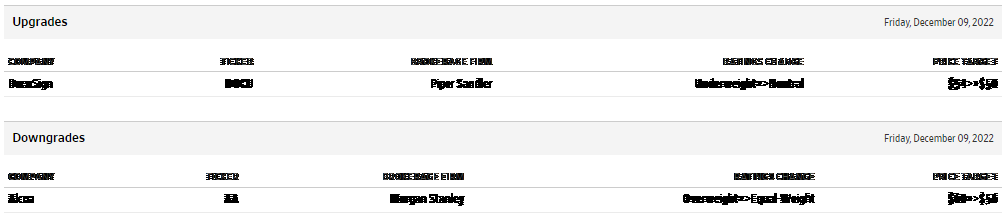

Upgrades and downgrades

Source: WSJ.com

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.