Wake Up Wall Street (SPX) (QQQ): Airlines take off, banks pay out, while jobless claims jump

Here is what you need to know on Thursday, July 22:

Stock markets are in a calm mood ahead of the open on Thursday as the whipsaw of the last few sessions looks to have parted for calmer seas. So it begins for financial stocks who had their dividend restrictions lifted recently, with Bank of America increasing its dividend to a 2% yield. Take that, 10-year! Most other bank stocks are expected to follow suit. Airlines are back in the grove as Southwest (LUV) and American (AA) both showed strong gains in revenue as travel demand roars back.

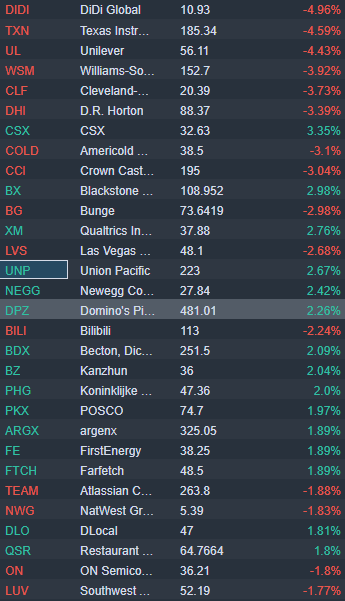

DIDI deja vu is back and once again for the wrong reasons as Bloomberg reports that China is considering an unprecedented fine. (see more).

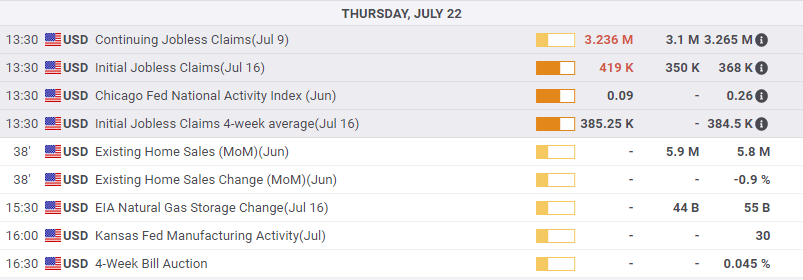

Jobless claims posted a surprise rise on Thursday, while over in Europe the ECB as expected left rates unchanged and said inflation is not to be worried about.

The dollar took the doveish stance poorly, sliding a bit to 1.1808 versus the Euro. Gold is at $1,803, Bitcoin $32,100 and the US 10-year yield at 1.27%.

European markets are mixed, the FTSE is -0.4%, while the Dax is +0.6% and Eurostoxx +0.4%.

US futures are all largely flat.

Wall Street top news

US Jobless claims rise to 419k.

ECB leaves rates unchanged.

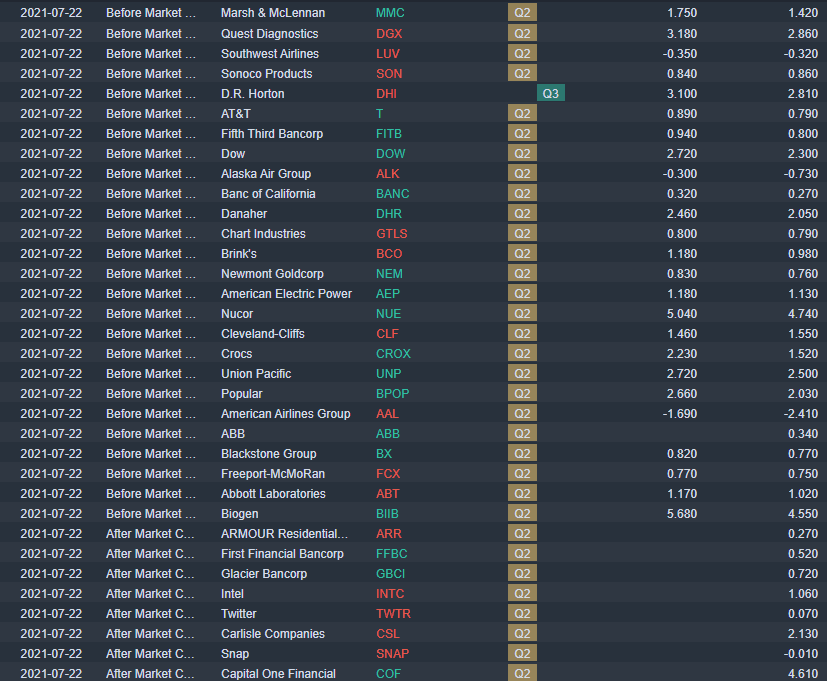

Southwest Airlines (LUV): Earnings per share (EPS) misses but revenue beats.

American Airlines (AA) beats on EPS and revenue.

AT&T (T) beats on EPS and revenue.

Crocs (CROX) beats on EPS and revenue.

Intel (INTC), Twitter (TWTR) and SNAP report earnings after the close.

Netgear (NTGR) results disappointed with lower sales and revenue than forecast.

Unilever (UL) cautioned on inflation and rising commodity costs. Let us see how many companies mention this in their earnings reports.

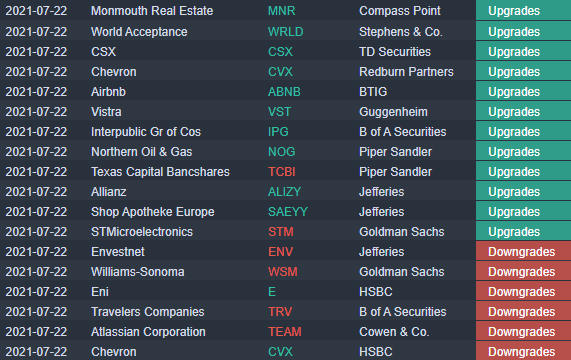

Chevron (CVX) was upgraded by Redburn but downgraded by HSBC.

Airbnb (ABNB) upgraded by BTIG.

Texas Instruments (TXN) earnings disappoint, stock down 5% premarket.

Williams Sonoma (WSM) downgraded by Goldman Sachs.

Domino's (DPZ) beats on EPS and revenue.

Upgrades, downgrades, premarket and results

Source: Benzinga Pro

Economic releases

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.