Here is what you need to know on Friday, February 3:

Nonfarm Payrolls (NFP) data day is here and the end of a full week. Wednesday and Thursday saw the Federal Reserve, European Central Bank and Bank of England report, and now the NFP becomes the cherry on top of an eventful week. It is a lot to pack in, but when you add Apple (AAPL), Amazon (AMZN), Meta Platforms (META) and Alphabet (GOOGL) earnings, then it was an overload for the mind.

So far we have not found a strong direction. We got close. A dovish Fed, ECB and BoE sent global yields lower and stocks higher, but then Thursday night we had poor earnings from Apple, Amazon and Google parent Alphabet, so now we are set for more chop.

NFPs may not provide any catalysts needed. If it is weak, then recession looms. Yes, lower rates would arrive quicker, but a recession will put the focus back on strong earnings. If the NFP data is strong, then the focus will return to higher yields. We needed the all-clear from Apple at least for this rally to gain legs, but now it likely stumbles.

The US Dollar, meanwhile, looks to be on a sounder footing with all major central banks now dovish. The Dollar Index is back to 101.60, oil is lower to $75.80, and gold is also lower to $1,915.

European markets are mixed: Eurostoxx flat, FTSE +0.5%, CAC -0.2% and DAX -0.5%.

US futures are lower: NASDAQ -1.1%, S&P -0.7% and Dow -0.2%.

Wall Street top news

Apple (AAPL): weak earnings, down 3-4% premarket.

Amazon (AMZN): weak earnings, down 5% premarket.

Alphabet (GOOGL): again weak earnings, down 5% premarket.

Ford (F): weak sales, down 7% premarket.

Starbucks (SBUX): weakness in China, misses EPS and sales, down 2-3% premarket. (Hmmmm, noticing a trend here!)

Tesla (TSLA) sells 66,051 China-made vehicles in January, up 10% yearly, according to China Passenger Car Association. Stock up 1% premarket.

Nordstrom (JWN) up on WSJ report of Ryan Cohen stake.

Regeneron Pharma (REGN) beats on earnings.

Aon (AON) beats on EPS but misses revenue.

Cigna Healthcare (CI) beats on EPS, revenue in line but outlook lower than expected.

Upgrades and downgrades

Upgrades

Friday, February 03, 2023

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

Cardinal Health |

CAH |

Robert W. Baird |

Neutral>>Outperform |

$87>>$94 |

|

H.B. Fuller |

FUL |

Citigroup |

Neutral>>Buy |

$72>>$85 |

|

Int'l Paper |

IP |

UBS |

Sell>>Neutral |

$31>>$43 |

|

Nordstrom |

JWN |

Gordon Haskett |

Reduce>>Hold |

$22 |

|

Erasca |

ERAS |

Morgan Stanley |

Equal-Weight>>Overweight |

$15 |

|

Esperion Therapeutics |

ESPR |

Morgan Stanley |

Underweight>>Equal-Weight |

$9 |

Downgrades

Friday, February 03, 2023

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

Aptiv |

APTV |

Wolfe Research |

Outperform>>Peer Perform |

|

|

Boeing |

BA |

RBC Capital Mkts |

Outperform>>Sector Perform |

$225 |

|

C.H. Robinson |

CHRW |

Stifel |

Buy>>Hold |

$107>>$99 |

|

Camden Property |

CPT |

Piper Sandler |

Overweight>>Neutral |

$136 |

|

Cognizant Tech |

CTSH |

Robert W. Baird |

Outperform>>Neutral |

$66>>$68 |

|

Ford Motor |

F |

Deutsche Bank |

Hold>>Sell |

$13>>$11 |

|

First Foundation |

FFWM |

Piper Sandler |

Overweight>>Neutral |

$17.5>>$16 |

|

Focus Financial |

FOCS |

BMO Capital Markets |

Outperform>>Market Perform |

$55>>$53 |

Source: WSJ.com

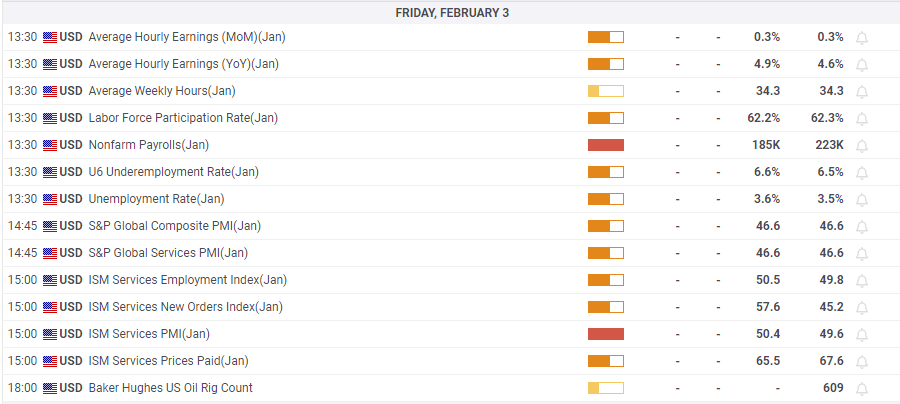

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD turns south toward 0.6500 as US Dollar finds fresh demand

AUD/USD hs turned south toward 0.6500 in Asian trading on Wednesday. The pair lacks bullish conviction after the PBOC left the Lona Prime Rates unchanged. Escalating Russia-Ukraine geopolitical tensions and renewed US Dollar demand keep the Aussie on the edge ahead of Fedspeak.

USD/JPY jumps back above 155.00 as risk sentiment improves

USD/JPY has regained traction, rising back above 155.00 in Wednesday's Asian session. A renewed US Dollar uptick alongside the US Treasury bond yields and an improving risk tone counter Japanese intervention threats and Russia-Ukraine tensions, allowing the pair to rebound.

Gold advances to over one-week high on rising geopolitical risks

Gold price (XAU/USD) attracts some follow-through buying for the third consecutive day on Wednesday and climbs to a one-and-half-week high, around the $2,641-2,642 region during the Asian session.

UK CPI set to rise above BoE target in October, core inflation to remain high

The UK CPI is set to rise at an annual pace of 2.2% in October after increasing by 1.7% in September, moving back above the BoE’s 2.0% target. The core CPI inflation is expected to ease slightly to 3.1% YoY in October, compared with a 3.2% reading reported in September.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.