Visa Inc. (V) Elliott Wave technical analysis [Video]

![Visa Inc. (V) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Candlesticks/stock-market-graph-and-bar-chart-price-display-75053099_XtraLarge.jpg)

V Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {iv} of 5.

Direction: Upside in wave {v} in 5.

Details: Looking for consolidation in wave {iv} as we stand at the beginning of MinorGroup1 at 310$.

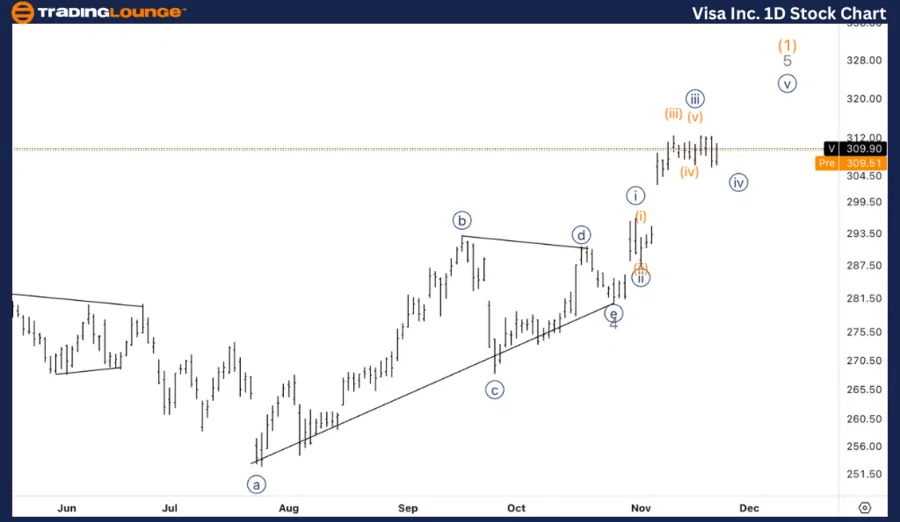

V Elliott Wave technical analysis – Daily chart

Visa (V) is currently in wave {iv} of 5, with the expectation of further consolidation as the price is hovering around the MinorGroup1 level at 310$. This wave is typically a corrective phase, and once complete, it should lead to an upside move in wave {v} to complete the fifth wave of the larger motive structure. The key to confirming this will be how the price reacts to the ongoing consolidation.

V Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (a) of {iv}.

Direction: Completion in wave {iv}.

Details: Looking for a potential pullback into wave (b) to then fall back down into wave (c). There is a probability we have already completed wave {iv} as we stand in the area of the previous (iv), as well as we can identify a three wave move in what is currently labelled as (a).

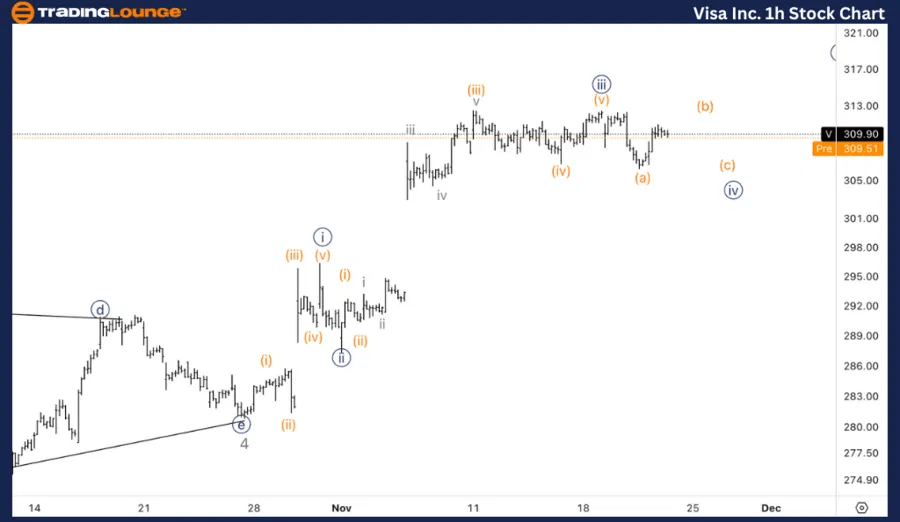

V Elliott Wave technical analysis – One-hour chart

On the 1-hour chart, Visa seems to have completed wave (a) of the corrective wave {iv}. The structure shows a potential three-wave move in wave (a), suggesting that we may see a pullback in wave (b) before completing wave (c) of {iv}. There is also a possibility that wave {iv} may already be completed, as the price is currently in the area of the previous wave (iv), adding to the probability that wave {v} could start soon.

This analysis of Visa Inc., (V) focuses on both the daily and 1-hour charts, using the Elliott Wave Theory to assess current market trends and forecast future price movements.

Visa Inc. (V) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.