- Virgin Galactic shares fall 10% as more technical checks needed.

- SPCE shares show usual volatility, news dependant stock.

- SPCE does not announce a new test flight date.

Update February 12: Shares in Virgin Galactic (SPCE) were sharply lower during Friday's pre-market session. SPCE shares were trading at $53.85 a loss of 10%. The company announced a delay to its scheduled test flight and did not immediately give a date for when it would be rescheduled.

Virgin Galactic is a US aerospace company involved in, as the ticker suggests, spaceflight. Virgin Galactic (SPCE) is aiming to launch space flight experiences for private individuals. SPCE is also a manufacturer of space flight vehicles. SPCE does not produce any revenues at present, its aim is to commercialize space flight.

See the new FXStreet Equities homepage

Hard landing to end 2020

Shares in Virgin Galactic had a difficult end to 2020 as the shares fell from above $35 to below $25. Reports of an aborted test flight in mid-December caused SPCE shares to fall 17% on December 17 alone.

The Reddit fuelled blast off

Virgin Galactic (SPCE) was brought to the attention of the /wallstreetbets traders as SPCE had a heavy short interest. The latest data shows the short interest at 30%.

This caught the attention of the new breed of aggressive retail traders looking to squeeze heavily shorted stocks. The Gamestop effect led to Virgin Galactic (SPCE) blasting off in January, shares rising from $23 to hit nearly $60 on Tuesday.

Crashing back down before blast off

Reports late on Tuesday that competitor SpaceX starship landing ended in an explosion hit Virgin Galactic (SPCE) shares as investors began to worry about the read across and the dangerous nature of space flight.

However, this news was tempered by a more positive release that SPCE will reschedule its aborted December test flight for February 13, with a second test flight potentially a few weeks later. Rumours of Richard Branson boarding his own test flight gave further reassurance to investors.

The shares rebounded sharply on Wednesday as retail traders returned to their meme stocks. Gamestop, AMC and others all bounced on Wednesday and SPCE followed suit. This renewed retail interest and news of the rescheduled test flight helped Virgin Galactic (SPCE) shares to take off (too easy!) on Wednesday, signing for a 17% gain to close at $57.12.

Where to from here

There is no doubt that SPCE is a very early-stage investment, the company does not produce any revenue. However commercial space exploration is the future and there appears to be strong demand, initially from wealthy customers as it is not a cheap enterprise. News flow and safety, in particular, will be key for the future performance of SPCE.

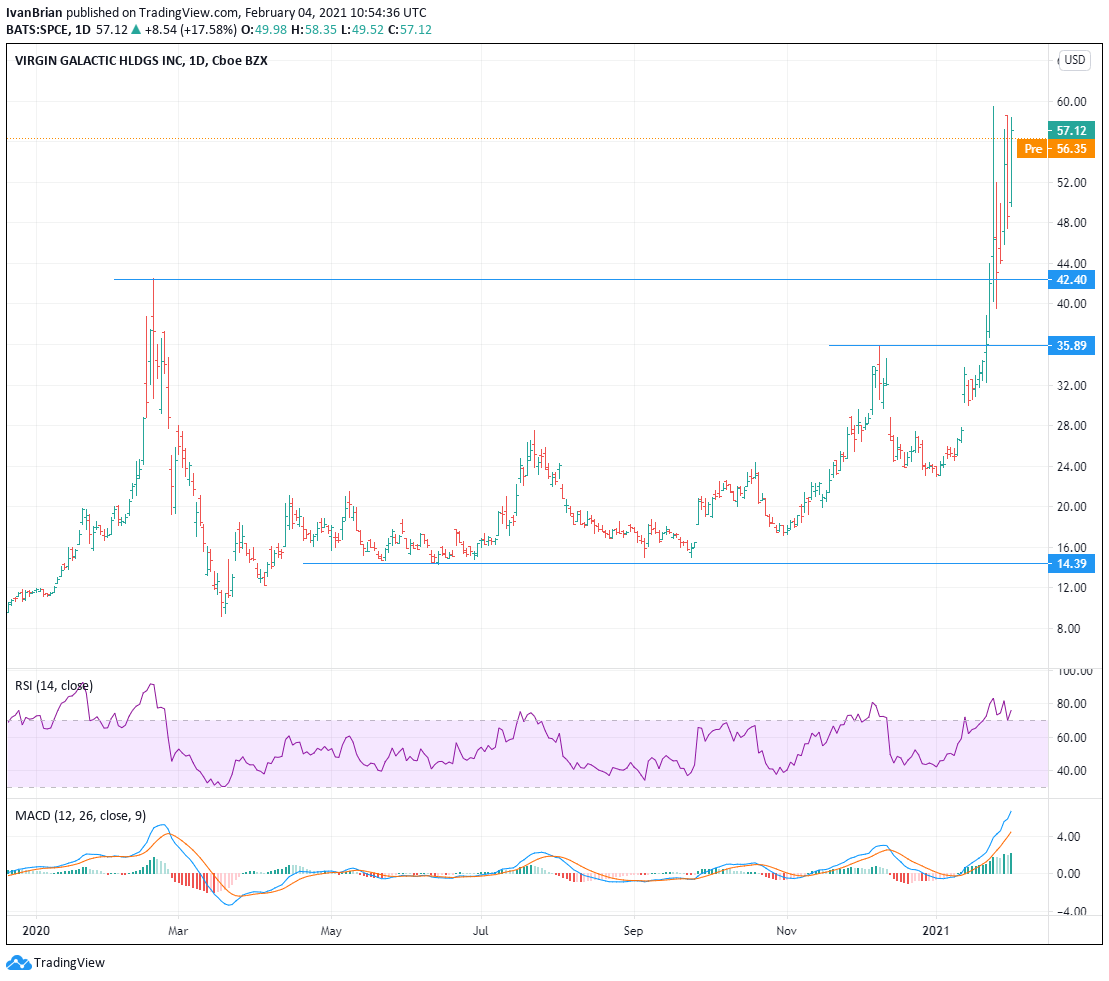

Virgin Galactic Technical analysis

Given the strong surge in January support from previous highs at $42.40 and $35.89 are in play. $60 is an initial key psychological level but not a chart level. Daily RSI and MACD both show high readings on the back of a sharp and aggressive move, but these are lagging indicators so the overbought readings need to be taken in this context. Newsflow will be more important to SPCE in the short term.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates gains below 1.1400 on weaker US Dollar

EUR/USD consolidates its recovery gains below 1.1400 in early Europe on Monday. Upbeat risk sentiment on Trump's tairff concession news fails to lift the US Dollar, supporting the pair. US-China trade headlines will continue to dominate ahead of Fedspeak.

GBP/USD climbs above 1.3150 as USD sellers refuse to give up

GBP/USD preserves its bullish momentum and trades above 1.3150 in the European session on Monday. The sustained US Dollar weakness suggests that the path of least resistance for the pair remains to the upside. US-China trade updates remain in focus.

Gold price eases from record high amid positive risk tone; bullish bias remains

Gold price refreshes record high as US-China trade war underpins safe-haven demand. A positive risk tone caps gains for the precious metal amid a slightly overbought daily RSI. US recession fears, Fed rate cut bets, and a bearish USD should support the XAU/USD pair.

TRUMP token leads $906 million in unlocks this week with over $330 million release

According to Tokenomist, 15 altcoins will unlock more than $5 million each in the next 7 days. Wu Blockchain data shows that the total unlocked value exceeds $906 million, of which the TRUMP token will unlock more than $330 million.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.