- ViacomCBS shares hit on Friday as part of a rumoured hedge fund liquidation.

- VIAC had earlier sold off as a capital raise was announced.

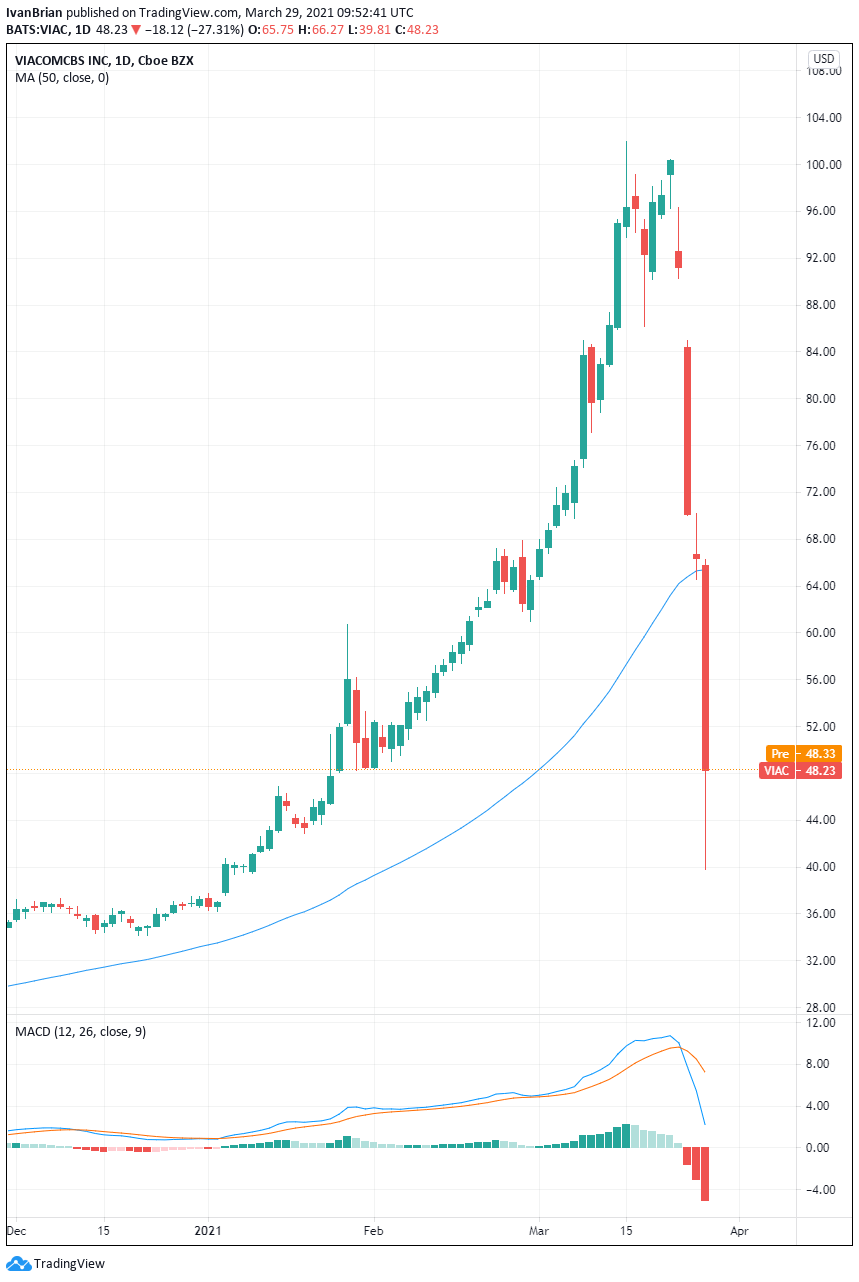

- The stock dropped 27% on Friday as block sales were sold.

ViacomCBS shares were one of the main victims of heavy selling in media and related stocks on Friday. Initial market reports had been that large blocks of stock were offered for sale hitting Viacom and Discovery. Over the weekend news reports and rumours emerged that these sales were possibly tied to Archegos Capital Management. IPO Edge broke the story.

Stay up to speed with hot stocks' news!

VIAC stock quote

ViacomCBS shares closed on Friday at $48.23, a loss of 27.3%! VIAC shares had traded above $100 at the start of the week.

ViacomCBS shares had already come under selling pressure when they announced a capital raise via class B common stock and convertible preferred stock. The combined stock offering is to raise between $2.65 and $3 billion. VIAC said it will use the money for general corporate purposes and investments in streaming. The rise of streaming and Netflix and Disney+ have changed the landscape, and ViacomCBS needed to quickly adapt to keep up. Viacom launched Paramount+ streaming service earlier in 2021.

VIAC shares were trading around $100 at the time of the announcement, and the shares were to be offered at $85. VIAC shares retreated 9% on the announcement. Moody's commented that the raise was a credit positive event.

The selling pressure accelerated on Wednesday, March 24, with VIAC losing 23% to close at $70.10. Thursday saw further losses of 5% before Friday's capitulation saw ViacomCBS shares drop below $40 before closing at $48.23 for a 27% loss.

Rumours began to swirl on Friday of large blocks of ViacomCBS shares being offered. Over the weekend reports have emanated from several sources that the selling is rumoured to be the results of the liquidation of positions held by Archegos Capital Management. It should be noted that this is not confirmed but has been widely reported in the financial press.

The issue appears to be a concentration of positions taken by Archegos in a small number of stocks. A move can become self-fulfilling in this case. Selling pressure comes on a stock. A client is requested to post extra margin by its investment bank to cover these losses. If the client cannot post the additional margin, the investment bank will sell the clients positions until it has sufficient margin to reduce its exposure. This appears to be the case here.

Other stocks have also been caught up in the block selling with Discovery and Baidu rumoured to be part of the forced liquidation. Baidu (BIDU) has fallen from $260 to $200 in the last three sessions. Discovery (DISCA) lost nearly 50% of its value last week.

Investment bank shares are all suffering in European trading this morning. Credit Suisse warned of a hit to first-quarter results due to its exiting positions with a large US hedge fund. Nomura issued a similar statement.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD clings to recovery gains above 1.2650 after UK data

GBP/USD clings to recovery gains above 1.2650 in European trading on Friday. The mixed UK GDP and industrial data fail to deter Pound Sterling buyers as the US Dollar takes a breather ahead of Retail Sales and Fedspeak.

EUR/USD rises to near 1.0550 after rebounding from yearly lows

EUR/USD rebounds to near 1.0550 in the European session on Friday, snapping its five-day losing streak. The renewed upside is mainly lined to a oause in the US Dollar rally, as traders look to the topt-tier US Retail Sales data for a fresh boost. ECB- and Fedspeak also eyed.

Gold defends key $2,545 support; what’s next?

Gold price is looking to build on the previous rebound early Friday in search of a fresh impetus amid persistent US Dollar buying and mixed activity data from China.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Trump vs CPI

US CPI for October was exactly in line with expectations. The headline rate of CPI rose to 2.6% YoY from 2.4% YoY in September. The core rate remained steady at 3.3%. The detail of the report shows that the shelter index rose by 0.4% on the month, which accounted for 50% of the increase in all items on a monthly basis.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.