- NASDAQ: VBIV is set to surge to the highest levels in a month.

- Enthusiasm over VBI Vaccines Inc's potent pan-coronavirus immunization candidate is driving shares higher.

- In a highly competitive race for COVID-19 vaccines, quality may mark a difference.

Vaccinating against more than one coronavirus – and doing it better than competitors – is what VBI Vaccines is seeking. The Massachusets-based pharma firm has performed several preclinical trials on mice and claims that they have provoked a substantial creation of antibodies and other mechanisms to defend against coronaviruses.

The use of the plural is no mistake – one of the candidates is a "trivalent" pan-coronavirus vaccine, protecting against the raging SARS-Cov-2, the 2003-era SARS-CoV, and also MERS-CoV, which dates back to 2015.

Another advantage is that VBI's vaccine may require only one shot – allowing faster distribution of immunization to the world population.

Skeptics have noted that optimism in the preclinical stage may not necessarily translate into success with human subjects. Moreover, several large pharma firms are already conducting Phase 3 tests – injecting their solutions to around 30,000 subjects.

Nevertheless, the AstraZeneca/University of Oxford project – considered the most advanced – may work for only 12-24 months. With dozens of companies working on a solution – and limited production capacity – there is still time for smaller firms to provide potentially better solutions.

The high level of antibodies created – at least among mice – may be a differentiating factor. That has led Steven Seedhouse, an analyst with Raymond James, to upgrade the stock to "strong-buy", adding that "VBI may be in an entirely different ballpark for potency vs. any other vaccine we've seen."

VBIV Stock Forecast

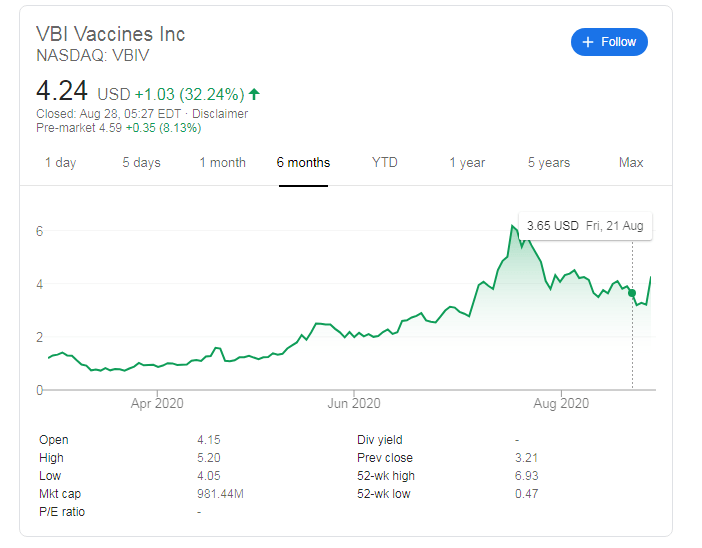

NASDAQ: VBIV is quoted at around $4.50 in Friday's pre-market trading, building on top of its whopping 32% leap on Thursday. VBI Vaccines is on course to hit the highest since late July, a one-month high. The 52-week high of $6.83 is the bullish upside target. Support awaits at $3.19, August's low.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.