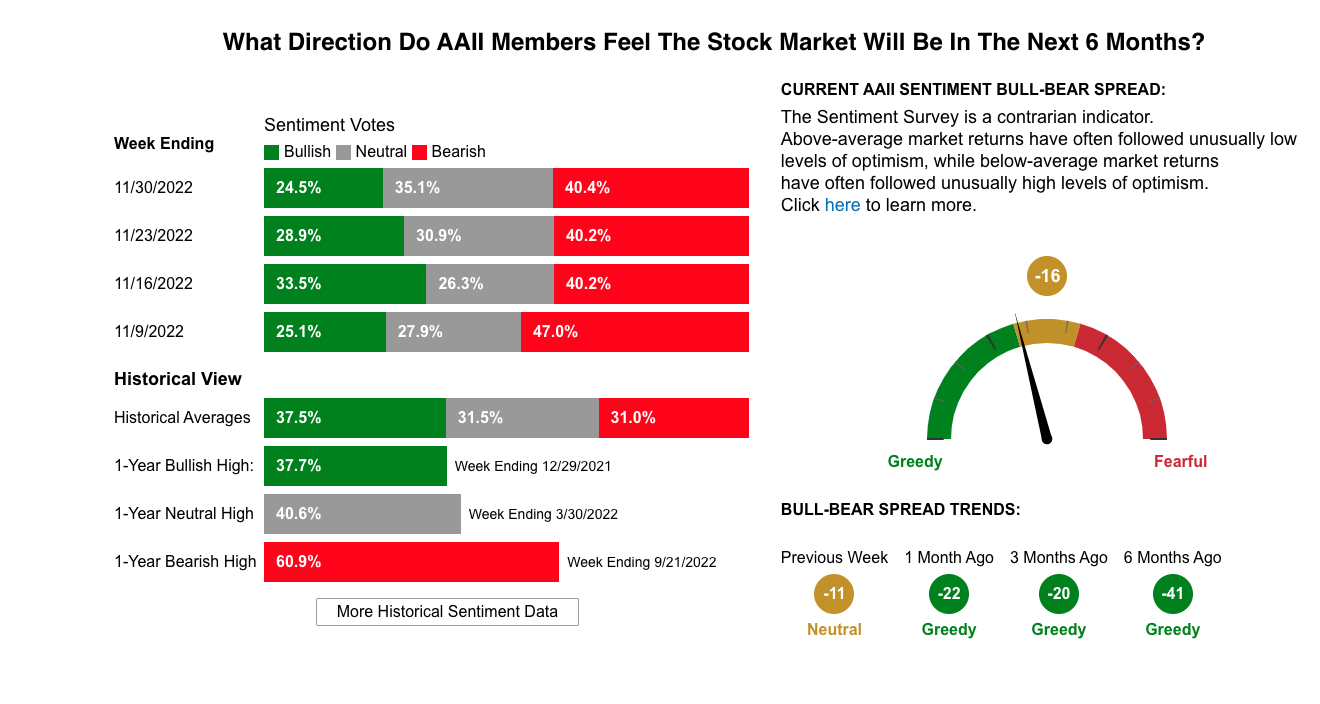

We have covered the impact of the magazine cover indicator before here. Another helpful sentiment indicator is also one of the most easily accessible and popular sentiment surveys – the American Association of Individual Investors. This is a weekly survey, free to access, where they ask individual investors this one simple question, ‘Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral), or down (bearish)?’ The results are then collected and displayed on the AAII’s website. Here are the results from the last few weeks.

You can see that sentiment is a helpful tool for seeing how investors’ views shift.

How to use it

This is more art than science. Some analysts will wait for extremes in sentiment, for example, when the sentiment survey is 2 or 3 standard deviations outside of the normal range. This shows extreme and, potentially, poorly positioned investors. You can see on the AAII page here that historically speaking investor sentiment that is very bearish (2 standard deviations away from the average) is a bullish signal for stocks. However, according to the AAII, the best results may actually come from when investors are neutral. In June 2014, the AAII published records showing that unusually high levels of neutral sentiment have been followed by a median 52-week rise in the S&P500 of 5.2% and 10.7% respectively. So, extreme views of bullish, bearish, and neutral sentiment can offer opportunities. However, these sentiment readings should not be used as automatic buy or sell signals, but help form part of your analysis. It is quite striking on the latest sentiment print from the week ending November 30 that there was a large jump in this neutral on stocks as we head into the Fed’s blackout period.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended content

Editors’ Picks

EUR/USD stays defensive below 1.0550 amid a cautious start to the week

EUR/USD stays defensive below 1.0550 in Monday’s European morning. The pair remains undermined by the re-emergence of the Russia-Ukraine geopolitical risks even though the US Dollar stalls its uptrend. Divergent ECB-Fed policy outlooks also weigh on the pair ahead of central banks' talks.

GBP/USD defends 1.2600 on subdued US Dollar

GBP/USD defends minor bids above 1.2600 in the early European session on Monday. A broadly subdued US Dollar and less dovish BoE policy outlook support the pair amid cautious market mood, induced by resurfacing Russia-Ukraine conflict. BoE- and Fed-speak eyed.

Gold price sticks to modest gains below $2,600 amid geopolitical risks

Gold price gains some positive traction but stays below $2,600 early Monday, snapping a six-day losing streak. Russia-Ukraine geopolitical risks benefit the safe-haven metal amid a subdued US Dollar demand. Bets for less aggressive Fed rate cuts and elevated US bond yields cap further gains.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC consolidates after a new all-time high

Bitcoin (BTC) price remains in a consolidation phase after reaching a new all-time high of $93,265 last week. Ethereum's (ETH) price is nearing its support level; a close below would cause a further price decline, while Ripple's (XRP) price shows bullish momentum as it tests and potentially breaks key resistance.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.