USD/ZAR Price Analysis: Wobbles near weekly low, inside two-month-old falling channel

- USD/ZAR struggles for fresh directions after refreshing the weekly low.

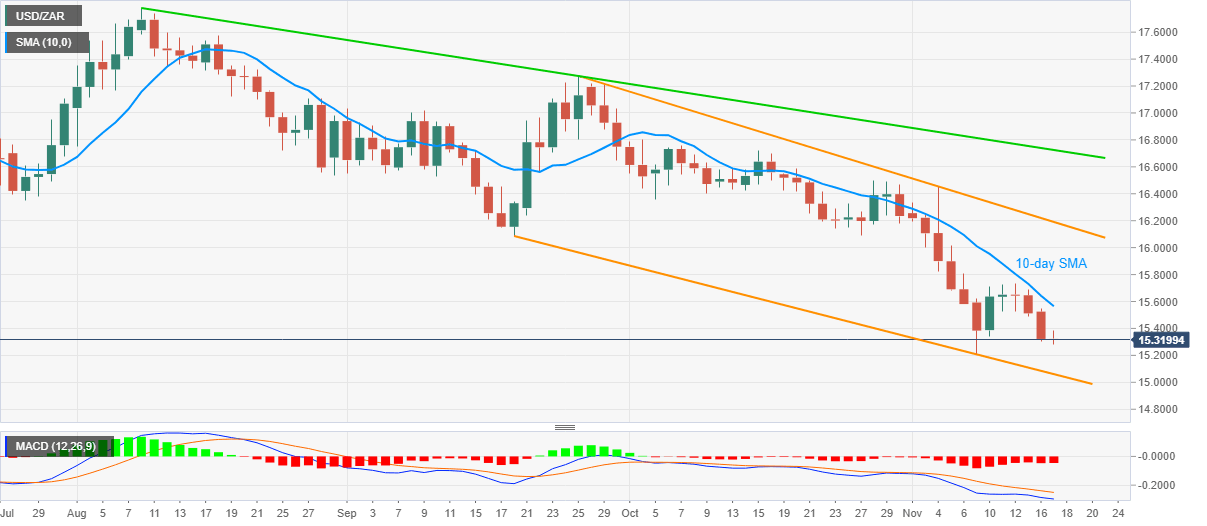

- Bearish MACD, sustained trading below 10-day SMA favor sellers.

Having recently refreshed the one week low with 15.28 level, USD/ZAR seesaws around 15.30 during the pre-European session trading on Tuesday.

The bearish MACD signals join the pair’s routine weakness below 10-day SMA to suggest further downside.

As a result, the lower line of a falling channel since September 18, at 15.06 now, followed by the 15.00 round-figure, pop-up on the USD/ZAR bears’ radar. However, any further downside past-15.00 will aim for December 2019 top near 14.85.

Meanwhile, an upside clearance of 10-day SMA, currently around 15.55, can help short-term traders to attack the stated channel’s resistance line, at 16.20.

Though, any more uptrend beyond 16.20 will be tamed by a falling trend line from August 10, around 16.75 by press time.

USD/ZAR daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.