USD/TRY Price Analysis: Remains trapped between two key barriers

- USD/TRY consolidates in a tight range, awaits fresh impetus.

- Bullish bias intact while above 21-DMA, as RSI holds above 50.00

- 8.80 is the level to beat for the bulls, focus shifts to US ADP jobs.

USD/TRY is holding the lower ground in the European mid-morning, having faced stiff resistance at Tuesday’s high of 8.7495 earlier in the late-Asian trades.

Despite the persistent upbeat mood around the US dollar, amid Delta strain worries and Fed’s hawkish turn, USD/TRY fails to benefit and flirt with daily lows of 8.6800, as of writing.

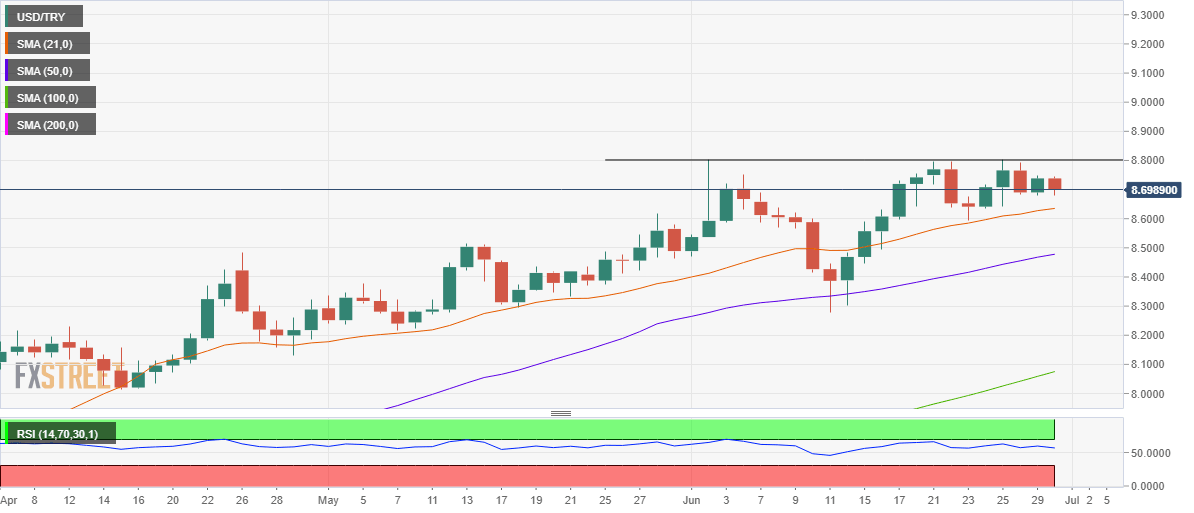

As observed on the daily chart, the spot extends its prison range into a fifth straight day this Wednesday, with the 8.80 barrier giving a tough fight to the bulls.

Meanwhile, the upward-sloping 21-Daily Moving Average (DMA) at 8.6351 continues to guard the downside.

Any sustained move below the latter could trigger a sharp sell-off towards the bullish 50-DMA at 8.7480. The next bearish target is envisioned at the June lows of 8.4469.

Note that the price has not given a daily closing below the 21-DMA since June 14.

USD/TRY: Daily chart

However, with the 14-day Relative Strength Index (RSI) still holding comfortably above the central line, the bullish undertone remains intact for the currency pair.

Acceptance above the horizontal trendline resistance at 8.80 could expose the 9.00 threshold, marking fresh record highs.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.