- USD/TRY trades on the defensive near 5.80.

- Q2 GDP contracted less than expected.

- Manufacturing PMI extends the recovery.

The Turkish Lira is gaining further upside momentum at the beginning of the week and is now dragging USD/TRY to the 5.80 area.

USD/TRY weaker on data despite USD-buying

TRY is extending the correction lower from the recent rejection of the 5.85 area, where sits a Fibo retracement of the May-August drop. Today’s lows in sub-5.80 area also coincide with the 100-day and 10-day SMAs.

The Lira's better performance today comes in despite the solid note in the Greenback and in response to upbeat results from the domestic docket.

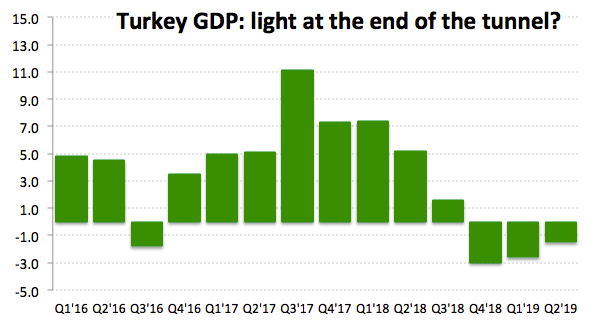

In fact, the manufacturing PMI improved to 48.00 in August (from 46.70), while GDP figures showed the economy contracted at an annualized 1.5% during the April-June period, less than forecasted.

In light of the recent GDP figures, the agricultural sector increased by 3.4% its total value added, went down 2.7% and 12.7% in the industry sector and construction sector, respectively and decreased 0.3% in the services industry.

Looking ahead, key inflation figures are due tomorrow along with Producer Prices and ahead of Friday’s Treasury Cash Balance results.

What to look for around TRY

The current preference for safer assets in response to the US-China trade war and fears of a technical recession at some point in the next couple of years in the US has undermined extra gains in the Lira. On another front, newly appointed Governor M.Uysal appears to have inaugurated an Erdogan-sponsored easing cycle following the interest rate cut by the CBRT earlier this month. Further moves from the CBRT included the reduction of the RRR in order to boost banks’ lending and give extra oxygen to the economy. In the longer run, however, TRY looks supported by the ‘hunt for yield’, as domestic rates still look attractive in spite of the recent cut. On the more macro view, the country needs to implement the much-needed structural reforms (announced in April) to bring in more stability to the currency and sustain a serious recovery in both economic activity and credibility.

USD/TRY key levels

At the moment the pair is losing 0.28% at 5.8149 and faces the next support at 5.7536 (38.2% Fibo of the May-August drop) seconded by 5.6791 (55-day SMA) and then 5.5847 (200-day SMA). On the upside, a surpass of 5.9416 (61.8% Fibo of the May-August drop) would expose 6.0027 (‘flash crash’ Aug.26) and finally 6.1516 (high May 23).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD dips below 1.1000 as Trump authorizes 90-day pause on tariffs

EUR/USD retreated below the 1.1000 mark on headlines indicating that United States President Donald Trump authorized a 90-day pause on non-retaliating countries. The pause applies to reciprocal and 10% tariffs, effective immediately, according to a Truth Social post. FOMC Minutes coming up next.

GBP/USD eases further on tariffs pause announcement, USD still weak

GBP/USD's correction seems to have met a decent contention around the 1.2750 zone so far on Wednesday, as investors continue to assess the ongoing US-China trade war ahead of the release of the FOMC Minutes. Pause in 10% and reciprocal tariffs lifted the mood.

Gold recedes to $3,050 on Trump's headlines

Gold prices now give away part of their advance and revisit the $3,050 zone per troy ounce after President Trump announced a 90-day pause on reciprocal and 10% tariffs.

Fed Minutes to offer clues on rate cut outlook amid tariff uncertainty

The eagerly awaited minutes from the US Fed’s March 18-19 monetary policy meeting are set for release on Wednesday at 18:00 GMT. During the gathering, policymakers agreed to keep the Fed Funds Target Range (FFTR) unchanged at 4.25%-4.50%.

Tariff rollercoaster continues as China slapped with 104% levies

The reaction in currencies has not been as predictable. The clear winners so far remain the safe-haven Japanese yen and Swiss franc, no surprises there, while the euro has also emerged as a quasi-safe-haven given its high liquid status.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.