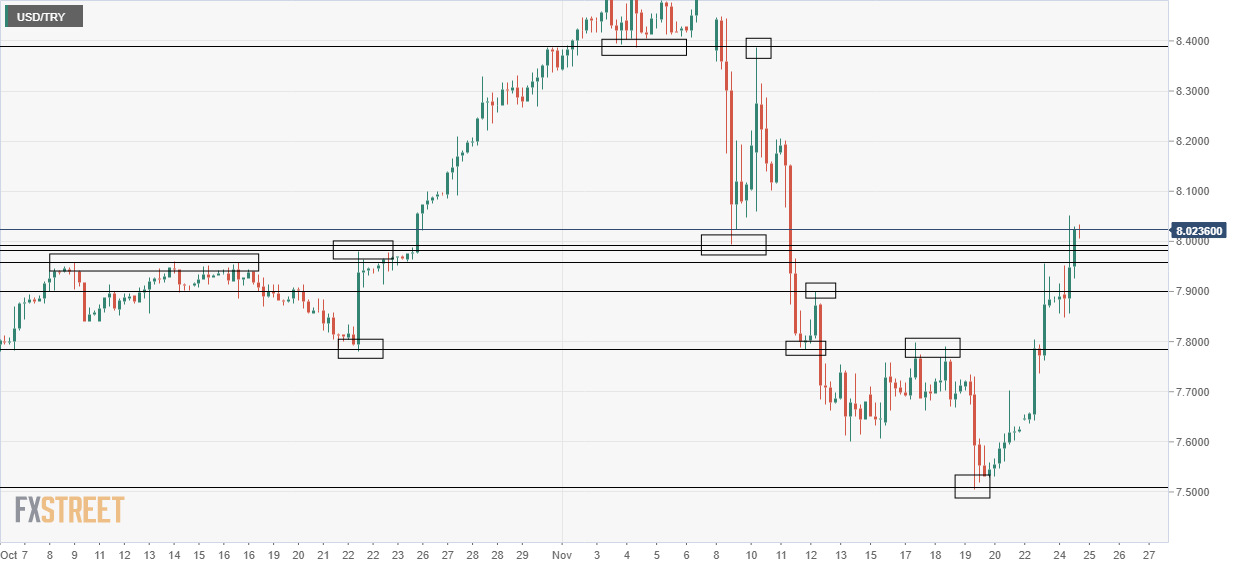

- Having flirted with the 8.00 level earlier during Tuesday’s European morning, USD/TRY has convincingly broken this level to the upside in recent trade.

- Higher oil prices, weak manufacturing data and ongoing diplomatic disputes with the EU are all weighing on sentiment.

The Turkish Lira has been on the defensive for a second day, with USD/TRY moving convincingly above the 8.00 level in recent trade, having flirted with a break above this level earlier during the European morning. As things stand right now, the pair trades with gains of nearly 1500 pips or 1.8% on the day.

TRY sell-off continues amid rising oil prices, ongoing diplomatic disputes

Poor data this morning in the form of a drop in manufacturing confidence in November to 103.9 from 108.1 set the negative tone for the day, but TRY investors seem to have their focus more on other themes, such as ongoing diplomatic disputes with the EU as well as rising oil prices.

On the latter, WTI is up nearly 5% on the day, rising to its highest levels since March, while Brent is up nearly 4% on the day, with the front-month futures contract rising almost as high as the $48 per barrel mark – this has, of course, benefitted oil-exporting nations (BRL, MXN, RUB, CAD, NOK) at the expense of oil import-dependent currencies such as TRY.

Meanwhile, the EU and Turkey are bickering over an EU military mission, which saw German forces board and search a Turkish cargo ship that they suspected of taking weapons to Libya illegally. Turkey summoned the EU, German and Italian envoys on Tuesday, and Germany called Turkish complaints unjustified.

While this mini-episode might be somewhat petty, it serves as a reminder of fraying relations with the EU, which consumes 50% of Turkish exports.

Looking ahead, attention is set to return to the CBRT with the release of the minutes from last week’s rate decision on Thursday. The CBRT’s recently appointed new Governor Naci Agbal has been talking a big game about continued monetary tightening in order to bring about stabler financial conditions but has cautioned that domestic reforms are needed for a sustained appreciation in TRY.

USD/TRY clears final key technical hurdle, opens door for test of ATHs

In surging above key levels of resistance located in the upper 7.90s and also above the psychological 8.00 mark, USD/TRY has opened the door, technically speaking, for a sustained move back toward all-time highs above 8.50.

Such a move seems unlikely from a fundamental standpoint, given Turkish President Erdogan’s recent change in heart regarding economic/monetary policy and subsequent replacement of the head of the CBRT, which has signalled more hikes ahead following last week’s 475bps rate increase.

But technically speaking, very few notable levels of resistance stand between USD/TRY at present levels and the all-time high set back on 6 November, aside from perhaps the high of 10 November at 8.39.

To the downside, there is plenty of support in the upper 7.90s, then again at 7.90 (12 November high), then again at just below 7.80. TRY bulls will be hoping that the pair can eventually recover all the way back to last Thursday’s lows at 7.50.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD keeps the bullish bias intact around 1.0500

A mild rebound in the Greenback prompts EUR/USD to recede from earlier peaks and settle around the 1.0500 neighbourhood on Tuesday, while market participants keep monitoring developments around US tariffs.

GBP/USD comes under pressure, revisits 1.2650

GBP/USD failed to extend its rebound further north of the 1.2680 zone on Tuesday, sparking instead a corrective move to the mid-1.2600s amid a mildt bounce in the Greenback.

Gold deflates below $2,900, six-day lows

The corrective move in Gold prices remains well and sound and now prompts the yellow metal to breach the key $2,900 mark per ounce troy despite the intense downside bias in the US Dollar and the generalised decline in US yields.

Bitcoin edges below $90,000, ending its long streak of consolidation

Bitcoin (BTC) continues to trade in red, reaching a low of $88,200 during Tuesday’s early Europen trading session and hitting the lowest level since mid-November after falling 4.89% the previous day.

Five fundamentals for the week: Fallout from German vote, Fed's favorite figure stand out Premium

Statements, not facts, are set to dominate the last week of February. Further fallout from Germany's elections and new comments from Trump on trade may overshadow most figures –but not the Fed's favorite inflation figure.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.