USD/SGD holds firm as markets assess robust US data, markets delay cuts

- USD/SGD rose to 1.3515 and managed to clear all of its daily losses.

- The US saw an uptick in manufacturing and services PMI data which bolstered the Dollar.

- Strong Jobless Claims figures are also painting a resilient US economy which justifies the delay of rate cuts by the Fed.

The USD/SGD recovered from daily lows, and ahead of the Asian session is trading with slight gains. The pair's movements have been influenced primarily by the cautious posture of the Federal Open Market Committee (FOMC) seen in Wednesday’s minutes, and the strong US Manufacturing and Services PMI figures. Strong Unemployment data released during the European session contributed to the recovery.

While the US Federal Reserve maintains its cautious approach towards monetary easing, strong manufacturing and service sector data seem to justify the bank’s stance. May's S&P Global Manufacturing PMI surpassed market expectations, increasing to 50.9 compared to April's figure of 50.0. Furthermore, a robust increase was also seen in the services PMI, which accelerated to 54.8 from 51.3, undermining market expectations. Additionally, the US Department of Labor reported a rise in Jobless Claims, which was below the expected estimates, suggesting that the labor market remains strong.

The strong economic figures fueled a rise in US Treasury yields which seems to be signalling that markets are delaying the start of the easing cycle. This is corroborated by the CME FedWatch Tool which indicated that the odds of a cut in September declined just below 40%. Next week, the US will release April’s Personal Consumption Expenditures (PCE) data which will provide additional insights into the US economy..

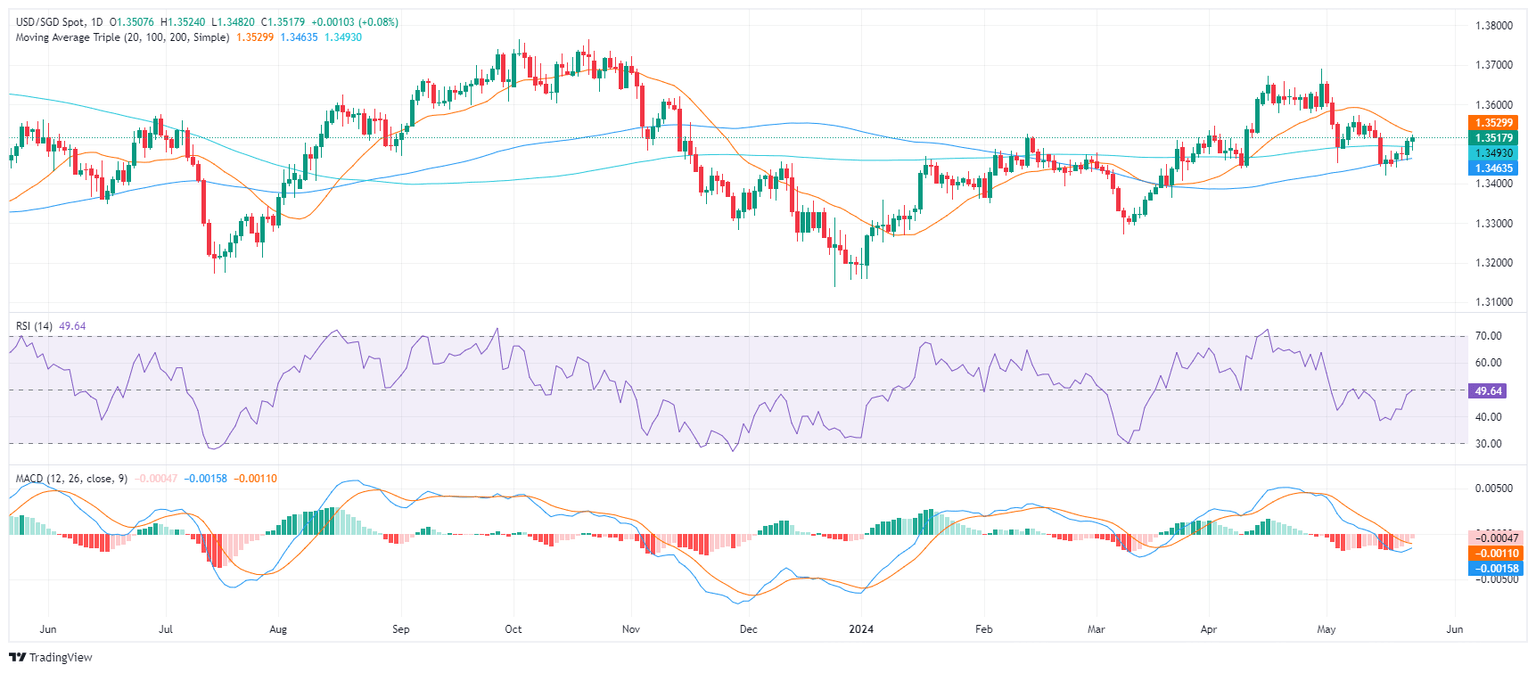

USD/SGD technical analysis

Within the daily overview, the Relative Strength Index (RSI) is treading in negative territory, inclining slightly towards a neutral trend while oscillating around the 50 mark. However, a recovery was seen after bottoming at 44 which may imply that the buyers are gaining ground. The decreasing red bars of the Moving Average Convergence Divergence (MACD) histogram reveals a decreasing selling momentum, providing a signal that the bear's time might be over.

USD/SGD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.