USD/SEK loses further ground despite hawkish Fed and mixed Swedish economic outlook

- The USD/SEK trades at 10.306, shedding 0.14% in Monday's trading session.

- The SEK is resilient and undervalued despite subpar economic fundamentals in Sweden, outperforming its G10 peers.

- Governor Per Jansson flagged the possibility of a rate cut in May or June before a surge in inflation to 5.4% YoY.

The USD/SEK pair experienced a slight dip, registering a 0.14% decline in Monday's session falling to 10.306. Datawise, the US trades weak, due to poor housing data reported earlier in the session, but all eyes seem to be on high-tier economic activity and inflation reports from the US set to be released later in the week.

The Swedish Krona (SEK) has recently gained significant ground against the US Dollar, despite presenting a mixed economic outlook. In addition, surging inflation for January in Sweden may push the Riksbank to hold delay cuts to June, somewhat aligning with the Federal Reserve’s (Fed) stance.

In case the Swedish monetary policy aligns with the American, the health of each economy will dictate the pace of the pair. For this week, the US will report revisions on the Gross Domestic Product (GDP) from Q4 and Personal Consumption Expenditures (PCE) figures from January, which may affect the expectations on the next decisions from the Fed and potentially fuelling volatility on the pair. As for now, the odds of a cut in March and May seem to have been disregarded by the markets and instead pushed to June.

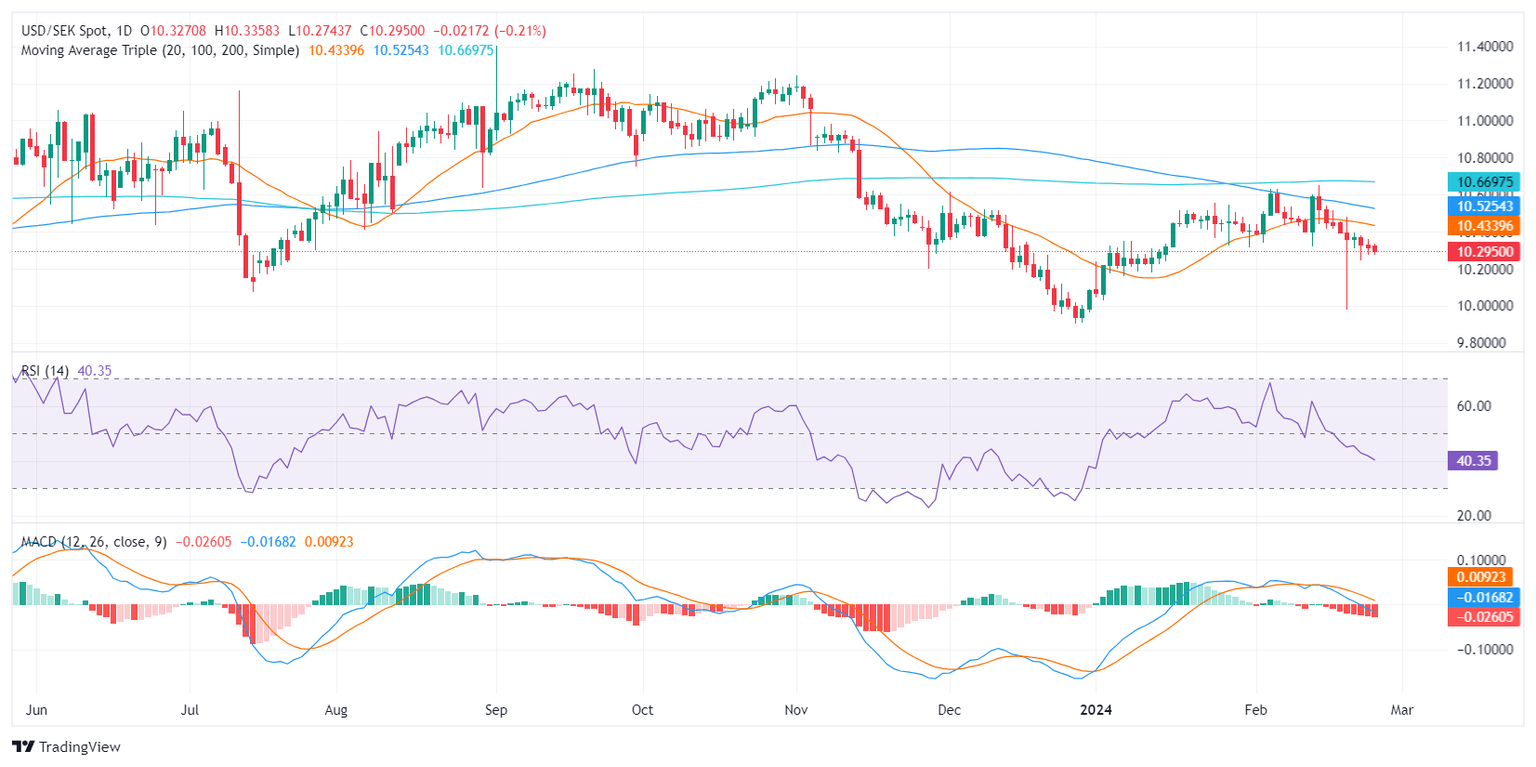

USD/SEK technical analysis

The daily Relative Strength Index (RSI) is currently positioned in the negative territory as it has been tracking lower than 50 while the Moving Average Convergence Divergence (MACD) histogram, with rising red bars, signifies a negative meaning that sellers are assuming control in the market, applying downward pressure to the pair.

In addition, the pair's underneath position relative to its 20, 100, and 200-day Simple Moving Averages (SMAs), reaffirms the bearish bias.

USD/SEK daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.