USD/PLN heading higher as Poland fumbles pre-election markets

- Poland is set for a critical parliamentary election, and the NBP's surprise rate cut continues to weaken the PLN.

- Poland's ruling Law & Justice party is facing down headwinds from a Ukrainian grain import ban.

- The Polish government, which campaigned on a platform of being tough on immigration, has been seen selling visas for profit.

The USD/PLN remains pinned to the upside ahead of the Federal Reserve’s (Fed) much–anticipated rate call on Wednesday. The Polish Zloty (PLN) remains a beleaguered currency as central bank blunders, European Union (EU) infighting, and government scandals knock around the currently ruling Law & Justice (PiS) party of Poland heading into next month’s critical parliamentary election.

The National Bank of Poland (NBP) recently slashed interest rates to the confusion of market participants everywhere, given the Polish inflation rate still remains above 10%. The Governor of the NBP, Adam Glapinski, has been accused of using the central bank’s authority to bolster support for the PiS.

Adam Glapinski is an open supporter of the PiS, and the surprise rate cut was seen as a way to temporarily ease borrowing and lending costs to improve the vote for the PiS in the upcoming election.

Poland recently moved to ban additional imports of Ukrainian grain, citing a need to protect their economy and their domestic farmers. Shipments of Ukrainian grains have increased in recent months as the Russian blockade of Ukrainian exports sees market excess sloshing into neighboring countries.

The European Union (EU) recently allowed a ban on Ukrainian grain excess to lapse, and Poland is coming under fire after President Andrzej Duda announced that Warsaw would simply disregard orders from Brussels and introduce their own ban on Ukrainian grain.

Poland, along with several other countries in the Eastern EU, are facing formal charges and lawsuits from Ukraine in both the EU trade courts and the World Trade Organization (WTO) over the grain bans.

President Andrzej Duda and the PiS dealt themselves a political blow this week after allegations of the country selling visas for profit to migrants who then used the credentials to travel to countries they would normally be banned from.

The PiS has undergone damage control, unexpectedly firing the part’s foreign minister for consular affairs, and terminating all contracts for external companies that handle visa processing. The head of the Polish foreign ministry’s legal and compliance department was also terminated.

Everything comes just as Poland is about to face an intense parliamentary election, where the PiS is seen struggling to maintain its vote share.

USD/PLN technical outlook

The Polish Zloty has struggled as of late, and continues to fall backwards against the Greenback (USD).

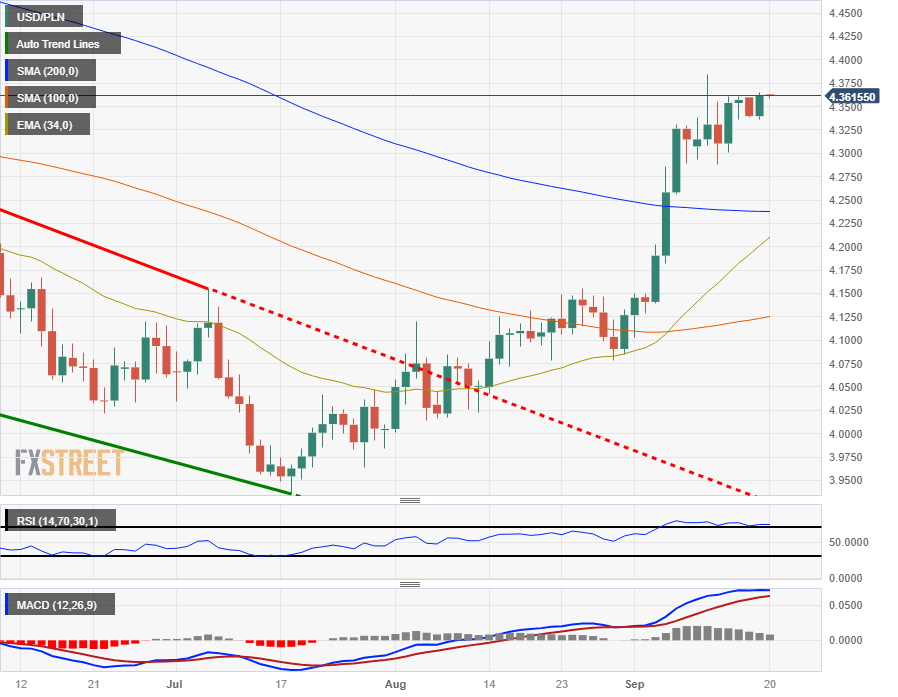

The USD/PLN pair is tapping into recent highs just north of 4.36, and an extended push could see the pair set to challenge fresh six-month highs above last week’s peak of 4.3841.

The pair’s technical stance remains firmly bullish, with both the Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD) indicators all but breaking their seals in overbought territory.

The 200-day Simple Moving Average is currently providing support from 4.2377, and the 34-day Exponential Moving Average is racing to cross over into a bullish confirmation, currently pricing in near 4.2100.

USD/PLN daily chart

USD/PLN technical outlook

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.