USD/NOK recovers following NB hawkish hold.

- Norges Bank kept rates steady at 4.5%, as expected.

- The bank is delaying the easing to Q1 of 2025.

- As long as the NB policy diverges with its peers the NOK might see further upside.

On Friday, the USD/NOK recovered towards 10.575 and cleared most of Thursday's losses. That being said, the NOK is holding strong against its peers as the Norges Bank will likely start the easing in Q1 of 2025.

The Norges Bank announced on Thursday that it will maintain its interest rate at 4.5%, a decision that was widely anticipated. This move is considered hawkish as the bank has delayed its initial rate cut projection to the first quarter of 2025, previously set for the third quarter of 2024. According to the new forecast, the policy rate will stay at 4.50% until the end of the year and will then begin to decrease gradually. This contrasts with the more aggressive rate-cutting strategies of neighboring central banks, which are grappling with different economic challenges.

Regarding the economic outlook, Norges Bank expressed concerns that reducing the rate too soon could lead to prolonged inflation above the target level despite the latest economic challenges. As a result, market expectations for a rate cut within the next six months have nearly vanished, with approximately 50 basis points of easing anticipated over the following half-year which fueled a rise of the Krone against its peers.

USD/NOK technical analysis

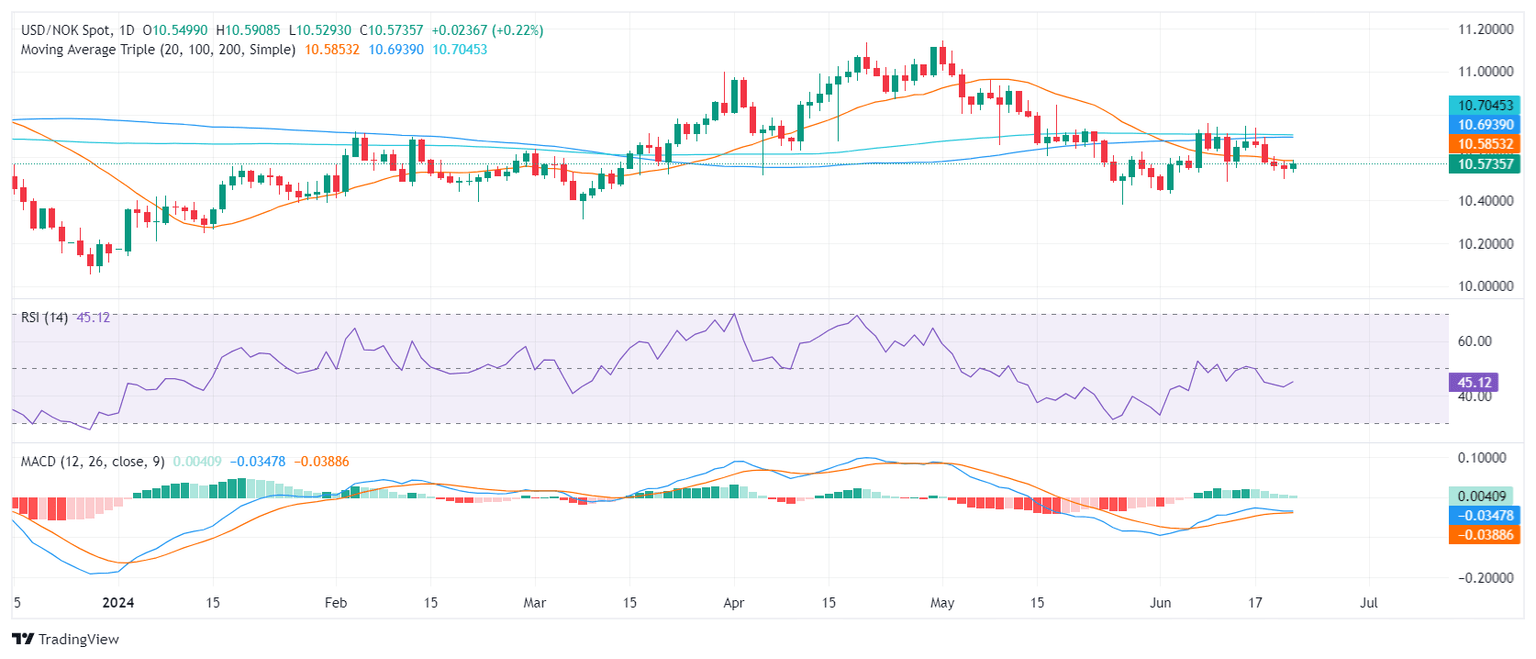

According to the daily chart, the outlook of the pair remains bearish with indicators flashing bearish signals. The Relative Strength Index (RSI) stands below 50 while the Moving Average Divergence Convergence (MACD) prints steady red bars.

The most clear of the bearish signals is that the pair has recently dipped below the 20,100 and 200-day Simple Moving Averages (SMA) as lost over 1% in the last four sessions.

USD/NOK daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.