USD/NOK falls below the 20-day SMA driven by USD’s weakness

- USD/NOK fell below the 20-day SMA towards the 10.6150 area.

- Norwegian CPI from August came in soft.

- Investors await US inflation figures on Wednesday.

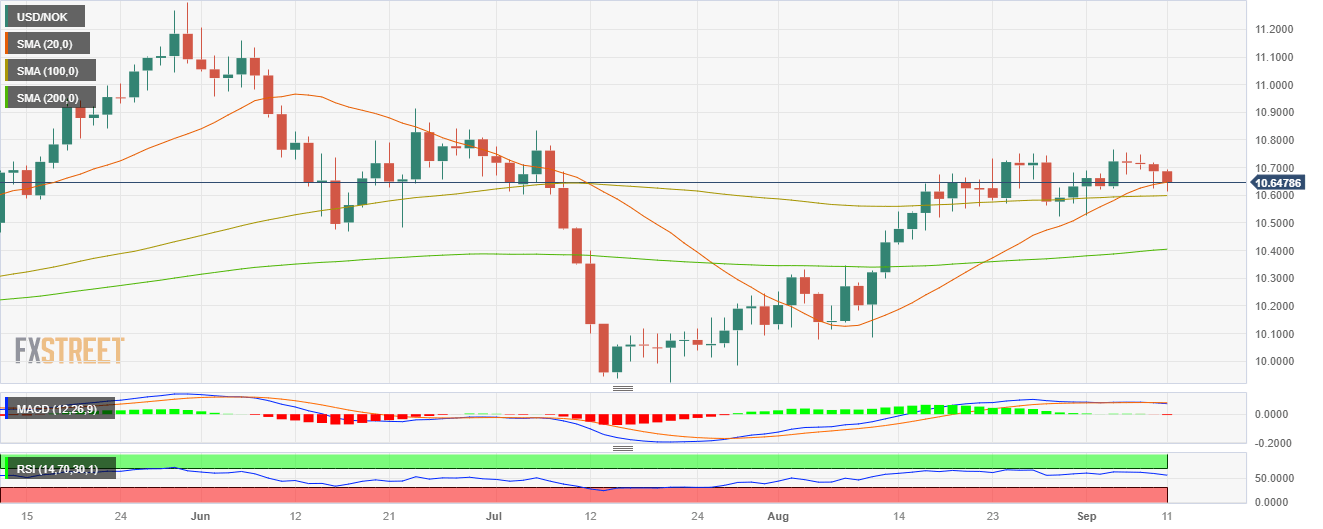

At the start of the week, the USD/NOK lost the 20-day Simple Moving Average (SMA) near 10.6150 and then settled around 10.6470. Despite Norway reporting soft inflation data, the pair movements are explained by a US Dollar (USD), which is experiencing weakness across the board.

After last week’s sharp gains, the NOK is tallying losses against most of its rivals, including the USD, JPY, EUR and GBP, and investors seem to be taking profits. No relevant data will be released during the session, and all eyes are on Wednesday’s US Consumer Price Index (CPI) from August, which is expected to have accelerated. Regarding expectations on the Federal Reserve (Fed), markets already priced in a pause in next week’s meeting. However, the odds of one last hike remain high in November and December, according to the CME FedWatch tool.

On the NOK’s side, August’s CPI from Norway came in at 4.8% YoY, lower than the expected and previous figure of 5.4%. The Norges Bank stated in its last meeting that it still has more ground to cover and will likely hike at the September meeting and a hawkish stance may provide further cushioning to the Norwegian currency.

USD/NOK Levels to watch

Analysing the daily chart, it is apparent that the USD/NOK has a neutral to bearish technical stance, with the bears gradually recovering. The Relative Strength Index (RSI) points downwards in the bullish territory, suggesting a possible trend reversal, while the Moving Average Convergence (MACD) histogram presents rising red bars. Moreover, the pair is below the 20-day Simple Moving Average (SMA), but above the 100 and 200-day SMAs, indicating that the buyers still hold momentum on the bigger picture, dominating the sellers.

Support levels: 10.5900 (100-day SMA), 10.5000, 10.4000 (200-day SMA).

Resistance levels: 10.6500 (20-day SMA), 10.7000, 10.7500.

USD/NOK Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.