USD/MXN sees uptick amid China’s economic concerns, ahead Powell’s Jackson Hole speech

- Wall Street shows positive signs, but China’s rate cut and push for increased lending dampen global sentiment.

- US Dollar remains steady with the DXY at 103.472 as market participants look forward to a packed US economic calendar.

- Mexico’s upcoming inflation and Q2 GDP data could influence the USD/MXN trajectory, with potential appreciation if Mexico’s economy falters.

USDMXN registers minimal gains even though a risk-on impulse would usually underpin the emerging market currency. Monday’s light economic calendar would leave traders adrift to sentiment weighed by China’s woes and US Dollar (USD) dynamics. The USD/MXN exchanges hands at 17.0620, gaining 0.01%.

Emerging market currency feels the heat from China’s rate cut and US Dollar dynamics, while traders await key economic data and Powell’s speech

Wall Street trades positively, portraying investors’ mood improved ahead of the Jackson Hole Symposium, organized by the Kansas City Fed in Wyoming. US Treasury bond yields advance, slightly underpinning the greenback, which remains flat at 103.472, as shown by its US Dollar Index (DXY).

China’s woes weighed on investors’ sentiment after the People’s Bank of China (PboC) cut rates on its 1-year Loan Prime Rate from 3.55% to 3.45%, disappointing analysts. As reported by Bloomberg, it’s said that PboC’s officials and government regulators told lenders to boost loans to support recovery.

In the meantime, a National Association of Business Economics (NABE) poll showed economists are more confident that the Fed would pull a soft landing, as revealed by Bloomberg.

The upcoming United States (US) calendar will reveal Existing Home Sales, Fed speakers, New Home Sales, S&P Global PMIs, Jobless Claims, Durable Good Orders, and Fed Chair Jerome Powell’s speech on Friday.

Across the border, the Mexican economic docket would witness the release of inflation figures for the first half of August and the second quarter Gross Domestic Product (GDP) report on Friday.

Given the backdrop, if the Mexican economy weakens, expect the USD/MXN to appreciate further. Likewise, dovish signals by Fed officials and Jerome Powell’s speech would be repriced by traders, weakening the USD/MXN pair.

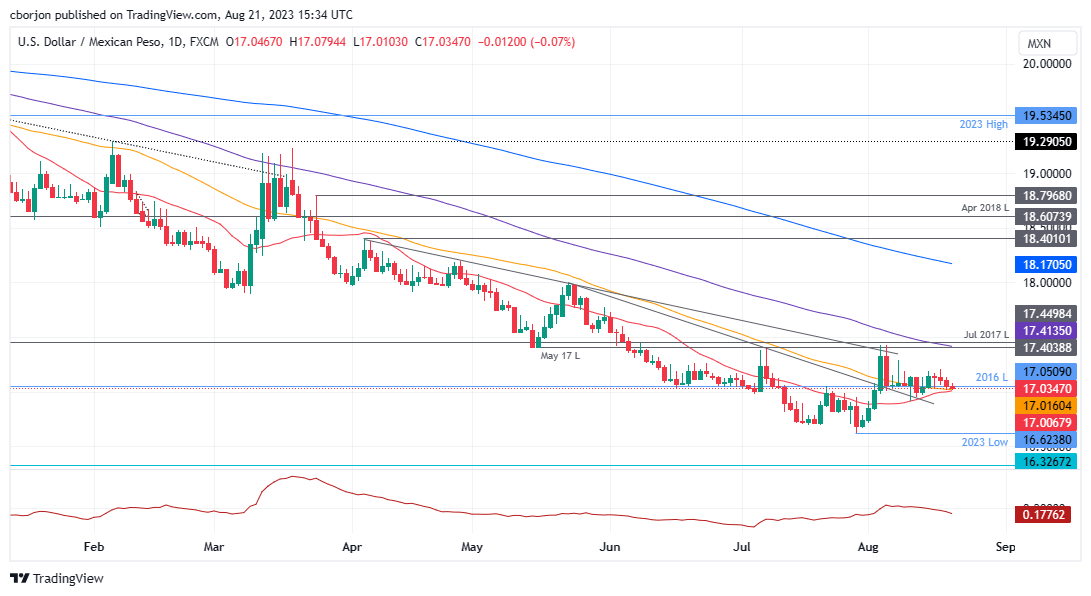

USD/MXN Price Analysis: Technical outlook

The USD/MXN remains subdued, unable to crack below/above support and resistance levels, each at 17.0000/17.1878. On the downside, the confluence of the 50 and 20-day Moving Averages (DMAs) at 17.0060/17.0160 emerged as a solid support level, which, if cleared, the USD/MXN could dip towards the year-to-date (YTD) low of 16.6238. Conversely, if USD/MXN breaks above 17.1878, the pair could rally towards the 100-DMA at 17.4135.

USD/MXN Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.