USD/MXN Price Analysis: Testing the 200-DMA as bears eye 20.1500

- The Mexican peso posts its biggest weekly gain, 2.39%.

- Market sentiment is mixed; the greenback rallies but falls vs. risk-sensitive currencies.

- USD/MXN Price Forecast: Neutral, but a daily close under the 200-DMA would expose the pair under downward pressure.

The Mexican peso extends its weekly rally gains 2.39% vs. the US Dollar, despite a mixed market mood, on Friday’s New York session. At the time of writing, the USD/MXN is trading at 20.4218.

European and US equity markets fluctuate between gainers and losers. At the same time, the greenback remains bid, with the US Dollar Index, a gauge of the greenback’s value against a basket of peers, is up 0.34%, sitting at 98.31, faltering of weighing on the USD/MXN pair.

Overnight, the USD/MXN pair was subdued in the 20.50 area, without much movement, though as the North American session began, the pair drooped through European session lows around 20.4646, towards lows 20.40s area.

USD/MXN Price Forecast: Technical outlook

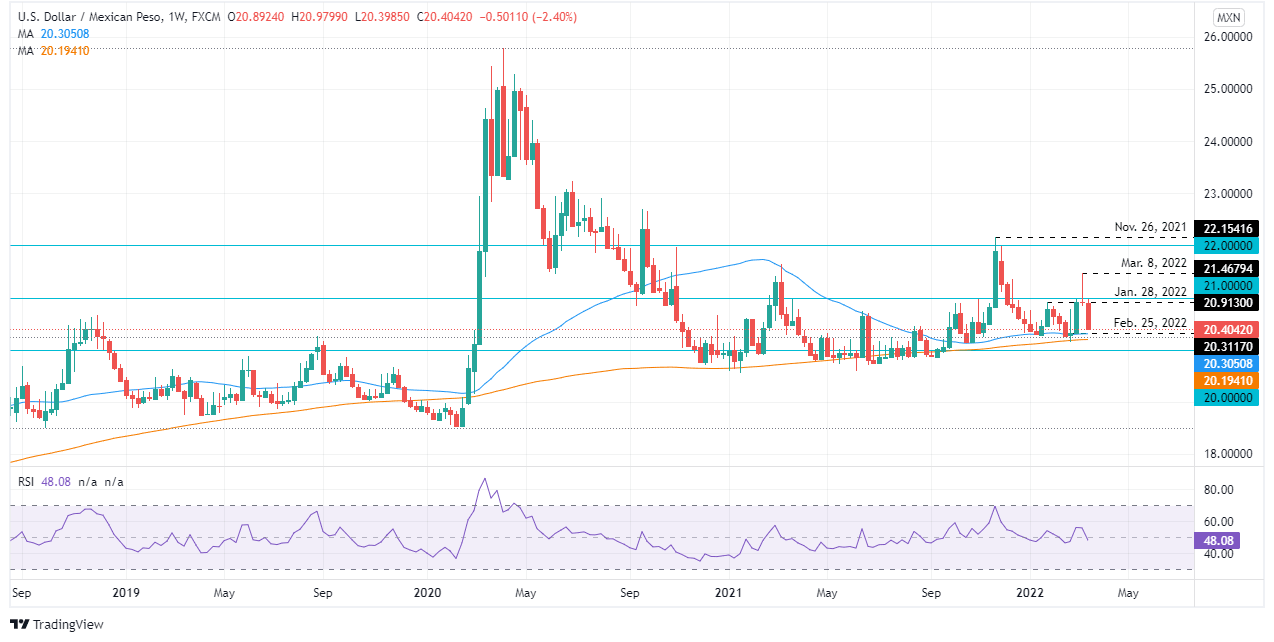

The USD/MXN is neutral biased and is probing the 200-day moving average (DMA), sitting at 20.4125. The Relative Strength Index (RSI) is at 41.50, beneath the 50-midline, aiming lower, suggesting the USD/MXN might be moving towards the February 23 YTD low at 20.1558, but it would find some hurdles on the way south.

If that scenario plays out, the USD/MXN’s first support would be the 200-DMA. Breach of the latter would expose 20.3117, which once cleared would pave the way towards February 23 daily low at 20.1558.

Upwards, the USD/MXX first resistance would be the 20.50 mark. A decisive break would expose the 50-DMA at 20.5667, followed by January 28 daily high at 20.9130 and then 21.00.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.