USD/MXN Price Analysis: Struggles for a firm near-term direction, stuck in a range above 17.00

- USD/MXN extends its consolidative price moves and remains confined in a familiar range.

- The technical setup favours bearish traders and supports prospects for additional losses.

- A sustained strength above the 17.20-25 area is needed to negate the negative outlook.

The USD/MXN pair struggles to capitalize on the previous day's positive move and oscillates in a narrow trading band, just above the 17.00 mark through the Asian session on Friday.

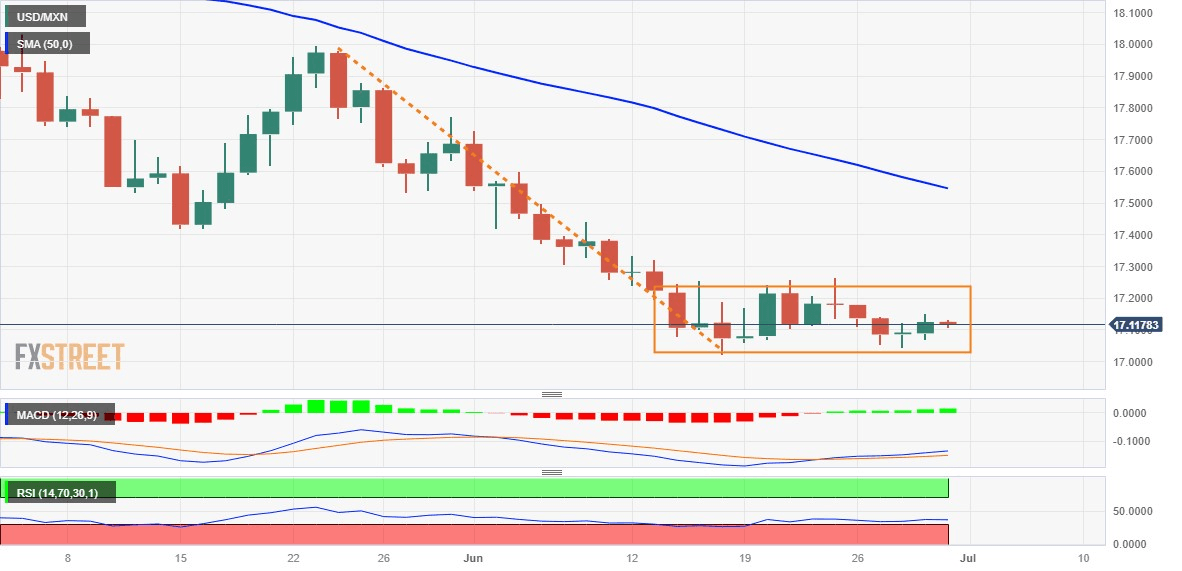

The range-bound price action witnessed over the past two weeks or so constitutes the formation of a rectangle on the daily chart. Against the backdrop of the recent downfall from the 18.00 mark touched on May 23, this might still be categorized as a bearish consolidation phase and supports prospects for additional losses. The negative outlook is reinforced by the fact that oscillators on the daily chart have recovered from the oversold zone and are holding deep in the bearish territory.

The aforementioned technical setup suggests that the path of least resistance for the USD/MXN pair is to the downside. That said, it will still be prudent to wait for a sustained break and acceptance below the 17.00 round figure before positioning for the resumption of over a three-month-old descending trend. Spot prices might then turn vulnerable to accelerate the slide towards the 16.60-16.55 intermediate support before dropping to November 2015 low, around the 16.35 area.

On the flip side, last week's swing high, around the 17.20-17.25 region, also representing the trading range barrier, should cap the immediate upside for the USD/MXN pair. A sustained strength beyond might trigger a short-covering rally towards the 17.40-17.45 region. This is closely followed by the 50-day Simple Moving Average (SMA), currently pegged near the 17.55 zone, which if cleared will suggest that spot prices have bottomed out and pave the way for further gains.

USD/MXN daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.