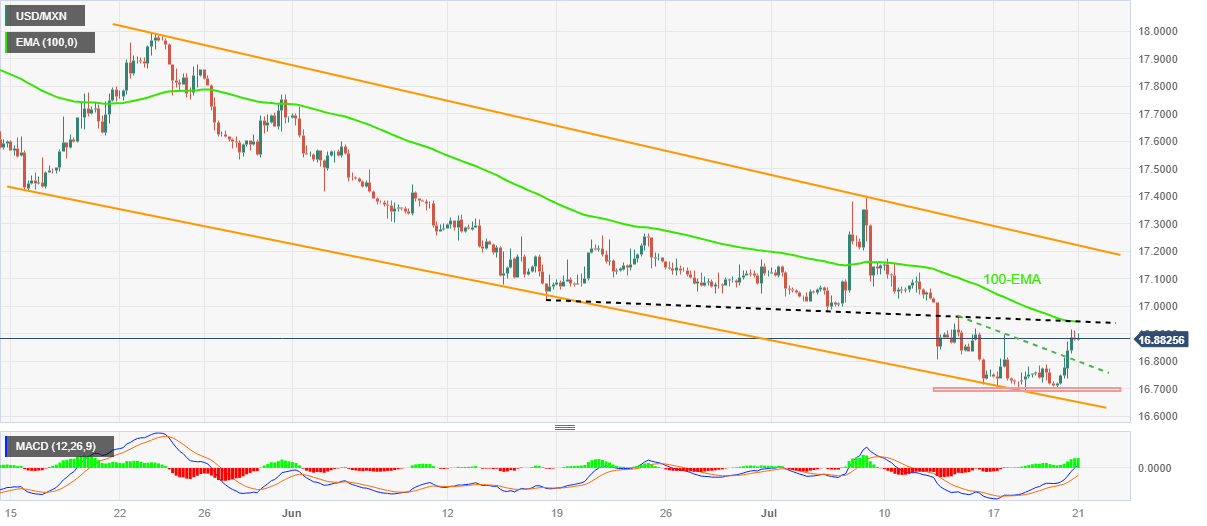

USD/MXN Price Analysis: Mexican Peso pares biggest daily loss in two weeks around 16.88

- USD/MXN retreats from weekly top marked the previous day, mildly offered of late.

- Upside break of one-week-old falling trend line join bullish MACD signals to prod pair sellers.

- Mexican Peso remains firmer unless defying 10-week-old trend channel by breaking 17.22 mark.

USD/MXN bulls take a breather around 16.88 amid early Friday morning in Europe, after rising the most in two weeks. In doing so, the Mexican Peso (MXN) pair cheered the upside beak of a one-week-old descending trend line, as well as the bullish MACD signals.

However, a convergence of the previous support line from mid-June and the 100-bar Exponential Moving Average (EMA), around 16.95 at the latest, restricts the immediate recovery of the USD/MXN pair.

Above all, USD/MXN buyers remain off the table unless posting a successful upside break of the 10-week-old bearish channel’s top line, close to 17.22 at the latest.

Even so, the monthly high of 17.40 will act as the last defense of the USD/MXN bears.

On the flip side, the previous resistance line from July 13, close to 16.80, limits immediate USD/MXN downside during a fresh pullback.

Following that, a one-week-old horizontal support zone and bottom line of the stated channel, respectively near 16.70 and 16.65, will be crucial to watch for clear directions.

Should the Mexican Peso fail to recover from 16.65, the odds of witnessing a slump toward the October 2015 low of 16.32 can’t be ruled out.

USD/MXN: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.