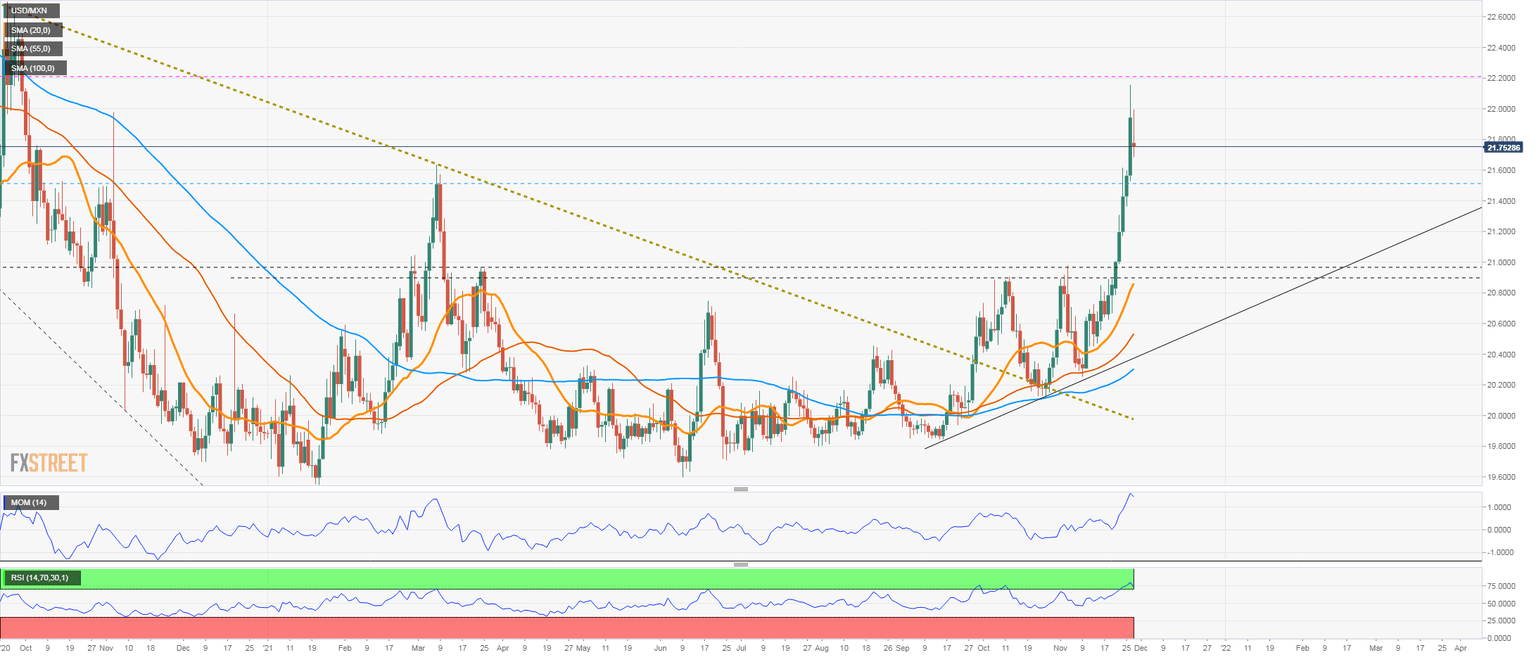

USD/MXN Price Analysis: Calm after the storm, could consolidate around 21.50

- Mexican peso flat on Monday versus US dollar after falling during seven days in a row.

- USD/MXN far from 22.00, above 21.60.

- Technical indicators turn south from overbought readings.

The USD/MXN is trading marginally lower on Monday, on what could be the end of a seven-day positive streak. Last week, the Mexican peso tumbled on domestic and international developments, with the cross reaching the highest intraday level at 22.15.

It pulled back under 22.00, finding support around 21.65. The main trend and the bias point to the upside. In the short-term technical indicators favor some consolidation ahead, as RSI and Momentum are turning south from overbought levels.

A retreat is seen finding support initially at 21.65 and below at 21.50. If price drops under 21.50, it could alleviate the bullish pressure. Below, the next strong support is located around 21.00.

On the upside, if USD/MXN rises above 21.90, it could likely rise further to test 22.00. The next medium-term resistance area is 22.20 that should hold, at least at the first attempt. A firm break higher, would clear the way to more gains, triggering more volatility.

USD/MXN daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.