- USD/MXN drops below the 200-day SMA.

- Outlook favor the downside, price to face strong support at 20.30 and 20.05.

- Any recovery of the dollar under 20.70, likely to be unstable.

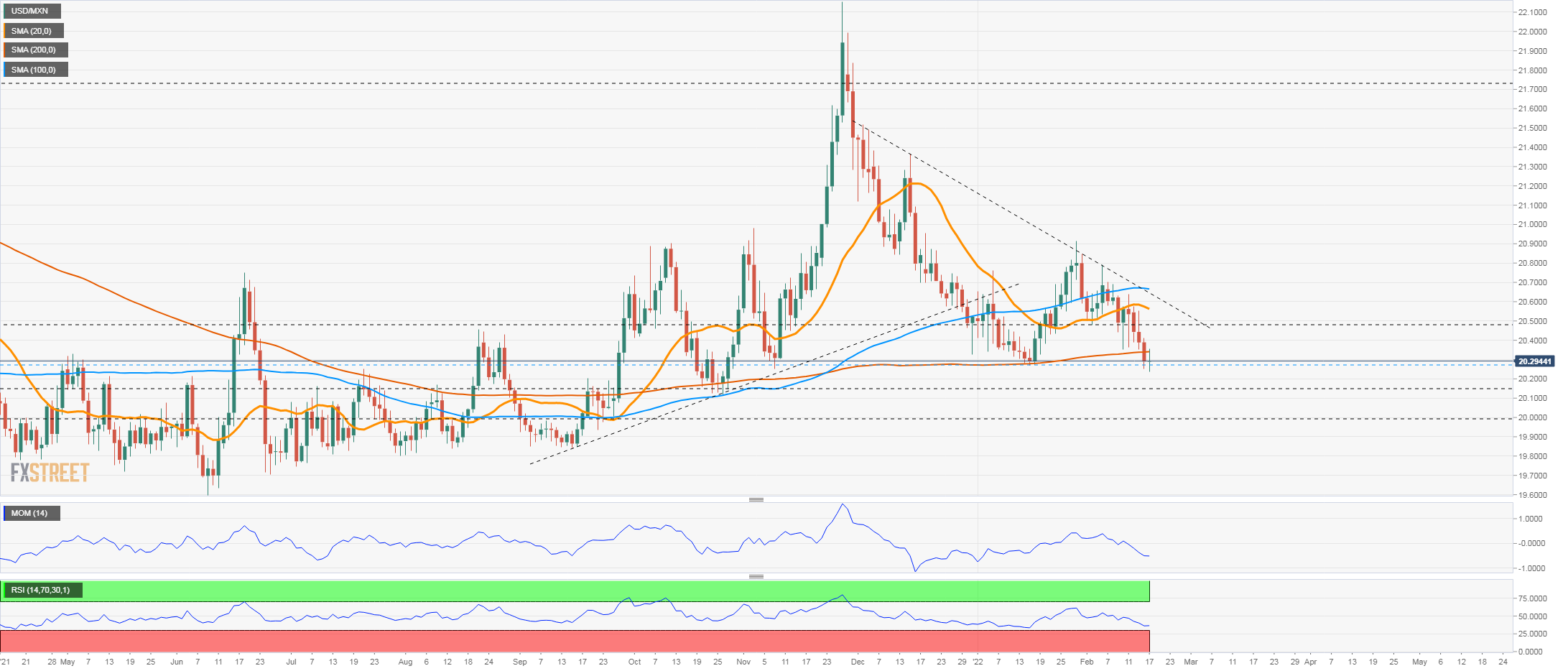

The USD/MXN posted on Wednesday the first daily close in months below the 200-day moving average and slightly under the 20.30 level. The 20.35/30 area was a strong barrier and while the cross remains below, more losses are on the table.

The next support stands at 20.15 and below a more relevant emerges at 20.00/05. A recovery of USD/MXN could take the price quickly to 20.45 but it should be seen as a correction. The critical resistance at the moment is seen around 20.70, the confluence of horizontal support, key MA and a downtrend line. A break higher would change the short-term bias from bearish to neutral/bullish.

Technical indicators look bearish. The RSI is approaching 70 and flattening, a potential sign of exhaustion, not necessarily followed by a sharp correction. A consolidation is also possible particularly if USD/MXN rises back above 20.30.

USD/MXN daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to strong daily gains near 1.0400

EUR/USD remains on track to post strong gains despite retreating from the session high it set above 1.0430. The positive shift in risk mood, as reflected by the bullish action seen in Wall Street, forces the US Dollar to stay on the back foot and helps the pair hold its ground.

GBP/USD surges above 1.2500 as risk flows dominate

GBP/USD extends its recovery from the multi-month low it set in the previous week and trades above 1.2500. The improving market sentiment on easing concerns over Trump tariffs fuelling inflation makes it difficult for the US Dollar (USD) to find demand and allows the pair to stretch higher.

Gold firmer above $2,630

Gold benefits from the broad-based US Dollar weakness and recovers above $2,630 after falling to a daily low below $2,620 in the early American session on Monday. Meanwhile, the benchmark 10-year US Treasury bond yield holds above 4.6%, limiting XAU/USD upside.

Bitcoin Price Forecast: Reclaims the $99K mark

Bitcoin (BTC) trades in green at around $99,200 on Monday after recovering almost 5% in the previous week. A 10xResearch report suggests BTC could approach its all-time high (ATH) of $108,353 ahead of Trump’s inauguration.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.