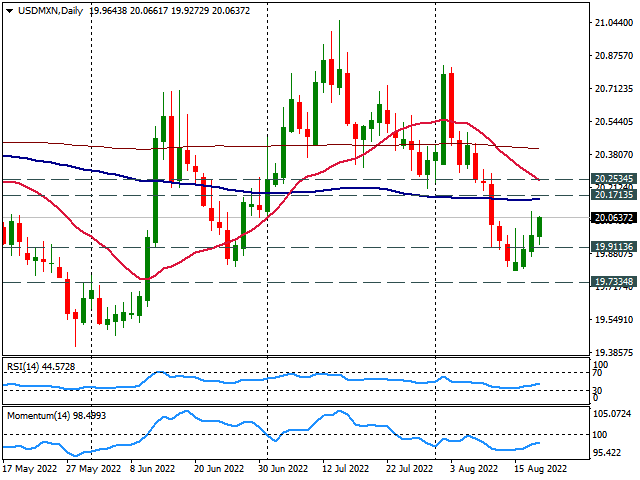

USD/MXN Price Analysis: Back above 20.00, losing momentum

- USD/MXN rises for the third consecutive day, again above 20.00.

- The dollar needs to hold above 20.00, next resistance at 20.15/20.

- Slide under 19.90 to remove bullish bias.

The USD/MXN is rising for the third consecutive day, although so far, it has failed to print fresh weekly highs. The upside remains capped below 20.10. The next critical resistance is seen around 20.15/20, an area that contains horizontal resistances and also the 100-day Simple Moving Average.

A firm break above 20.25 would open the doors to more gains targeting the 20.50 area.

In the very short term, the bias is to the upside, with technical indicators flat to bullish. The momentum is not strong enough and appears to be fading. The bias will weaken with a decline back under 20.00. While a daily close well above 20.00 would be a positive sign for the bulls.

A key support emerges at 19.90 that if fails to hold, USD/MXN could drop further to test again the 19.80 area.

USD/MXN Daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.