The Mexican peso dropped across the board in the currency market amid rising tension between the US and Mexico. Mexico’s president, Enrique Peña Nieto, canceled a planned meeting with US President Donald Trump over, in the US, after Trump insistence that Mexico will pay for the border wall.

“This morning we have informed the White House that I will not go to the meeting scheduled for next Tuesday with @POTUS,” Peña Nieto tweeted, announcing the decision.

From best to worst

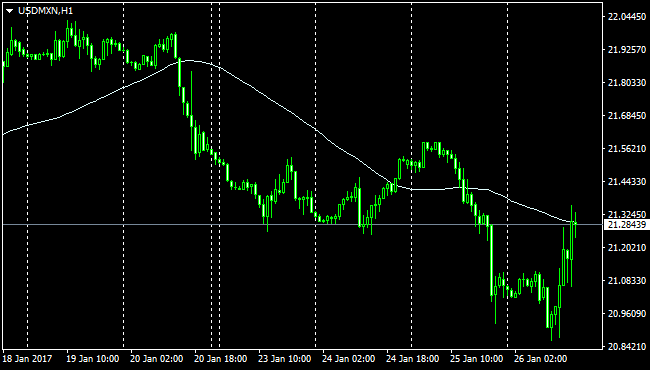

USD/MXN jump to 21.35, hitting a fresh daily high. The rally changed the tone of the pair that earlier was trading below 21.00 for the first time in three weeks. It bottomed at 20.86, the lowest since January 3.

At the moment, is trading at 21.28, still down for the week but the recent reversal could signal the end of the bullish correction of the Mexican peso, that is taking place since last week, when it started to recover after hitting record lows (USD/MXN at 22.03).

Earlier today the Mexican peso was among the top performers in the currency market.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD rises above 1.2450 ahead of UK GDP data

GBP/USD extends its winning streak for the third consecutive day, trading around 1.2460 during Thursday’s Asian session. Traders await the UK’s preliminary Gross Domestic Product (GDP) data due later in the day.

EUR/USD appreciates to near 1.0450 ahead of German HICP inflation data

The EUR/USD pair continues its upward momentum for the third straight session, hovering around 1.0430 during Asian trading hours on Thursday.

Gold price builds on steady intraday ascent amid trade war fears and weaker USD

Gold price attracts buyers for the second straight day amid a combination of supportive factors. Concerns about Trump’s trade tariff and a modest USD weakness underpin the XAU/USD pair.

Ripple's XRP eyes a recovery as investors switch toward accumulation

Ripple's XRP is up 2% in the early Asian session on Thursday following rising accumulation among investors and a potential bottom signal in the MVRV Ratio.

How the European Union could counter US tariffs

With Trump ordering a 25% import tax on all steel and aluminium entering the US, trade tensions are inching closer to Europe. We take a closer look at how European policymakers could react. Spoiler alert: it's complicated.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.