USD/MXN jumps to highest in almost three weeks near 21.00

- Mexican peso under pressure across the board amid concerns about the economy.

- USD/MXN eyes 21.00, up for the fifth consecutive day.

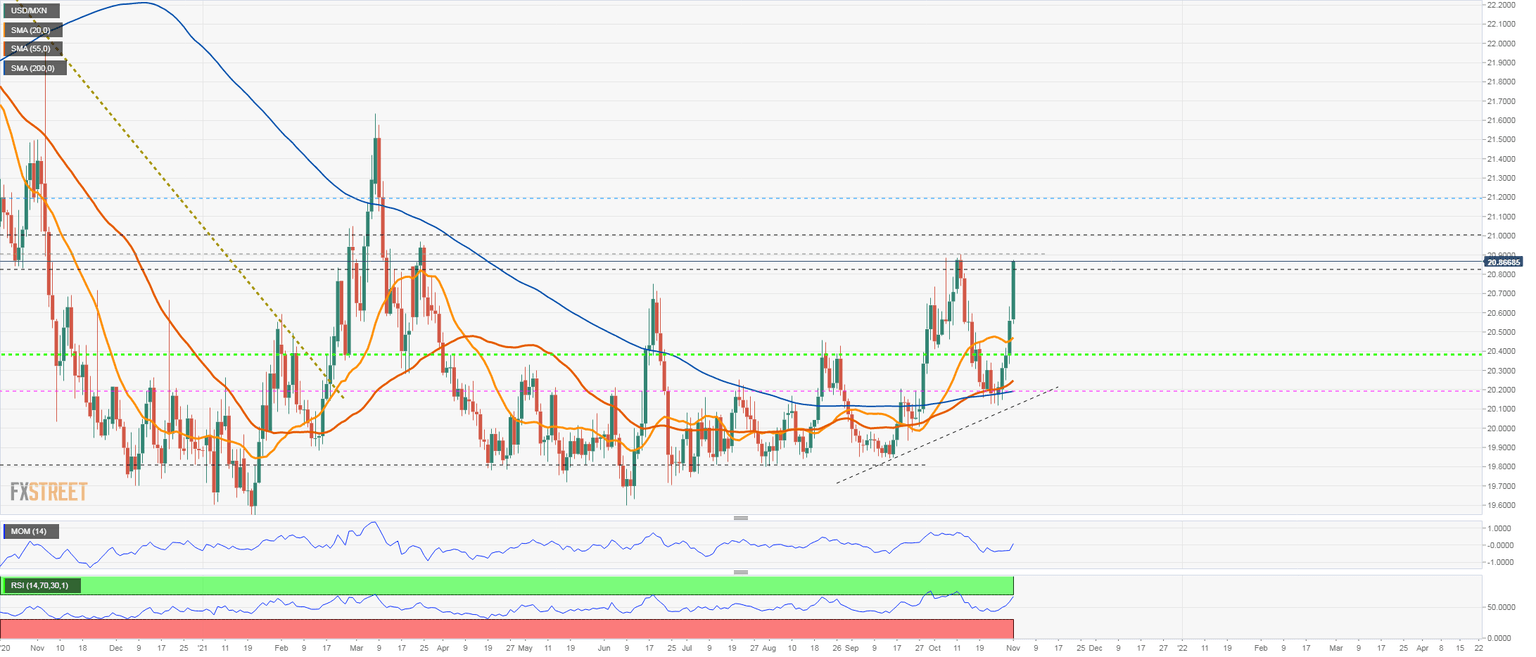

The USD/MXN is rising for the fifth consecutive day on Monday and it has accelerated the move reaching 20.85, the highest level since October 12. It remains near the highs with the bullish tone intact.

The MXN is being affected by increasing concerns about the health of the Mexican economy after it was reported last week a GDP contraction for the first time since the recovery from the COVID begun. At the same time, inflation remains elevated forcing the Bank of Mexico to raise rates.

The deterioration in the economic outlook weighs on the Mexican peso that continues among the worst performers. Not even an improvement in global risk appetite and in crude oil prices helped the currency.

Higher interest rates in the US are also affecting MXN. On Wednesday, the Federal Reserve will announce its decision on monetary policy that could impact on yields. Another relevant event will be the release of the US employment report on Friday.

The rally of the USD/MXN looks now at the 20.89 October highs. If it breaks higher, attention would turn to the 21.00 zone. The immediate short-term support has been moved to 20.70 and 20.50.

Technical levels

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.