USD/MXN dives to seven-year low as risk-on mood underpins MXN, Fed’s decision looms

- USD/MXN trades at 17.2807, nearing a seven-year low, as MXN capitalizes on risk-on sentiment.

- USD/MXN loses nearly 11.32% in 2023 due to the rate difference between US and Mexico’s central banks.

- Market awaits US CPI data and Fed’s decision, with Banxico’s commitment to restrictive monetary policy underpinning MXN.

USD/MXN continues its way towards plunging below the 17.0000 figure, printing another seven-year low of 17.2402 due to a risk-on impulse that generally boosts risk-sensitive currencies like the Mexican Peso (MXN). Albeit the US Dollar (USD) strengthened vs. most G10 FX, it slipped against the MXN. At the time of writing, the USD/MXN is trading at 17.2807, down 0.01%.

MXN benefits from interest rate differential with the US, while upcoming US inflation data and Fed decision hold sway

There’s an old saying amongst traders that the trend is your friend, and that’s what is happening with the USD/MXN pair. According to Reuters, since the beginning of 2023, the USD/MXN has been losing close to 11.32%, benefitted by the interest rate differential between the United States (US) and Mexico.

The US Federal Reserve (Fed) in the US raised rates by 500 basis points (bps) since March 2022, toward the 5.00%-5.25% range, while the Bank of Mexico (Banxico) lifted rates by 725 basis points since June 2021, towards 11.25%, as inflation began to rise, a consequence Covid-19 pandemic.

On Wednesday, the Fed is expected to hold its main rates reference unchanged amidst a labor market flashing signs of easing, as well as manufacturing and services PMIs, - revealed by the ISM, portrayed an economic slowdown. That increased the likelihood of a recession, hence one of the reasons behind Powell’s decision.

Nevertheless, the US Bureau of Labor Statistics (BLS) is set to reveal Tuesday’s Consumer Price Index (CPI) for May. Analysts estimate inflation would dip toward 4.1% YoY against the prior’s month reading of 4.9%, while Core CPI, which strips volatile items, is calculated to slow toward 5.3% YoY, vs. 5.5% in April.

Any upward inflation revision could change the Fed’s skipping playbook and rock the boat in the financial markets. Money market futures show a 20% chance of a 25 bps hike on Wednesday, vs. 80% odds for keeping the Federal Funds Rate (FFR) unmoved.

Another factor that underpins the USD/MXN pair is Banxico Governor Jonathan Heath, saying that monetary policy must remain restrictive “as long as possible,” to ensure inflation reaches its target. Heath forward guided the markets, “We want to keep the monetary policy in the restrictive zone for as long as possible — and that’s way more than three decisions,” according to an interview in Bloomberg News.

USD/MXN Price Analysis: Technical outlook

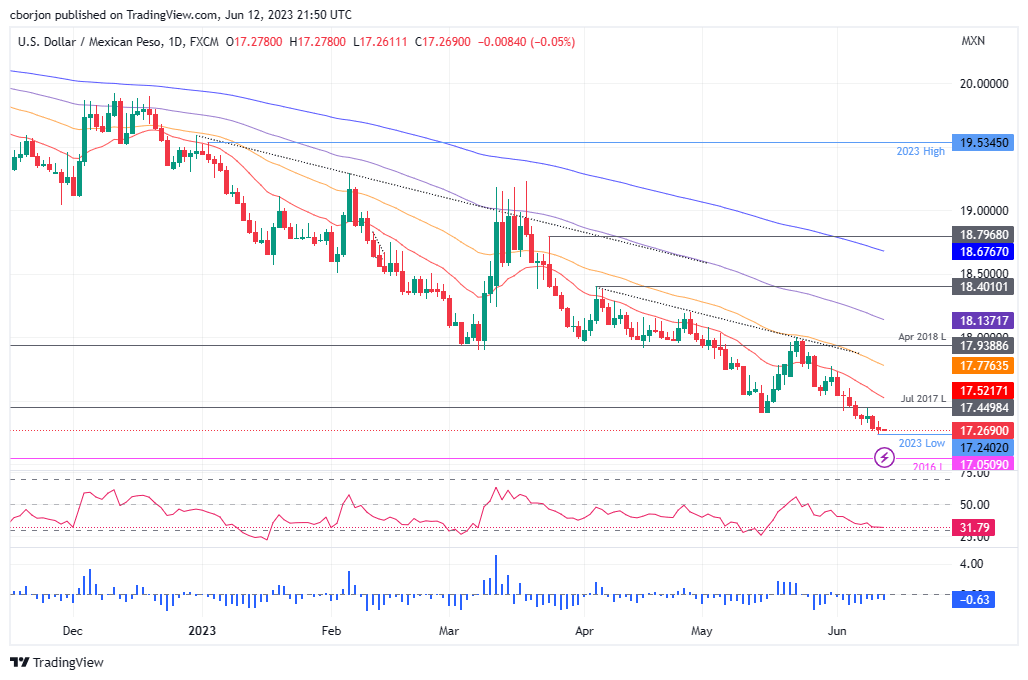

The USD/MXN remains downward biased after reaching new multi-year lows at 17.2402. Although the Relative Strength Index (RSI) remains close to oversold conditions, it is still bearish, suggesting that further downside is expected. That would put the 2016 low of 17.0500 into play, ahead of reaching the 17.0000 figure. Conversely, if USD/MXN buyers reclaim, the psychological 17.50 would put the 20-day EMA up for grabs at around 17.5218 before rallying toward the 50-day EMA at 17.7764.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.