- Bears take charge and are testing below critical support structures across the timelines.

- USD/JPY has been pressured by a chorus of concerning headlines surrounding the Ukraine crisis.

USD/JPY is under pressure as the yen picks up a safe-haven bid amid the latest bullish developments for the currency pertaining to the onset of war between Russia and the West.

Following news that Russian President Vladimir Putin had sent troops into separatist regions of Ukraine, the prospects of a deeper infiltration into the country was announced just after the Wall Street open by the United States of America. According to US intelligence, Russia will invade within 48hrs.

Further reports enhanced the risk-off moves on Wednesday that cited convoys of military equipment moving towards Donetsk in eastern Ukraine from the direction of the Russian Frontier. Consequently, Ukraine has planned to declare a state of emergency and the yen started to breakdown the hourly support vs the US dollar as follows:

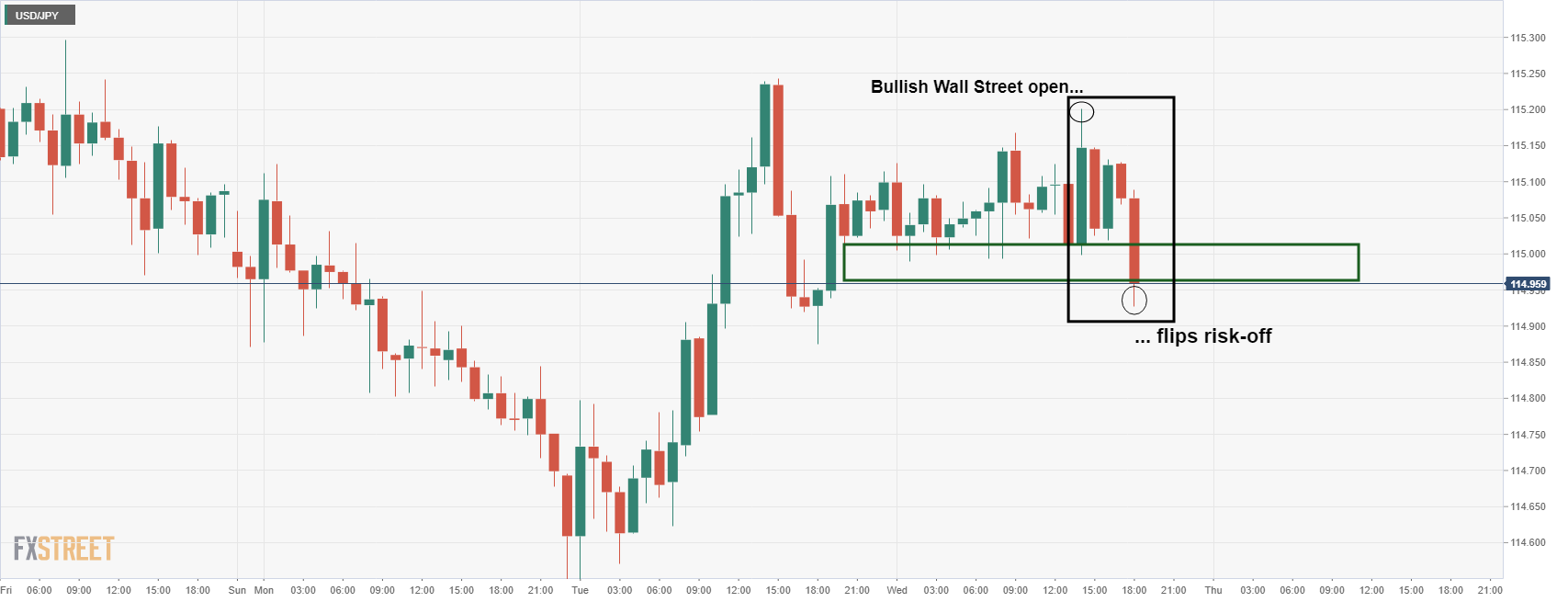

USD/JPY H1 chart

The price action on the hourly time frame is making for a bearish structure, confirming the bias:

The M-formation would be expected to pull in the bulls for a restest to the neckline near 115.05/15. This resistance would be expected to equate to a full-on breakout below the counter-trend lines and the sideways topping structure that has been building over the course of this week.

Meanwhile, from a longer-term perspective, the week and daily price action and market structure also give us a few clues on where the bias is on a technical basis.

USD/JPY weekly chart

The weekly chart has been giving signs of bullish exhaustion since the middle of the month with the weekly wicks left unfilled by subsequent weeks of trading activity. The Bulls are tired and are throwing in the towel.

Additionally, the daily chart shows the bulls are losing the battle to the bears as follows:

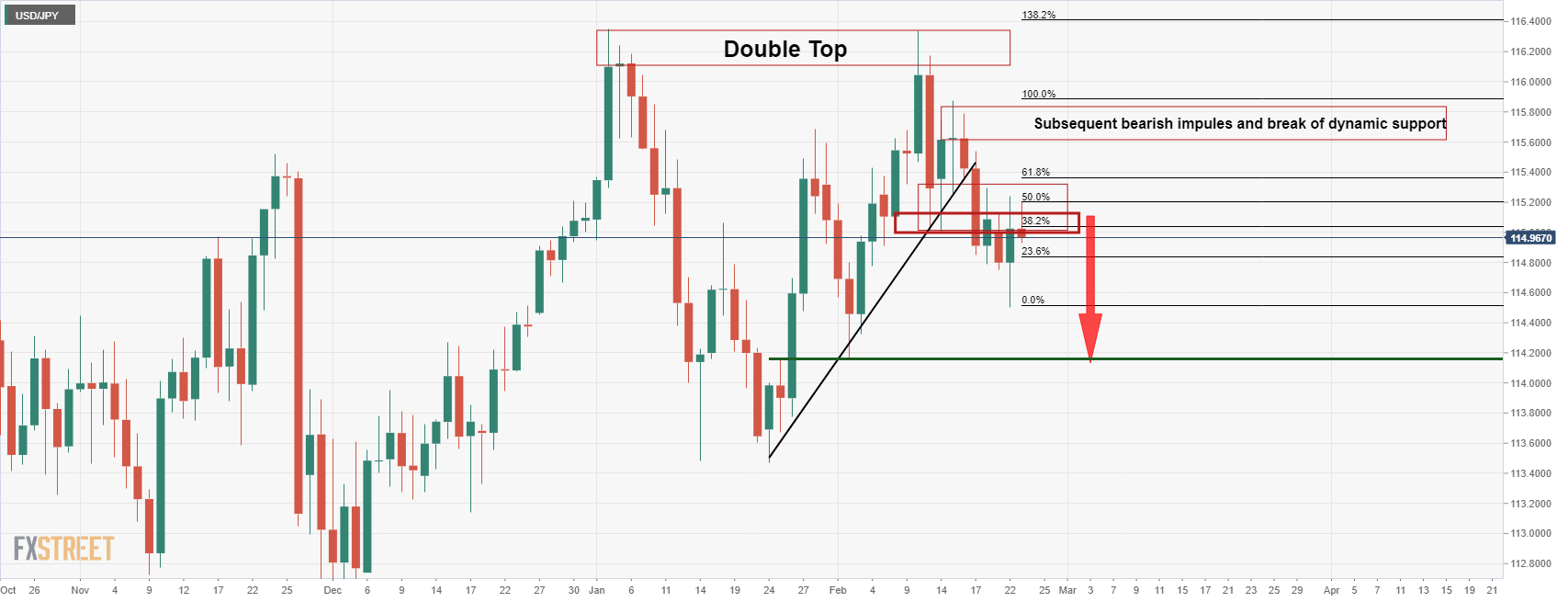

USD/JPY daily chart

The above analysis illustrates the bearish bias given the series of bearish events in price action since the double top was accompanied by a bearish engulfing close on Feb. 11. We have since seen a break of the trendline support and retests back into the cluster of offers below 115.30.

The price is failing there and near a 50% mean reversion of the bearish impulse that broke the dynamic support. This leaves the attention on the downside towards 114.20 for the days ahead as the last defence for much lower levels:

When considering the Japanese fiscal year-end seasonal flows from Japanese exporters buying at the end of their financial year, the accumulation of short positions against the dollar looks vulnerable to a further squeeze over the coming weeks.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD remains below 1.1000 on Powell's remarks

The US Dollar's recovery has gained momentum, pushing EUR/USD down to sub-1.1000 levels—the daily lows—following Fed Chair Jerome Powell's "Economic Outlook" speech.

GBP/USD loses the grip and approaches 1.2900

GBP/USD is shedding some of its weekly gains and retreating back to around the 1.2900 level, as the Greenback continues its recovery following Chair Powell's comments.

Gold remains offered, looks at $3,000

Gold prices are deepening their daily retreat, edging closer to the crucial $3,000 per troy ounce level as the US Dollar strengthens, all while investors digest Fed Chair Powell's speech.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.