USD/JPY steady near 151.00 as markets chew on Fed rate hold

- The USD/JPY is treading water near 151.00 as Fed holds rates, as expected.

- Only minor changes in Fed statement leaves investors strung along the middle.

- Markets set to turn towards Friday's US NFP.

The USD/JPY is holding steady near the 151.00 handle as the Federal Reserve (Fed) holds rates at 5.25-5.5%, as markets broadly expected, but a lack of significant changes in the Fed's rate statement leaves investors unsure of an additional rate hike in December to close out the year.

Fed leaves interest rate unchanged at 5.25%-5.5% as forecast

The Fed's statement noted a firmer pace of economic expansion, but a moderation in jobs gains for the US.

Inflation remains elevated, and the unemployment rate remains low, but the Fed dropped few flags indicating one last rate hike for the year and the US Dollar (USD) is trading into the midpoint of Wednesday's chart moves.

Fed Statement comparison: November vs September

USD/JPY Technical Outlook

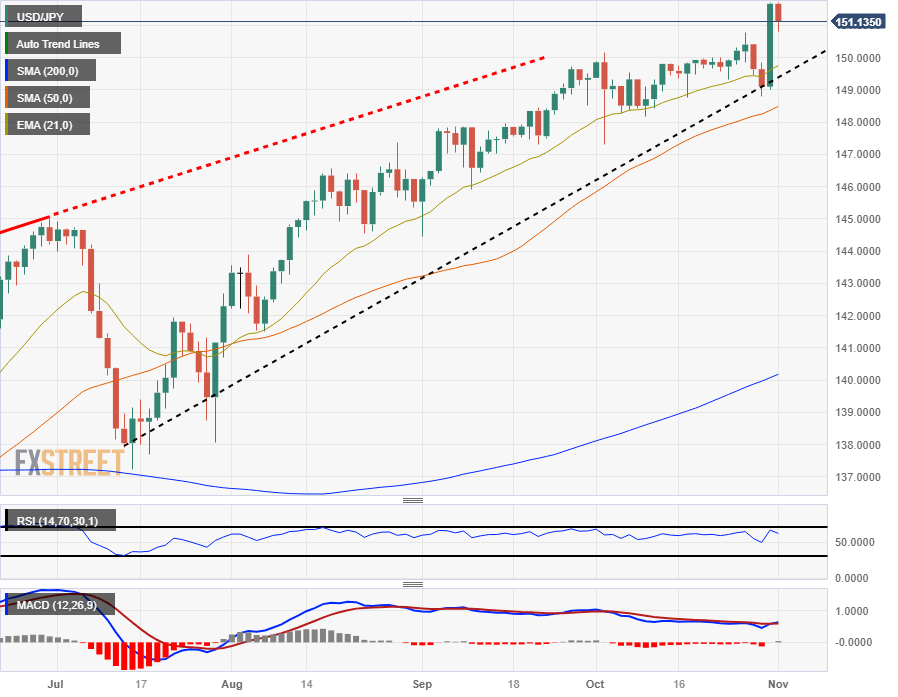

The Dollar-Yen pairing is ever-so-slightly down from yesterday's twelve-month high of 151.72 after catching a bounce from a rising trendline etched in from July's low closes near 138.00.

The USD/JPY continues to catch bids from the 21-day Exponential Moving Average (EMA) currently lifting into 150.00, and medium-term support is baking in from the 50-day Simple Moving Average (SMA) near 148.50.

USD/JPY Daily Chart

USD/JPY Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.