USD/JPY steady near 149.30 as Fed holds rates, signals caution

- USD/JPY hovers near 149.37, little changed after the Fed keeps rates unchanged but slows balance sheet reduction.

- Inflation remains “somewhat” elevated, with the Fed revising PCE and Core PCE higher, while GDP and unemployment estimates were lowered.

- Fed Governor Waller dissents, favoring an unchanged pace of balance sheet reduction as markets digest mixed policy signals.

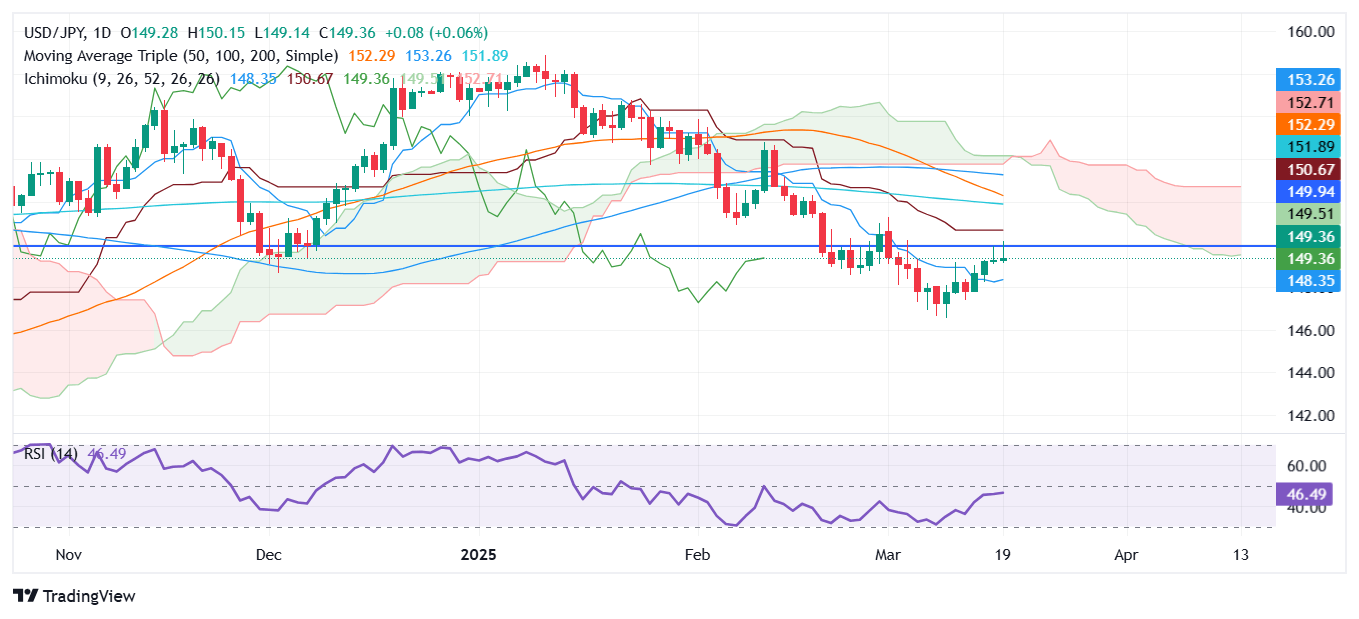

The USD/JPY pair climbs on Wednesday after the Federal Open Market Committee's (FOMC) decision to keep rates unchanged. Even though officials turned cautious on rates, the US Dollar (USD) failed to rally sharply. The pair hovers near 149.37, virtually unchanged.

Dollar struggles to rally despite Fed’s cautious stance on inflation and policy

In its monetary policy statement, the Federal Reserve (Fed) acknowledged that labor market conditions remain solid but noted that inflation remains "somewhat" elevated. The FOMC reaffirmed its commitment to monitoring risks to both sides of its dual mandate and announced plans to slow the pace of balance sheet reduction starting in April.

The decision was unanimous, except for Fed Governor Christopher Waller, who preferred to keep the pace of balance sheet reduction unchanged.

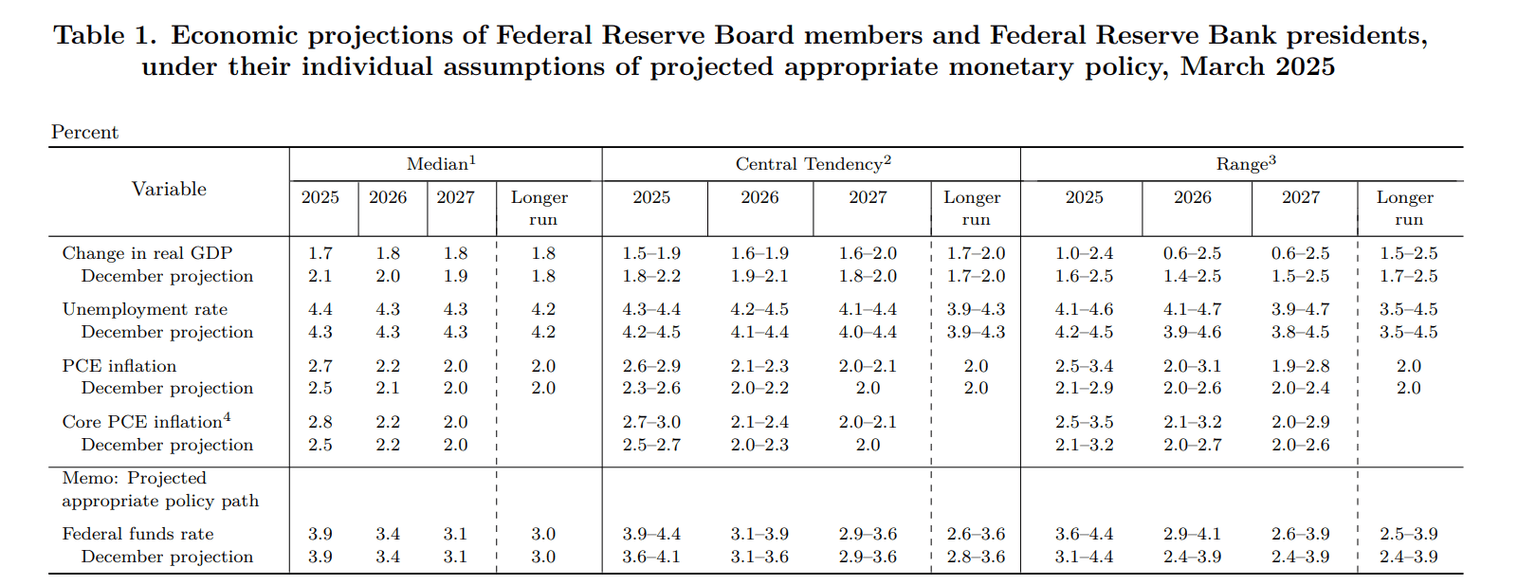

In the Summary of Economic Projections (SEP), the Fed funds rate projection remained at 3.9%, unchanged from December's forecast. Officials' projections for inflation remained upwardly revised, both PCE and Core PCE figures.

The US economy is expected to slow down below the 2% threshold, an indication that the economy has shifted fragilely amid US President Donald Trump's trade policies.

Source: Federal Reserve

USD/JPY reaction to Fed’s decision

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.54% | 0.16% | 0.04% | 0.20% | 0.35% | 0.49% | 0.24% | |

| EUR | -0.54% | -0.39% | -0.49% | -0.34% | -0.18% | -0.05% | -0.30% | |

| GBP | -0.16% | 0.39% | -0.10% | 0.05% | 0.22% | 0.34% | 0.08% | |

| JPY | -0.04% | 0.49% | 0.10% | 0.13% | 0.30% | 0.41% | 0.17% | |

| CAD | -0.20% | 0.34% | -0.05% | -0.13% | 0.17% | 0.30% | 0.02% | |

| AUD | -0.35% | 0.18% | -0.22% | -0.30% | -0.17% | 0.13% | -0.10% | |

| NZD | -0.49% | 0.05% | -0.34% | -0.41% | -0.30% | -0.13% | -0.26% | |

| CHF | -0.24% | 0.30% | -0.08% | -0.17% | -0.02% | 0.10% | 0.26% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.