USD/JPY stages mild recovery amid mixed US NFP, rising US Treasury bond yields

- USD/JPY trades nearly flat at 145.46 after dropping to a three-week low of 144.44.

- US Nonfarm Payrolls for August beat estimates, but Unemployment Rate misses, keeping the pair in check.

- Rising US Treasury bond yields lend some support to the USD.

The Greenback (USD) stages a recovery against the Japanese Yen (JPY) after dropping to a three-week low of 144.44 amid a busy schedule in the United States (US) economic docket. US Treasury bond yields advance, boosting the USD. The USD/JPY is trading at 146.196, gains of 0.45%.

Greenback recovers from three-week low vs. Yen, despite mixed signals in US labor market

The busiest US economic docket finalized, as the latest employment report, namely the Nonfarm Payrolls for August, was above estimates of 177K, with the economy adding 187K, unchanged compared to July’s data. Even though the report was good, and the Greenback should have witnessed a more robust appreciation, it did not. The Unemployment Rate closed towards the US Federal Reserve’s forecast of 4.1% for 2023, which was 3.8% YoY, missing estimates of 3.5%, the highest level since February 2022.

In other data, manufacturing business activity improved, as shown by the ISM Manufacturing PMI for August, rose by 47.6, smashed July’s 46.4 drop, and above estimates of 47. Most subcomponents of the index rose, except for new orders, which are set to improve as factory inventories remained at lower levels.

On the Japanese front, manufactury activity shrank, blamed on costs as revealed by the Jibun Bank Manufacturing PMI, which dropped to 49.6, below the prior month’s 49.7, and the third month the index was below the 50 threshold that separated expansion from contraction.

Given the fundamental backdrop, the USD/JPY remains bullish but subject to an FX intervention by Japanese authorities, which has remained vigilant. On this theme, Japanese Finance Minister Shunichi Suzuki said markets should set currencies, though sudden moves are undesirable, and added that’s closely watching currency moves.

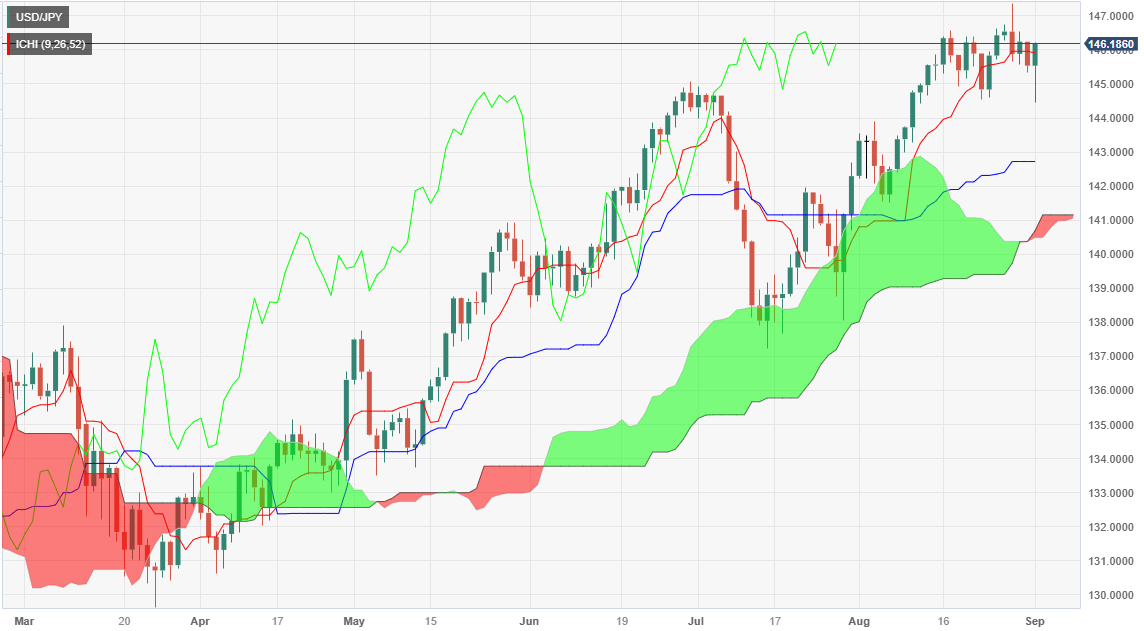

USD/JPY Price Analysis: Technical outlook

Price action depicts the pair dipping to a lower low than the previous one, at 144.53, opening the door for a deeper correction, but unless sellers stepped in and dragged the USD/JPY towards the 145.00 figure, bulls remain in control. Next resistance emerges at 146.00, followed by the year-to-date (YTD) high at 147.38.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.